A fundamental study on LCTH (5092)

noobnnew

Publish date: Thu, 30 Jun 2016, 08:21 AM

Corporate Review

LCTH was incorporated in Malaysia on 10 November 2003. LCTH is principally an investment holding company, with two wholly owned subsidiaries, namely Classic Advantage Sdn Bhd ("CA") and Fu Hao Manufacturing (M) Sdn Bhd ("Fu Hao"). The two subsidiaries are engaged in manufacturing and sub-assembly of precision plastic parts and components and fabrication of precision mould and dies. To date, the Group has successfully exported its products to United States, United Kingdom, Singapore, China, Spain, Germany, Mexico, Hungary and Thailand. It is one of the largest suppliers of high precision injection moulds and plastic injection moulded parts in the Asia region.Today, FYC has manufacturing subsidiaries in Singapore, Malaysia and China. The Group’s operation is divided into local and export market. The local market relates to sales to customers within Malaysia who are non Licensed Manufacturing Warehouse (“LMW”). The export market relates to sales to LMW in Malaysia and overseas customers, with Singapore, Hong Kong and China being the principal market segment.

The Principal Business activities of the LCTH Group are as follows:

· Manufacture of precision plastic parts and components

· Sub-Assembly of plastic parts and components

· Fabrication of precision mould and dies

The Group's manufacturing operations are also supported by:

· Mould and die modification and maintenance;

· Secondary finishing processes such as:

Ø silk-screening

Ø pad printing

Ø spraying

Ø heat-staking

Ø untra-sonic insert & etc.

(Source: http://www.lcthcorp.com/)

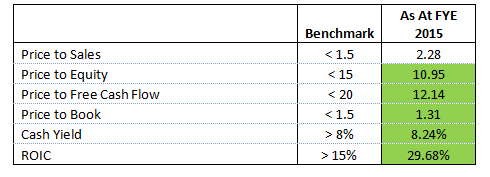

Snapshot Valuation

The main reason of LCTH Corp fall into radar was due to the attractiveness of the valuation on the company based on FYE 2015. A simple snapshot on the company valuation as below.

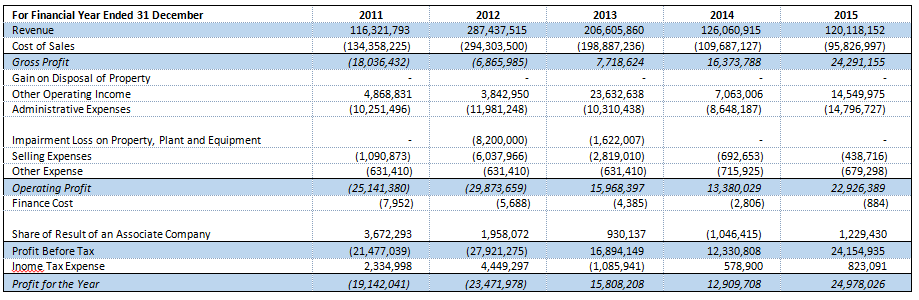

Financial Statement Analysis

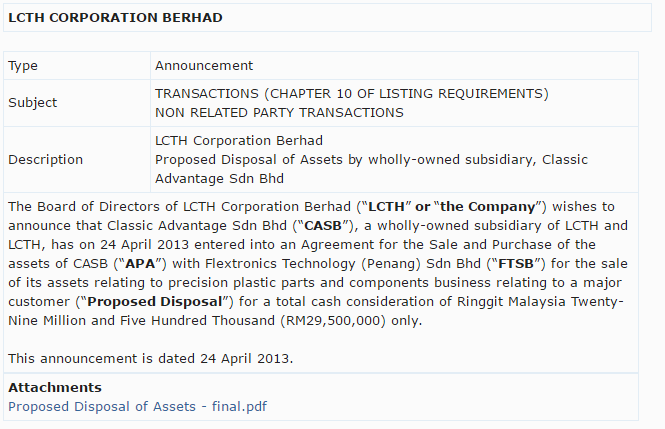

Table above had shown the financial statement of LCTH Corporation for the past 5 years (2011 -2015). We noted that the revenue of the company had slightly increased compare to 2011. However, the net profit of the company had turned from red to black within the five year period. The main corporate exercise happened to LCTH within the period was was the disposal of their asset (Classic Advantage Sdn Bhd) to Flextronic in 2013 with a cash consideration of RM29.5 million.

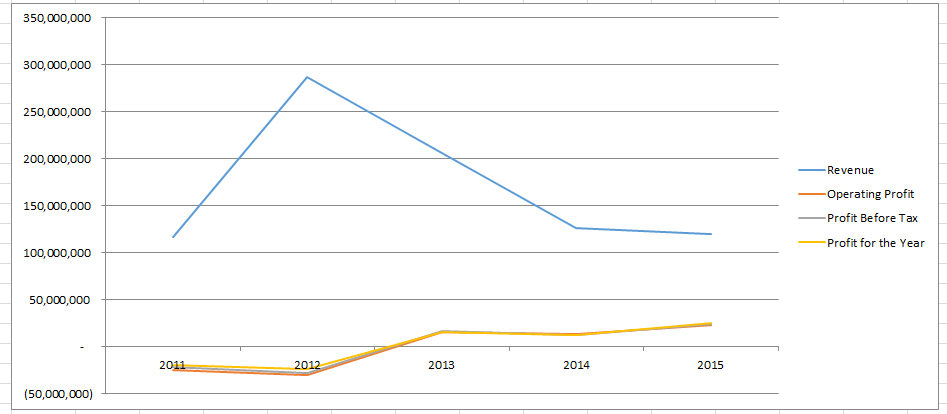

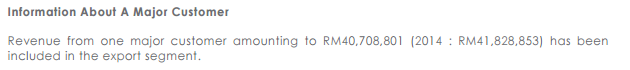

The line chart above had shown YoY changes of LCTH Corporation in order to provide a clearer picture on the profitability of the company. We are able to observe that despite a revenue drop since 2012, the profitability of LCTH actually were increasing. The reason behind the loss in between 2011 was due to the shift of the largest customer order from Malaysia to China and bring down the total revenue of the company. However, due to the disposal of assets in 2013 and effective corporate restructuring on cost control, LCTH has seen it net profit increase on YoY again from 2013 to 2015. Even though the net profit had increase on the YoY basis but the revenue of LCTH does not actually growth much. The revenue of the company actually was declining and according to their latest annual report, one major customer actually contribute around 30% of the revenue of LCTH. In short, this might be a huge threat to the company as it depends on its single customer to contribute 30% of revenue. The information about the major customer as below.

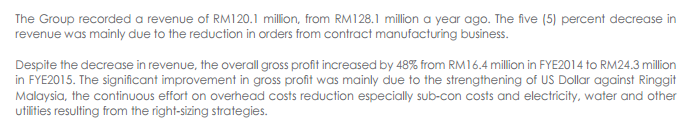

Lastly, exerpt below are the management comment on the latest financial performance of the company.

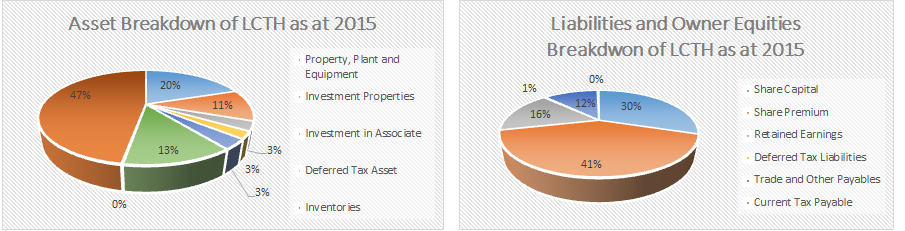

Below are the breakdown of Balance Sheet on LCTH as at FYE 31 December 2015:

From the pie chart above, we notice that LCTH had a strong balance sheet with zero debt and huge chunk of their assets was comprise of cash and follow with PPE. The net cash per share for LCTH was RM0.31 per share. In short, we are comfortable to conclude that LCTH was in an extremely healthy financial position with huge cash in hand that are able to support any corporate activities.

Return on Equity (ROE)

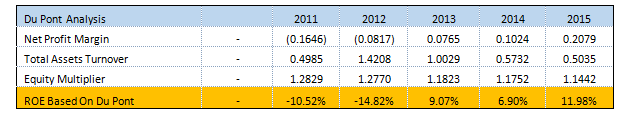

Return on Equity (ROE) might be a good indicator to examine the ability of LCTH to generate return compare to normal P/E ratio analysis. By decomposing the ROE through DuPont Analysis, we may be able to understand more on the main driver in the profitability of LCTH.

The ROE of LCTH had achieved historically high in 2015 which was 11.98%. By breaking down the component, we noted that the record high ROE was achieved through higher net profit margin and lower equity multiplier. However, the Total Asset Turnover of LCTH had deteriorating as well. This signal that LCTH still does not fully utilize their PPE to achieve maximum capacity.

Conclusion

In conclude, the strength of LCTH include strong balance sheet with massive amount of cash, effective corporate cost reduction strategy that create high net profit margin. LCTH also have several weaknesses such as relying on one major customer to contribute 30% of earnings and also no revenue growth. Most of the profit are from the cost cutting which is inorganic to the corporation. However, the silver lining is LCTH had begun to invest in their PPE again in year 2014 and 2015. The total CAPEX Spending was around RM46 million. Currently management also working to turnaround their China Operations. Therefore, this might be a signal to show that the company will be in their expansion again.The valuation done on LCTH was based on the annual report of 2015 and the closing price of 0.76 per share as at 31 December 2015. It means that by trading at 0.56 per share currently, the valuation of LCTH may be more attractive. By having 0.31 cash per share, by paying 0.58 we are actually getting a discount of 46%. Hence, it might be a good buy for investor that are hunting for value and turnaround.

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Noob Investor

Created by noobnnew | May 13, 2016