OpenSys (M) Bhd (0040) - Robust Growth Ahead

noobnnew

Publish date: Sat, 12 Nov 2016, 10:41 AM

As one of the penny stock that below RM1 that recommended by Cold Eye, OpenSys (M) Bhd had fly into our radar. For those who want to understand the fundamental of OpenSys, you are welcome to read the article published by Shinado in the link below. He had done a good job that we couldn’t done it better.

http://klse.i3investor.com/blogs/shinado/92831.jsp

One of the famous blogger Icon8888 had cover OpenSys previously as well that mentioned about the future prospect of the company in end of June 2016. Those who are interested can read about in the link below.

http://klse.i3investor.com/blogs/icon8888/99160.jsp

Same as every article that published by Icon previously, the share price of OpenSys had surged to all time high at around 41sen but drop drastically after the Q2 financial result came out as the result are not as good as aspect by speculator. Some of the member in i3 even comment that the company account seems fishy due to high receivable. The purposed of this article is to examine that whether the prospect of OpenSys is as good as it promoted by Icon and also Cold Eye.

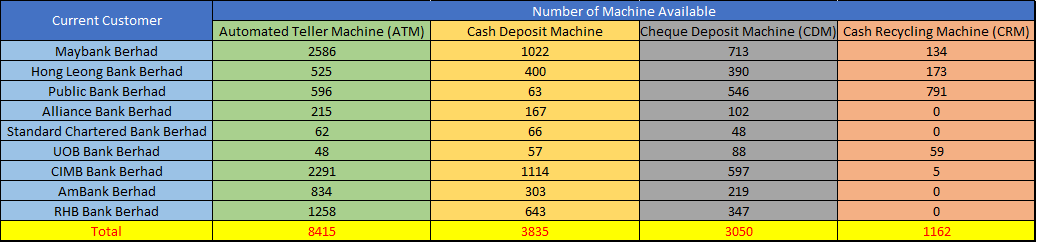

The table below had shown the number of self-service machine available throughout Malaysia by the customer of OpenSys as at 31 December 2015.

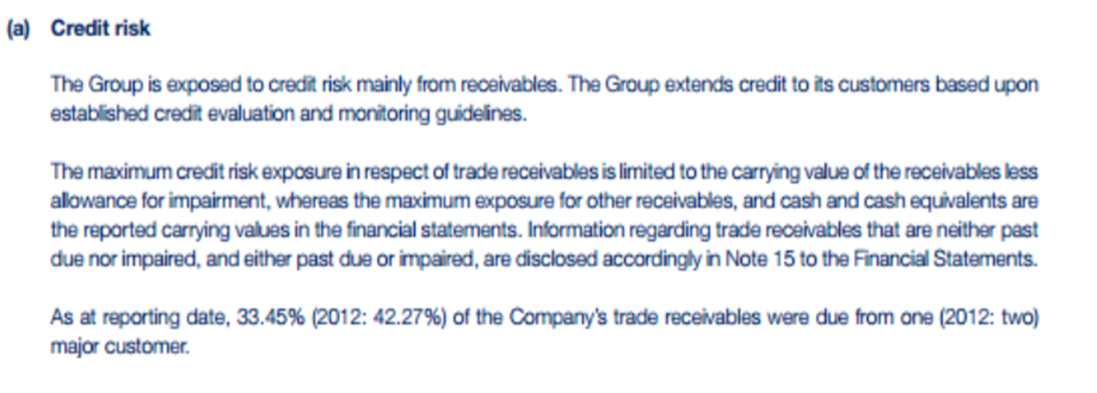

As we can see, currently there are 1162 units of Cash Recycling Machine available in Malaysia. Public Bank have the most number of CRM machines follow by Hong Leong Bank and Malayan Banking Berhad. The number of CRM are almost 8x lower and 3x lower than ATM and Cash Deposit Machine available nationwide. Based on the excerpt of the annual report below, we understand that bank branches can replace two ATM/CDMs with on CRM without compromising the quality of services provided. Besides that the action also will help the bank to save their operational cost up to 30%.

Judging from the current number of 8415 units of ATM and 3835 units of CDM available without considering the future growth of CRM installation in new places. If all the current customer are going to replace their old ATM/CDM machines to CRM, the market still need about 4000 units of CRM. So, the question now will be how OpenSys benefit from the CRM Market compare to all its competitor.

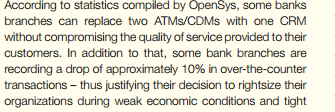

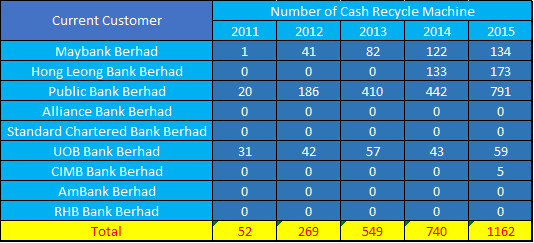

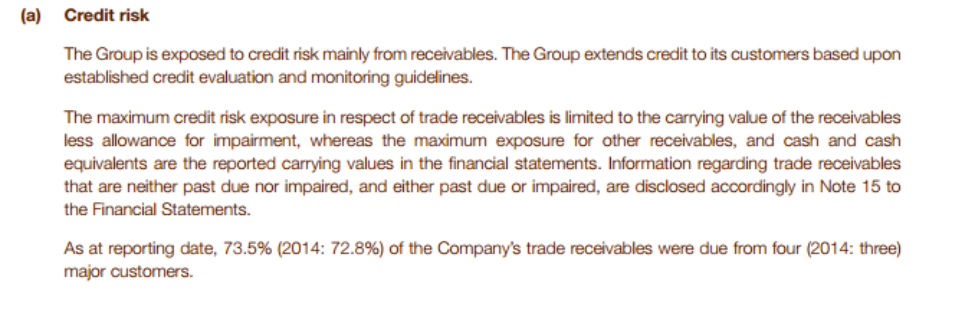

The number of CRM available in Malaysia are only 52 units in the year of 2011, before that there are no data of CRM installed among the local financial institution. One of the interesting thing noted when we study the annual report was coincidentally OpenSys also begin to shift into CRM business in the year of 2011. By studying the financial notes from the annual report in 2013 below, we noted the management mentioned that main trade receivables are from 2 customer in the year of 2012 and 1 in 2013.

In the whole year of 2012, Public Bank had installed 146 units of CRM whereas Maybank had installed 40 units. We believe that they are the two major customer that mentioned by the management of OpenSys. In the year of 2013, Public Bank had installed more than 200 units of CRM which make him the single largest customer of OpenSys with huge trade receivables.

If we continue to go through the annual report in 2014 and 2015, we will noticed that the management continue to mentioned that the trade receivables in 2014 are from 3 different customer in 2014 and 4 different customer in 2015. The new bank that installed CRM in 2014 is Hong Leong Bank and 2015 is CIMB. Therefore, by putting the puzzle together, we believe that currently the four main customer that purchasing CRM from OpenSys are Maybank, Public Bank, Hong Leong Bank, Public Bank and CIMB which are 4 out of 5 banks that had already installed the CRM.

Since the installation of CIMB and HLB still low compare to Maybank and Public Bank, we expect that both of the bank will continue the installation of CRM in near future in order to achieve cost efficiency management. From the observation above, we also does not worry about the huge receivable in the balance sheet of OpenSys as it was almost unlikely for local financial institution to default their payment obligation. The future for OpenSys is bright as well since there are still RHB, AMBank and Alliance Bank as an existing customer for the Cheque Management Solution of OpenSys that are still do not adopt CRM in their business. Given the past record of OpenSys, we believe that OpenSys able to convince all these bank to purchase their CRM as well.

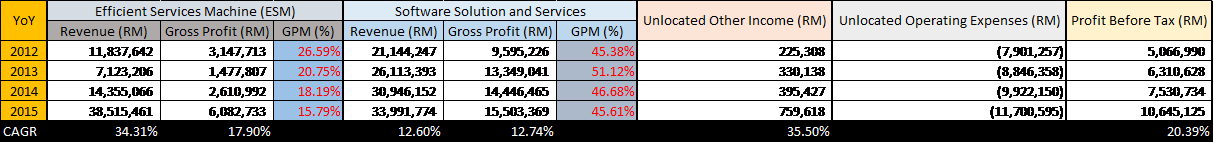

Some of the investor might argue that the profit margin of CRM is not as high as expected therefore OpenSys might not be able to benefit much from it even OpenSys is the market leader in CRM business. Below had showed the segmented revenue of OpenSys.

From the first table, we are able to observe that the revenue contribution of ESM had increased from only 35% of revenue increased to more than 50% in 2015 and judging from the CRM installation rate, we expect the contribution of ESM will continue to growth in the next few years. Compare to the net profit margin of ESM that range from 15% to 25%, the SSS clearly provide a higher profit margin at around 45% to 50% each year. However, we noted that the revenue are stable and no growth in the past few years. This is due to the revenue contribution of SSS are per transaction basis which means that OpenSys will charge certain amount of fees for each cheque process through their machine. We have the reason to believe that the revenue from the SSS business will having exponential growth in future after the installation of CRM slowdown. This is due to OpenSys are offering free solution services for the first few years to their customer that purchased the CRM from them. Upon the completion of installation on CRM, it will be time to charge for the SSS services. Hence the company will not experience any slowdown or decline in their revenue even there are low CRM installation in the future due to new contribution from their Cash Recycling Solution provided.

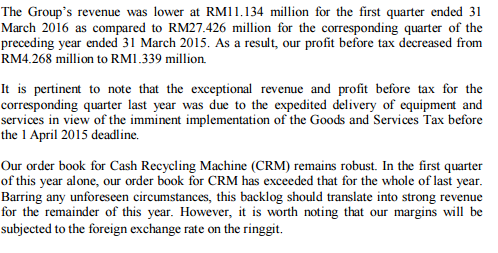

Referring to the excerpt from Q1 2016 issue by the management, we noted the management mentioned that the order book for first quarter has exceeded whole of last year. Since the CRM installation was 422 unit last year, we expected the order book will be in between 450 to 550 units this year for OpenSys.

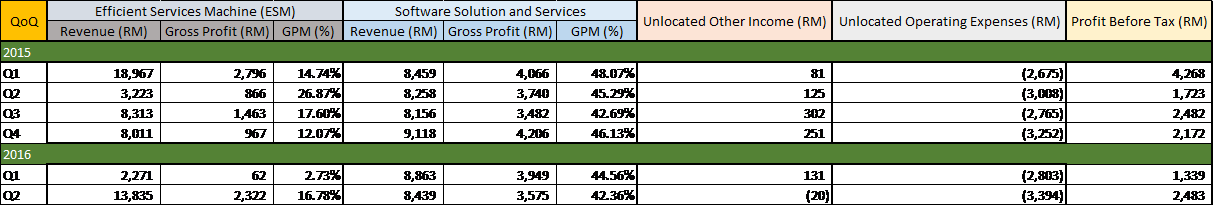

Based on the QoQ breakdown of segmental reporting below, we noted that the said strong order book still are not reporting in the latest quarterly result. Hence we have reason to believe that a strong result will be posted by management in coming Q3. As the management continue to hint in their Q2 financial result that it normally take 4 to 5 months for OpenSys to deliver the product once it was ordered.

In short, we are positive to the bright future of OpenSys due to following reason,

- Strong upcoming Q3 result

- Market leader for CRM

- Robust growth ahead due to low CRM installation from local financial institution

- Sustainable income as the low CRM revenue in future will be able to compensated by revenue from Cash Recycling Solution

- Strong balance sheet and Cashflow

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals. By the time of writing, the author have a LONG POSITION on OpenSys BHD.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Noob Investor

Created by noobnnew | May 13, 2016

Discussions

With such low margin for CRM hardware, Opensys future cannot depend on CRM hardware sales, it is not exciting at all. As for software, there are 2 ways that CRMs are integrated into banking system. 1. Direct integration, this will be one off system integration, there will be no recurring income for Opensys, for large integration, most bank will choose this form of integration. 2. Use middle ware to act as communication between CRM and the rest of banking system, this will have recurring income for Opensys.

Perhaps someone can ask Opensys directors to ascertain which method they are using then we can know the prospect of Opensys better.

2016-12-11 08:42

paoblocrk

Well written, just like a typical accountant.... well I believe opensys will continue to grow as more bank turn to CRM

2016-11-15 21:59