Why You Should Sell Karex

noobnnew

Publish date: Sat, 07 May 2016, 11:26 AM

THE CHART TOLD YOU TO DO SO!!!

As Chinese proverbs said, a picture worth more than a thousand words, the chart of Karex does not look good. In fact it look pretty bad. It move below the Bollinger band, break below SMA 200 and EMA 200, MACD turn negative. It all point to one direction, more downside is coming. So, SELL BEFORE TOO LATE.

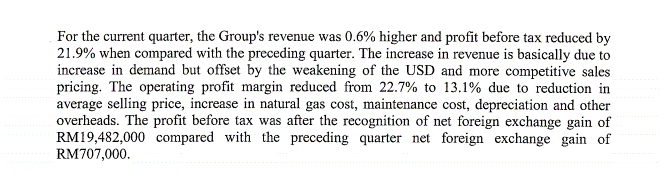

Bad Result of Hartalega

Hartalega just announce their 2016Q1 result a few days back and it totally does not look good. Their EPS had drop about 15% and of course, the share price tank as well. According to the management of Hartalega, even though the revenue had increase but due to the weakening of USD, it had eat up their profit.

The price movement of Hartalega after the announcement of QR.

Since Karex was almost in the same industry as Hartalega, we would almost certain that the Quarterly result for Karex will be bad as well. Here are some simple calculation. The EPS of Karex for last quarter was 3.39 sen. Let’s assume that their EPS only drop 10% which will bring their EPS to around 3sen. By annualizing it, the full year PE will be 12sen. If we give a generous 18 times PE to Karex then it will only worth around RM2.16 which is far below current price.

The Management Told You To Sell

Below are the excerpt of management performance review from their last quarterly report,

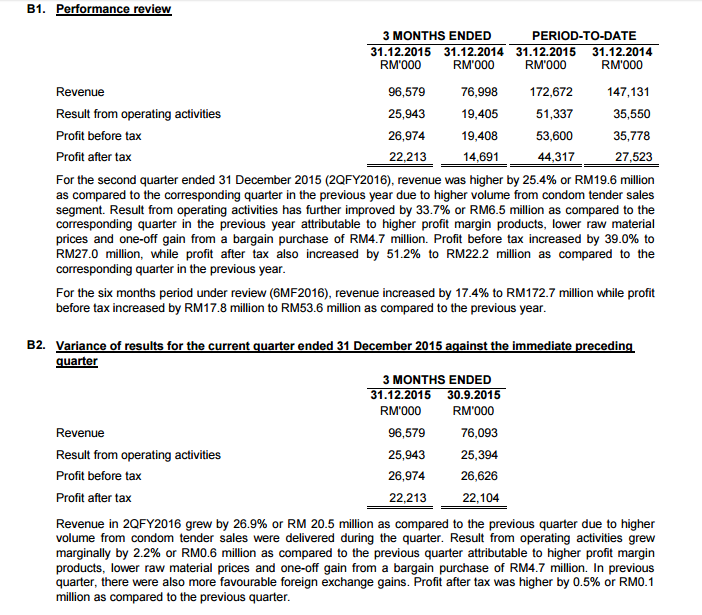

The good result in their previous quarter was mainly due to lower raw material price, one off gain from a bargain purchase and also more favourable exchange rate. All of these advantage will not appear again in this quarter, the raw material price had gone up and our MYR will be strengthen. So, we can expect a worse their quarter result compare to second quarter.

Unjustifiable High P/E Ratio

Karex had maintain a high P/E Ratio since the first day of their listing due to huge expectation on their performance growth. If things back to normal in this quarter, Karex won’t be able to sustain their high P/E Ratio. Hence, a normal P/E ratio of within 5 to 8 will be assigned to Karex. Their TTM EPS was 11.78 and we assume they will for 3rd and 4th Quarter is 3sen each. The total EPS will only be 17.78sen, a P/E ratio of 8 will only price Karex at RM1.42.

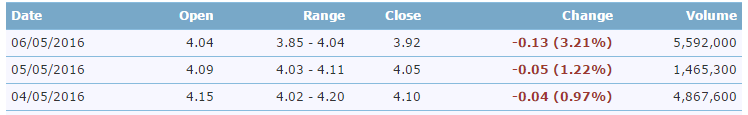

Unusual Price and Volume Movement Post Bonus Issue

Below show the share price movement of Karex after their bonus issue. As we can see, there are not much volume and price movement around the first 10 days of post bonus issue. However, something odd suddenly happen in this week. There are suddenly a total more than 6million of transaction happen in the last 3 day, which is a 12times of volume on 3/5/2016 and the price drop for around 6%. This might indicate that the insider had got their hands on the latest quarterly report and sell before it release. So, sell before it’s too late.

In conclusion, no matter the technical or the fundamental or educated guess had shown us that Karex was indeed overvalue at current stage and their result might be in very bad shape based on recent price movement. I think most of the investor should SELL BEFORE IT IS TOO LATE! For those who are wishing to buy, I hereby advice don’t try to catch a falling knife. It is better to be safe than sorry.

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Noob Investor

Created by noobnnew | May 13, 2016

Discussions

@noobnnew, kindly clarify why d breaching of lower Bollinger line situation around end-Jan/early-Feb 2016 has resulted in d price to recover abit subsequently. So, can I infer tht it can go up or down depending on market forces? Let's not speculate and just wait for d release of QR in due course.

2016-05-07 14:07

Hi noobnnew, i don noe the motive u post this article but pls do more homework be4 u post an article. The eps u use is the eps b4 bonus issue. It shud be less then the figure u use. Also, u use hartalega as an example but u noe wat is the normal PE fr glove company? Later u say the normal PE fr karex is 5 to 8 time? Really fainting!! U noe karex is trade at PE 30 now? The high PE fr tis company is not solely because of usd issue. Is because of the growing potential of tis company. I agree karex was trade in very high PE and was in down trend now. In TA view it had potential to drop to around rm 2.2 before stablilise. I think the only part tat true in tis article was the disclaimer part. Good luck noobnnew.

2016-05-07 16:14

@cmchong1, I already say is assume. You can assume whatever PE u like. So I gave two assumption, the first is the market generous enough to give 18 times then Karex will not have so much downside.

The second assumption is market does not like their quarter result and give a 5 to 8 times PE which is a normal PE ratio to consider a company as cheap then Karex will have more downside.

As I said the article is just the express of my own opinion and if you can write a better article to teach us about the upside or downside of Karex then I am more than happy to listen.

Thanks in advanced.

2016-05-07 18:18

as Chinese proverb said. 識少少, 扮代表。 @

noobnnew better make your fact correct before posting.

2016-05-07 22:23

@bsngpg, thanks for your comment. It's ok to agree or disagree. It is just my personal opinion. I might be right and I might be wrong. Let's see on the financial result and market reaction.

2016-05-09 10:28

the EPS should be adjusted lower to factor in the bonus issue.

which means the fair price is even lower.

2016-05-09 17:07

Really thankful for those purposely create id to comment. Thanks for your effort.

2016-05-09 18:53

good observation. let's see how is the coming qtr result. it will tell the truth

2016-05-10 16:42

Karex will be moving down, please sell ASAP. if not, you all will suffer lose as MBSB...

2016-05-12 15:30

Hiu Chee Keong

I will consider buy if it's forward PE down to around 20.

2016-05-07 13:12