Ekovest Acquisition on IWC - Worst Deal Ever?

noobnnew

Publish date: Thu, 02 Nov 2017, 08:28 PM

I believe the announcement above had caught a lot of investor in shock. The first and most common reaction for Ekovest Shareholder was it is LKH trying to bail out IWC in order to save face as IWC is worthless without Bandar Malaysia deal. Things does not get better when the next day some major Investment Banking Analyst starting to downgrade the share price to RM1.05 and as at today, some others technical analyst start throwing TP further to 95sen. It might be the worst deal in the history of trade deal, as put it in one of the current U.S President quote.

However, we should take a step back and study how the deal affect shareholder before start pointing fingure and throwing different TP from 70sen to 30sen which is obviously pluck from the sky.

Scenario A:

Minority shareholder of Ekovest vote to block the deal, hence the deal will not go through and no changes in Ekovest fundamental. Everybody panic selling for nothing. Share price back to Normal.

Scenario B:

The deal actually get through, which means currently there are two options for Ekovest to complete the deal i) Cash consideration of RM1.50 per share or ii) Issue new share of RM1.50 per share on the basis of one for one.

(i) Cash Consideration

Based on the latest QR of IWC, the diluted number of share outstanding for the company is 821,341,000share. If Ekovest want to acquire the 62% of share of IWC through cash, it will need to come out with around RM 760million (821,341,000 share x 62% x RM 1.50).

In order to determine whether Ekovest have RM 760mil in hand to pay for the deal, we will need to examine the latest balance sheet of Ekovest below.

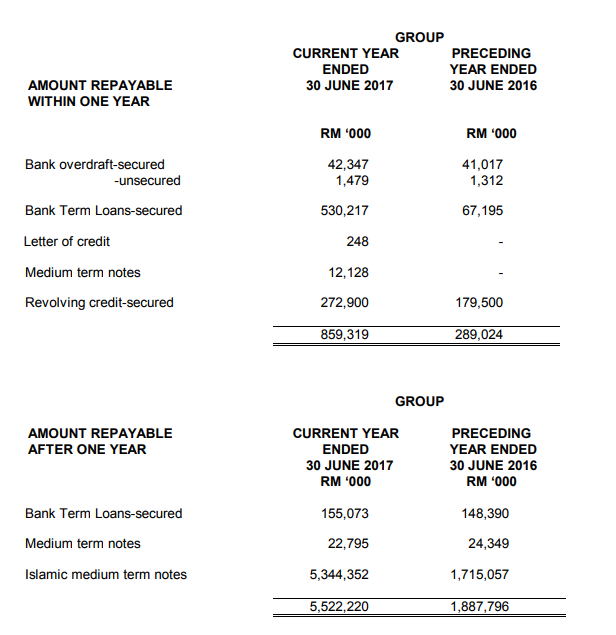

As we noted, the total cash and cash equivalent (Investment Fund, Short Term Deposits & Cash and bank balances) of Ekovest stand at RM 4.5 billion compare to its total debt of RM 6.3 billion. In short glance, it seems that it is impossible for Ekovest to come out the fund for the corporate exercise due to the huge amount of debt. But we need to bear in mind more than 70% of the debt is long term bond which only required periodic payment. The composition of the long term debt as below.

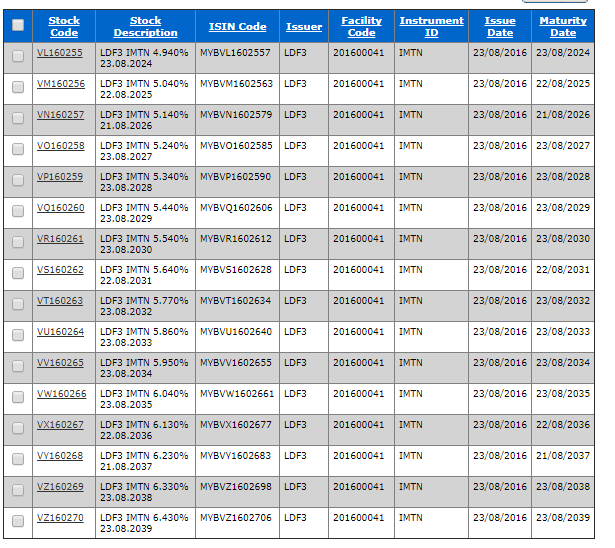

So, as showned above, the Islamic Medium Term Note (IMTN) issued are have different phase of maturity and also different payment period, The main purpose of the IMTN is to fund the construction of Duke 3. Since Ekovest do not need to pay fully upon the construction, the proceed from IMTN had been placed into investment fund to generate interest. Hence, technically, Ekovest can withdraw part of the fund to pay for the acquisition of RM 760mil.

One might ask how did Ekovest restore the fund that are supposed to fund LDF3 but now used to pay IWC shareholder for the acquisition. To answer this, we need to turn our eye to one of the jewel of IWC, the recent land disposal deal.

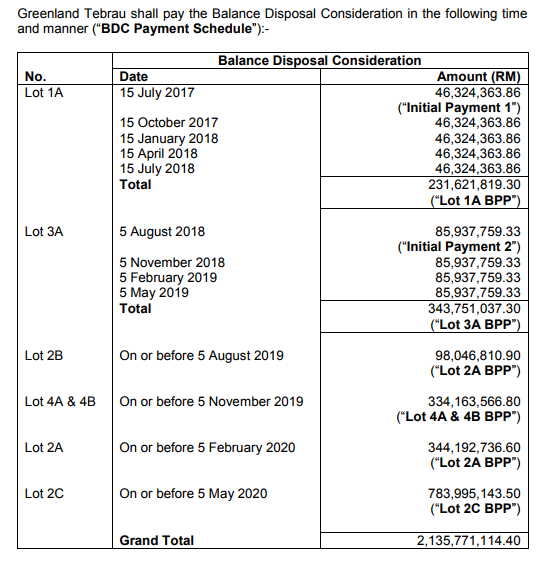

IWC had been entered into an land disposal and joint venture deal with Greenland Malaysia Berhad not too long ago. The initial and second payment had been received. The payment schedule as showned below.

Based on the payment schedule above, the total payment will be expected to received on 2018 will be around RM310 million and since Ekovest only acquired 62% of IWC, the final cash received by Ekovest will be around RM 192million.

Hence, by 2020, Ekovest will get a total cash consideration of around RM 1.3 billion (RM 2.1billion x 62% = RM 1.30 billion). After the deduction of acquisition cost of RM 760million, Ekovest will have a net gain of RM 540million in 2020. Hence, the total earning per share of Ekovest the disposal of land through out the period should be around RM0.25 (RM 540million / 2,139,203,000).

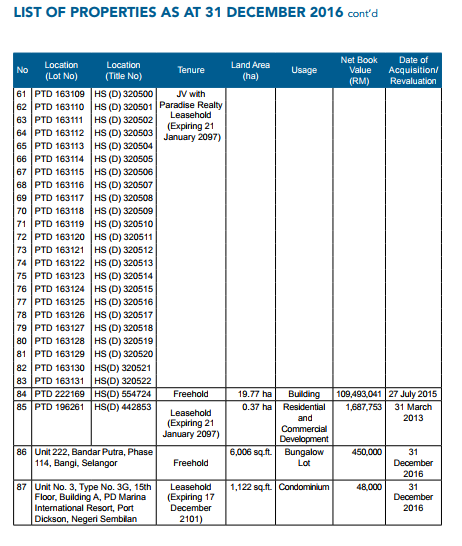

Apart from that, based on the declaration in the AR, total land area of IWC will be 751.84 hectare (upon disposal) with a total book value of more than RM 950million which will include in the land bank of Ekovest for future property development.

ii) Share Issuance

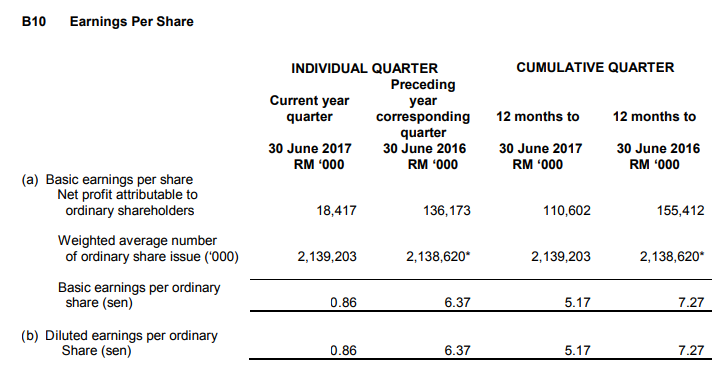

Based on the current number of share outstanding for IWC of 821,341,000, the number of share need to be issue by Ekovest on 1 existing share to 1 new share basis will be 509,231,420 shares. This number of share had represent 23% of current share base of Ekovest (509,231,420 / 2,139,203,000). The current diluted number of share outstanding for Ekovest as showed below.

Upon the completion of share issuance, the enlarge share base of Ekovest will be 2,648,434,420; this will dilute the EPS of Ekovest on around 20%. The main advantage from share issuance will be i) no changes on balance sheet composition and ii) share price of Ekovest need to be push to at least RM 1.50 in order for IWC Shareholder to accept the share swap deal.

Upon the share swap deal, Ekovest will be able to consolidate the income from land disposal deal into their 2018 Income Statement. Potential gain of Ekovest for 2018 alone will be RM 192,726,136 (62% of total payment receive). It will translate to full year earnings per share of RM0.07 which should be enough to offset the 20% of dilution in earning per share. Apart from that Ekovest will have access to the land bank same as the cash consideration.

Conclusion

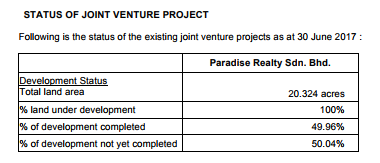

In short, the proposed deal was a good deal to Ekovest. One might argue it will take long time to monetize the acquired asset. However, Ekovest shareholder still able to gain from land disposal until 2020. Apart from that, the almost complete JV with Paradise Realty Sdn Bhd will provide another stream of income as showe below.

Hence, the income might be bumpy but it does not as bad as we think.

So, stand from a perspective of Ekovest shareholder, the best to worst scenario will be:

i) No Deal – Share Price back to normal

ii) Deal With Cash – No dilution of earning, better future earnings due to land disposal deal

iii) Deal with Share – Dilution of earning, but no effect on working capital as no changes in composition of balance sheet.

Final Remark

Note: The remark here is just a speculation which got without proof or basis. Reader do not need to take it seriously but discussion are welcome.

Finally, the main goal for Ekovest will be spin off and listing. By going through current corporate exercise, IWC will be part of Ekovest entity. However, the future plan might be the spinoff of asset from Ekovest into three separate company: Highway Toll, Construction and Property & Development for IPO. One might argue if that is the final goal, why don’t Ekovest just sell its property development business for IWC instead of acquisition. I think the main reason will be most of the investor fail to see the value of IWC beyond Bandar Malaysia and IWC do not have the power to carry out the corporate exercise. But if the company is acquired and relist again after a few years after Bandar Malaysia was resolve and the JV with Paradise Realty is complete, a higher valuation might be given to the new IPO company instead of current low valuation towards IWC.

Appendix:

Land Owned By IWC

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals. By the time of writing, the author have a LONG POSITION on Ekovest BHD.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Noob Investor

Created by noobnnew | May 13, 2016

Discussions

Come permas n stay one week. U might second guess will greenland see through such schedule payment with iwc. Schedule payment could be an indefinately non schedule payment. Just like 2020 to TN50. Big hope to achieve

2017-11-02 21:48

Bull, I am waiting for your to delete your bull-shit comment.

Fortune Bull This is the best analytical though process i ever seen! Kadoos!

02/11/2017 20:35

2017-11-02 22:56

Dude the imtn Money can be used only for DUkE. To do otherwise will trigger event of default on the IMTN.

2017-11-02 23:18

Secondly why is the amount due on the 15th Oct not in yet? Is there something wrong with Greenland?

2017-11-02 23:23

I like the idea of having `bird in hand is better than 2 in the bush'. We are now living in difficult times.

2017-11-02 23:51

initial payment received in aug, i suppose 2nd payment will only receive in nov

2017-11-03 01:49

minority shareholders suffer price drop $1.16 fiwn to $0.99 (-16). just bote and say No to the deal

2017-11-03 06:41

LKH game...he can also change his mind if it suits him.

minorities can also vote this down.

2017-11-03 08:46

https://www.thestar.com.my/business/business-news/2017/11/04/kang-hoo-has-his-say/

Thanks for the question about the article and overwhelming response. I think the article on The Star above pretty much confirm my theory. Of course, my number is a bit off.

2017-11-04 10:40

There are people above asked the right question. Why need to takeover iwcity? Iwcity can hold on to all the positive aspects it have by itself. What's the benefit of consolidating iwcity in Ekovest and having to fork out a premium for it. Remember iwcity is only an 80+sen counter prior IWH takeover news. In all aspects of the potential of iwcity land, at the end of it, it's all future talk, but money spent by Ekovest is now. Make sense?

2017-11-04 22:33

Hi, as I mentioned clearly in my discussion above. IWC deal is more than enough to cover the acquisition cost. The initial payment had been made and the article from both The Edge and The Star also pointed out that there wont be any default in payment as the counterpart was China. Hence, there will be no money spent by Ekovest as the payment schedule showed that the payment in 2018 and 2019 will be cover the cost.

Put it in simpler term, it is like you are using your current credit card to purchase an item that would generate cash in next 2 month which will be sufficient to cover the cost. It is a win deal. So, why not?

Zillions 04/11/2017 22:33

There are people above asked the right question. Why need to takeover iwcity? Iwcity can hold on to all the positive aspects it have by itself. What's the benefit of consolidating iwcity in Ekovest and having to fork out a premium for it. Remember iwcity is only an 80+sen counter prior IWH takeover news. In all aspects of the potential of iwcity land, at the end of it, it's all future talk, but money spent by Ekovest is now. Make sense?

2017-11-04 23:42

See, told already, bull/tomoto juice/kimmi juice always did that

Posted by KLCI King > Nov 2, 2017 10:56 PM | Report Abuse X

Bull, I am waiting for your to delete your bull-shit comment.

Fortune Bull This is the best analytical though process i ever seen! Kadoos!

02/11/2017 20:35

2017-11-09 12:00

i wont comment much on iwcity BUT there's something you guys never thought about. There's one point. I think you all know the story of IWCITY from BM to merger. The IWCITY IWH merger plan was delayed, think was it 2 times, and there were this good will nego..... well these are public relation words when something not right, they tried to make it look nice. When I saw those words, knew something was not right.

So now the key point is this, I don't want to be accuse of bashing this stock BUT the point is if IWCITY-IWH merger was so good, why did it failed? It is quite clear that the failed merger would have an impact on IWCITY after the BM botch. The last hope was the IWCITY-IWH merger, so it failed too. So now ekovest is brought in, so what does it mean?

2017-11-09 12:32

newbie5354

Why must use Ekovest cash? To bailout IWC minority including LKH?

2017-11-02 20:37