Things That You Should Know About TEKSENG (7200)

noobnnew

Publish date: Sun, 15 May 2016, 11:32 AM

The EGM of Tek Seng will be held on this coming Thursday (19 May 2016) and their share price had increased about 20% since last around RM1.1 last month to RM1.34 currently. Even though the heavy selldown on last Friday, the share price of Tek Seng still able to up 1sen and closed at RM1.34. However, before you invest in Tek Seng Bhd or you are going to attend the EGM, there are a few things that you need to know.

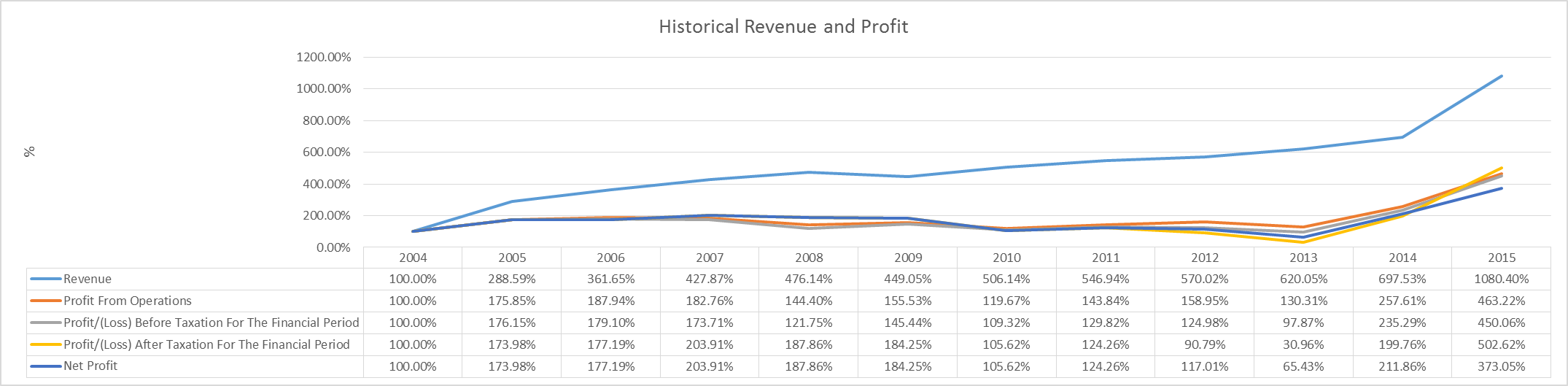

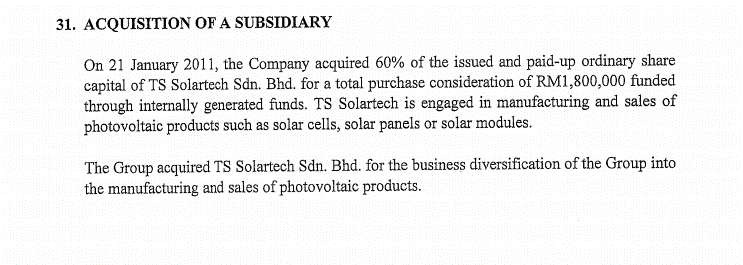

Tek Seng was a company that listed in 2004 and the company core business are PVC Sheeting and PP-Non Woven Product. The company had invested in a joint venture with Solartech Taiwan and form TS Solartech, a subsidiary that manufacturing solar cell in the year of 2011. Below are the revenue and profit growth of Tek Seng since 2004.

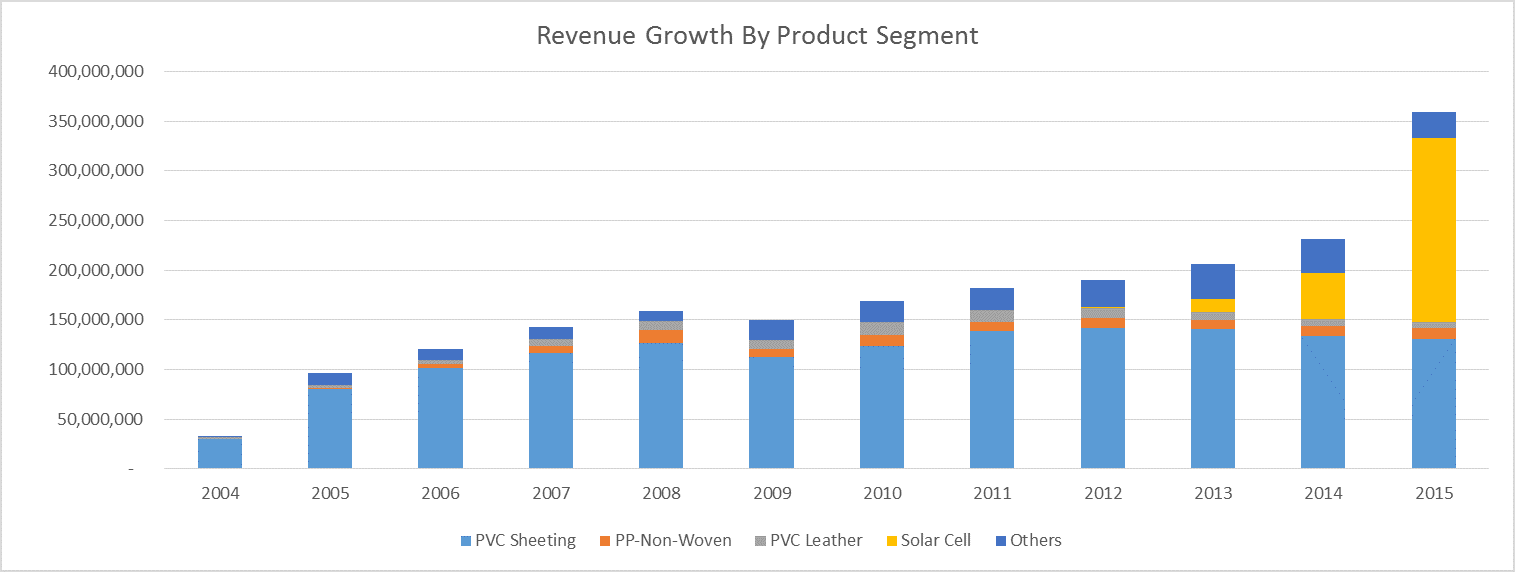

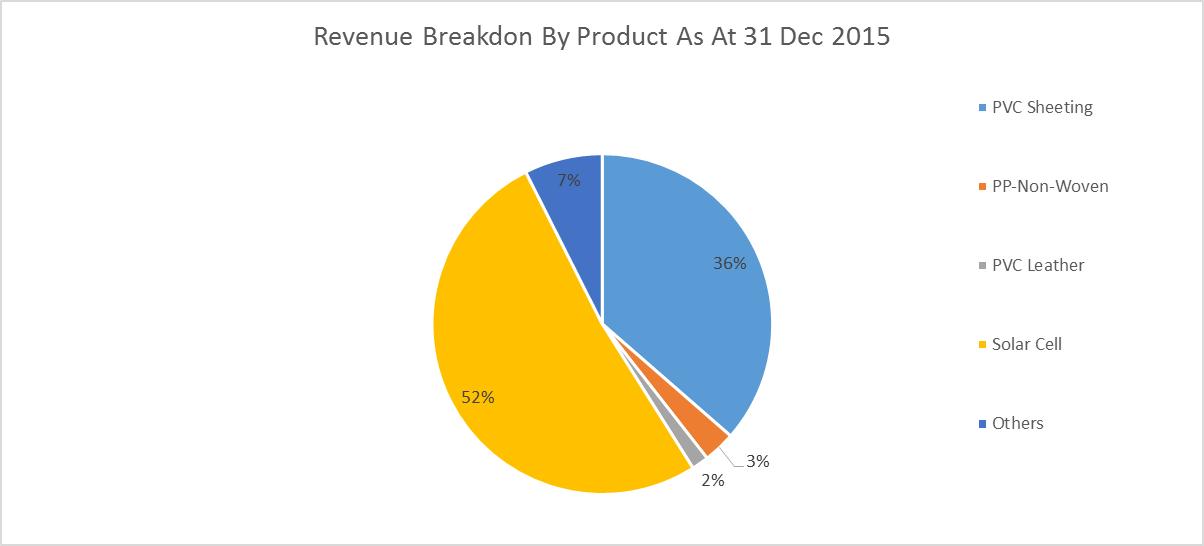

As we can observe, the revenue of the company had increased 1080% and net profit had triple or increase 373.05% due to their successful diversification to solar cell manufacturing business. Besides that, the EBIT of Tek Seng also increased from 7% to 9% due to the explosive contribution of their solar cell business. Below are a more detail breakdown of Tek Seng in terms of product segment.

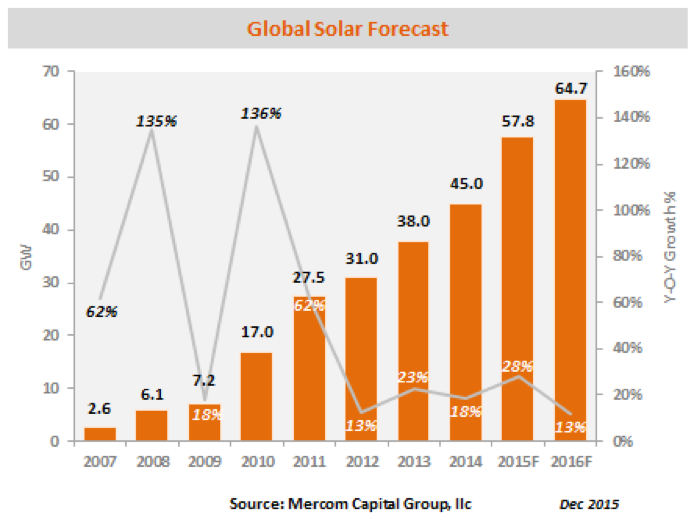

Tek Seng are expected to generate higher net profit since their management had decided to expand 7 manufacturing line in their solar cell manufacturing. Their order book had been filled up for the year of 2016 and 1Q2017. Despite for the high order book for their solar cell manufacturing business, the whole outlook of solar energy sector are promising as well. Below the global solar forecast base on Mercom Capital Group, LLC.

The ratification of Paris Accord last year means that the world are going to invest more in renewable energy sector especially the solar energy. Besides that, the extension of Investment Tax Credit in the United States had become another catalyst that contribute to the booming of solar energy sector. Hence, according to Bloomberg, the solar installation industry in the United States are expected to double over the next five year. Besides that, China are expected to install approximately 19.5GW of solar cell panel in 2016 and the figure expected to fourfold within 5 years due to air pollution continues to drive China’s environmental policies, of which clean power generation is a big part. Officials from China’s National Energy Administration (NEA) are considering raising the 2020 target from 100 GW to 150 GW, which will bring about 21 GW of annual installation between 2016 through 2020. China also has pledged to reach an ‘emissions peak’ around 2030 with non-fossil fuels making up 20 percent of the nation’s energy generation mix, according to the report issue by Renewable Energy World. In short, the fantastic sector outlook for renewable energy will be able to drive Tek Seng well in the future.

Eventhough Tek Seng Bhd had a good future prospect, but there are some problem that investor need to aware of before invest in Tek Seng.

Working Capital Management Issue

The issue of working capital management had always been a nightmare to solar company. The bankruptcy of SunEdison recently due to aggressive growth plan need to be serve as an alarm to the management of Tek Seng Bhd.

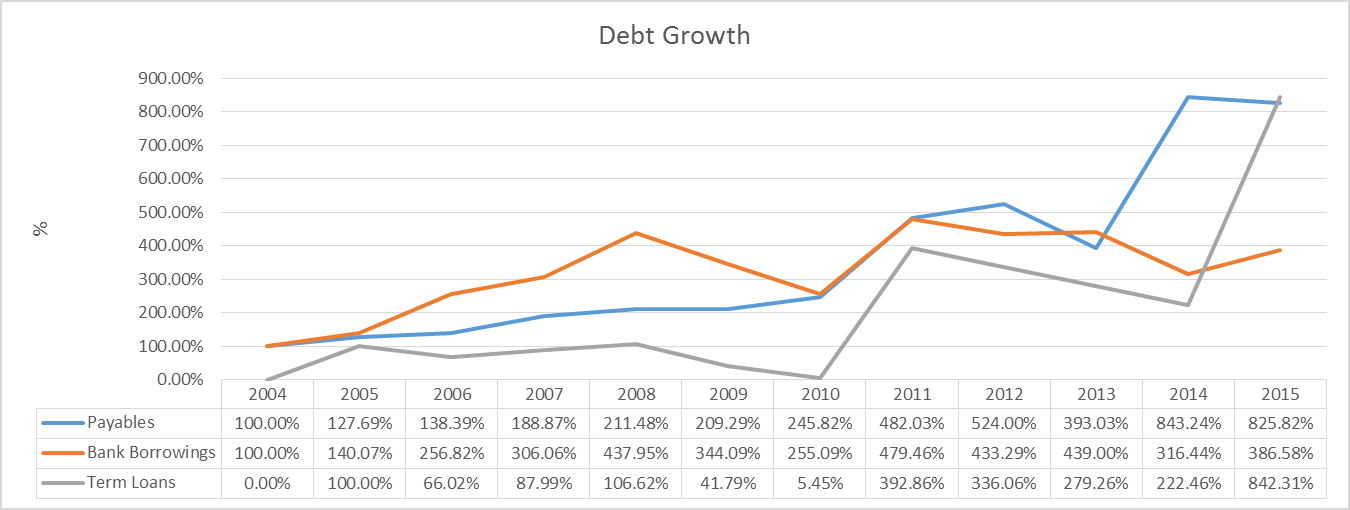

Similar to SunEdison, the amount of interest bearing debt of Tek Seng Bhd had been rocketing over the year. Their long term debt had inflate for more than 800% since listing on 2004. Besides that, their bank borrowing also almost quadruple. Below are the graph of debt growth of Tek Seng Bhd since 2004.

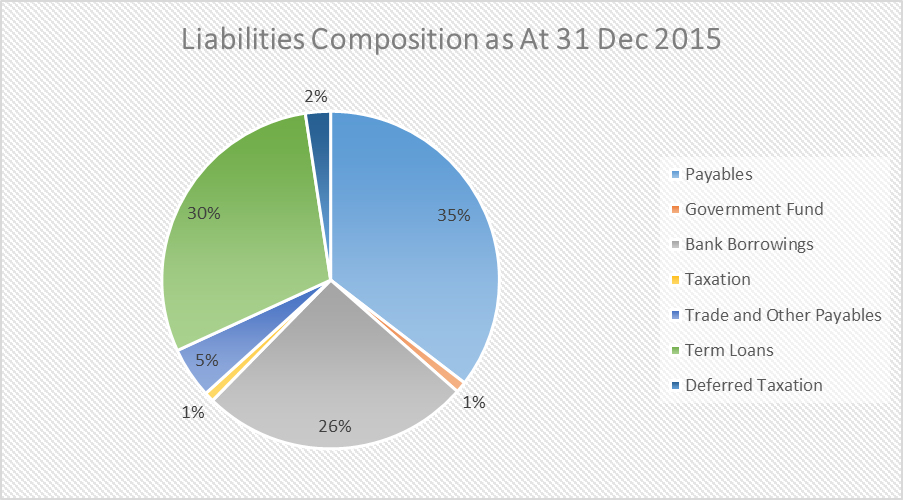

Based on the latest liabilities composition of Tek Seng Bhd as below, the largest composition will be their payables stand at 35%, followed by term loans which is 30% and bank borrowings at 26%.

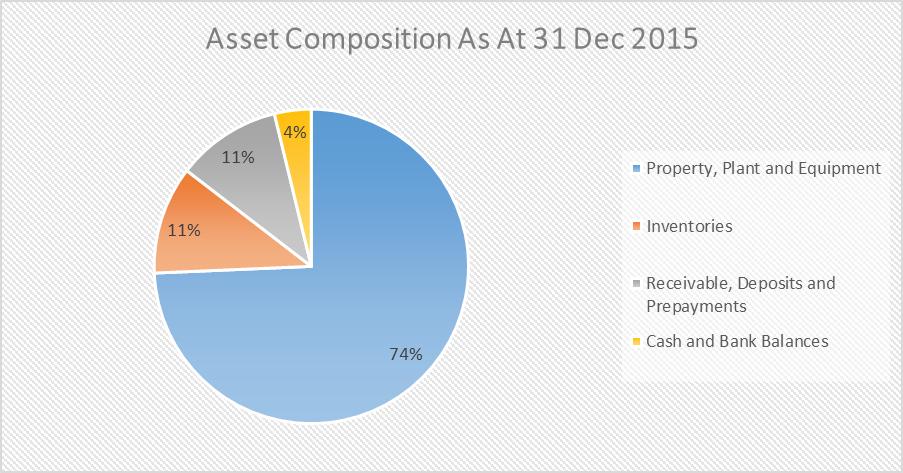

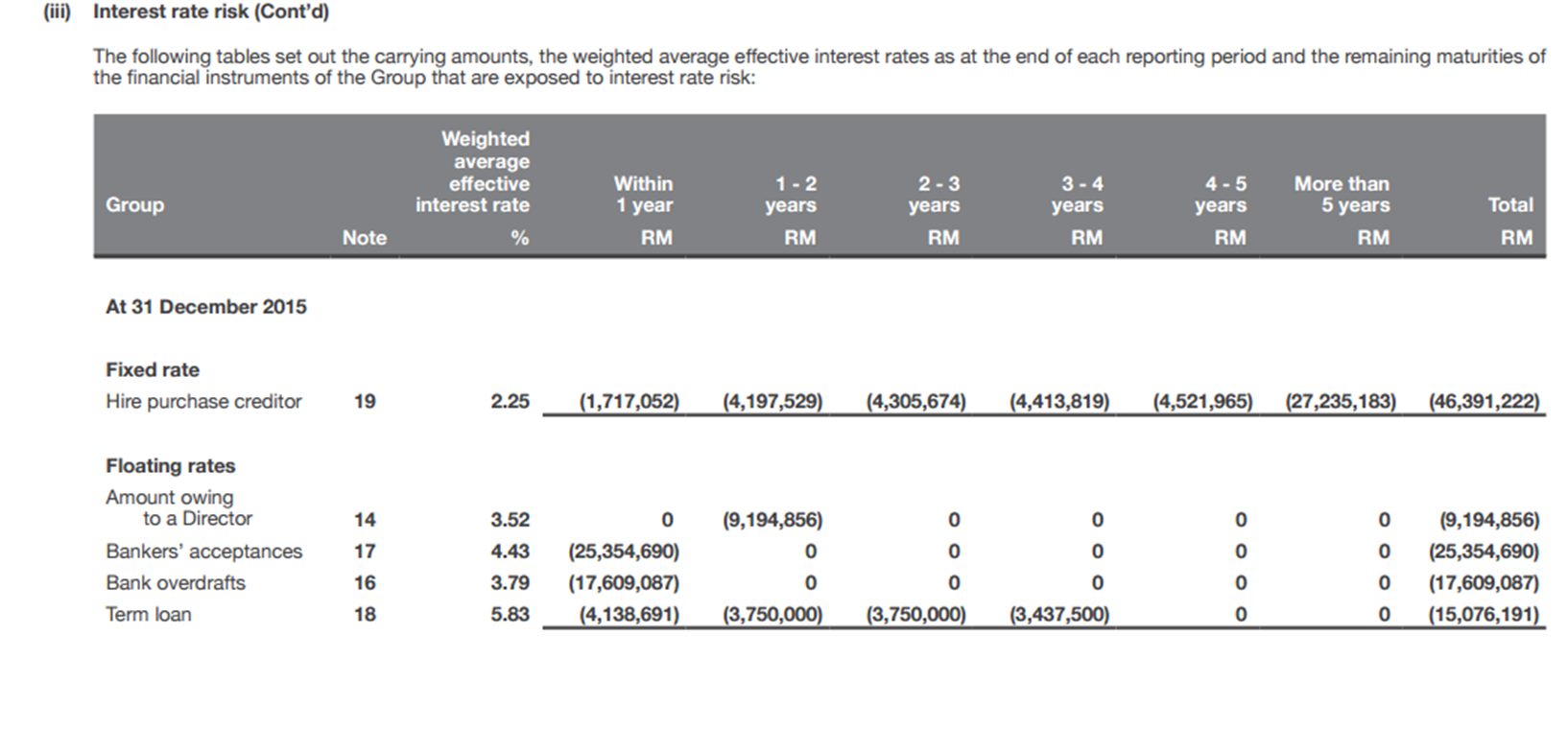

And according to the excerpt from their annual report, the interest rate of their loan was vary from 2.2% to 6%. The alarming high debt and receivable issue are becoming a threat to Tek Seng Berhad. This is due to the company might not have enough liquidity to serve their loan based on their asset composition as below. Based on the pie chart below, most of the asset of Tek Seng Bhd are property, plant and equipment (74%). Cash and cash equivalent in bank are only consist of 4% on their total asset. In other words, the company only had RM18million of cash but have RM104million of loans. Besides, that Tek Seng also had around RM66million of payable exclude hire purchase. The huge amount of debt might be due to the increase expansion of Solar Cell manufacturing line since their debt are stable until 2013 and start to balloon at 2015. However, this does not change the fact that the working capital management of Tek Seng are fragile if Tek Seng was unable to generate enough revenue to repay its debt and their supplier then Tek Seng might be going into bankruptcy in worst case scenario.

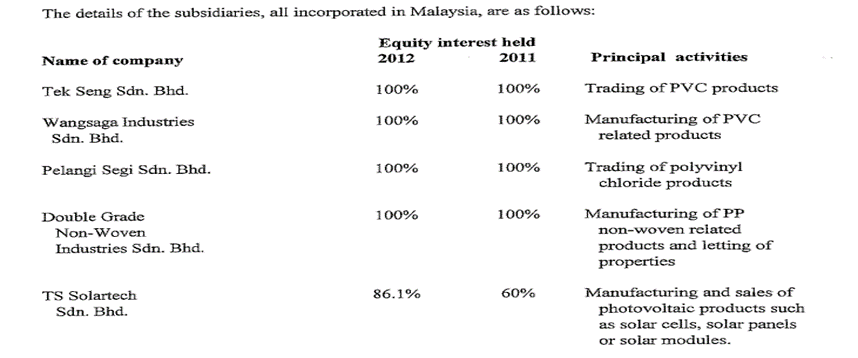

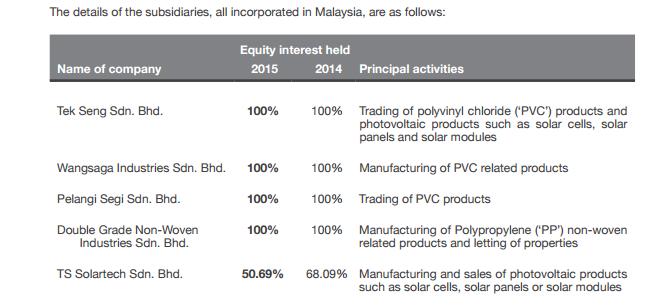

Dilution of Control on TS Solartech

In order to increase their revenue stream, Tek Seng had diverse themselves into Solar Cell manufacturing business in the year of 2011. As seen from the excerpt above, Tek Seng had a 60% of controlling interest in the business. Tek Seng had increased their shareholding to 86.1% at the year of 2012. However, as at 31 December 2015, the controlling interest on TS Solartech Bhd had fallen to 50.69%. As we know, most of the revenue of Tek Seng are from their Solar Cell business. So, Tek Seng need to remain control in TS Solartech in order to maintain their valuation. So, the controlling of TS Solartech should be the first priority on management.

Concluding Remark

In conclude, the Solar Energy sector of are promising and Tek Seng might be benefit from it’s due to its cost efficient production and high quality product. Solar conversion efficiency was the main concern for the user of Solar Panel. The new world record on highest solar conversion efficiency was 22.1%. The PV that manufacturing by Tek Seng are able to achieve a solar conversion efficiency of 17.8% which considered are highly effective conversion rate among the manufacturer. As the company currently undergoing extensive expansion, below are two question that need to be answer by the management during the EGM before further investment decision:

· The plan for Tek Seng on capital management. How to manage their debt?

· Controlling interest on TS Solartech. How to avoid further dilution? Are there plan of management to increase their controlling interest in the business?

Since I am unable to attend the EGM due to personal reason, I am more than happy if the question are being bring up in the upcoming EGM and some of the reader could share their answer here.

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals. By the time of writing, the author have a LONG POSITION on TEKSENG BHD.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Noob Investor

Created by noobnnew | May 13, 2016

Discussions

Good inputs noobnnew, hope someone can ask during the EGM/AGM and post the reply here.

FY15 capex is a large number of ~RM160mil, that is 45% of revenue.

The debt is high but the operating cash flow still in positive region for the pass few years.

Acid ratio is 0.57 in FY15, but TekSeng operate in <1 acid ratio for years. This had shown their management capability in the cash flow.

Lets see what's the outcome from this coming EGM/AGM.

2016-05-16 01:08

This company got no control over the solar business....none at all.

You are at the mercy of the Taiwanese.

2016-07-05 17:18

We got no control over the KLCI...none at all. Your are at the mercy of Ah Jib.

We got no control over the export...none at all. Your are at the mercy of US and China.

We got no control over the security surrounding us...none at all. Your are at the mercy of police.

........

2016-08-15 12:00

Hiu Chee Keong

Last year i bought tekseng at 0.40 only, after reading a report from a research firms. at that time they gave it TP1.20, 300% potential gain. but unfortunately, i sold it long before it reach TP 1.20. you can't take all the cake all the time :D

2016-05-15 11:54