Why I think Hevea Is Undervalue

noobnnew

Publish date: Mon, 09 May 2016, 07:02 PM

Before you continue to read on the article below, I am oblige to tell you that I am currently hold some position in Hevea. Hence my view might be biased.

Below are the reason that why I think Hevea currently is undervalue:

a) Financial Performance Review

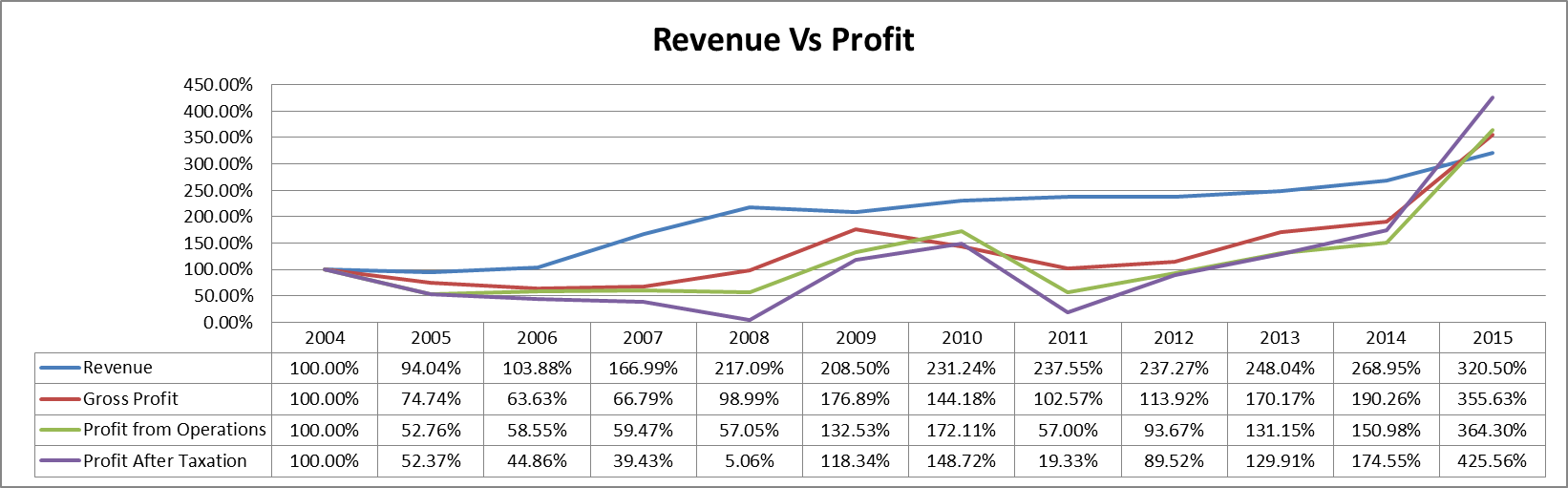

1. Strong Revenue and Profit Growth

Looking at the income statement, the revenue and profit of Hevea Bhd had growth strongly and consistently since 2004. It is obvious that the revenue of the company had growth consistently at CAGR of around 10% per year which resulted in triple their revenue in 12 years. As we can see, the both Profit from Operation (EBIT) and Profit after Tax (PAT) had grown consistently and only shrunk during 2008 and 2011 financial crisis. The net profit for the group had quadruple during 12 year period with CAGR of more than 12% per year. The net profit for Hevea as at 2015 was 14.62% which was almost double compare to 2014 that recorded only 7% net profit.

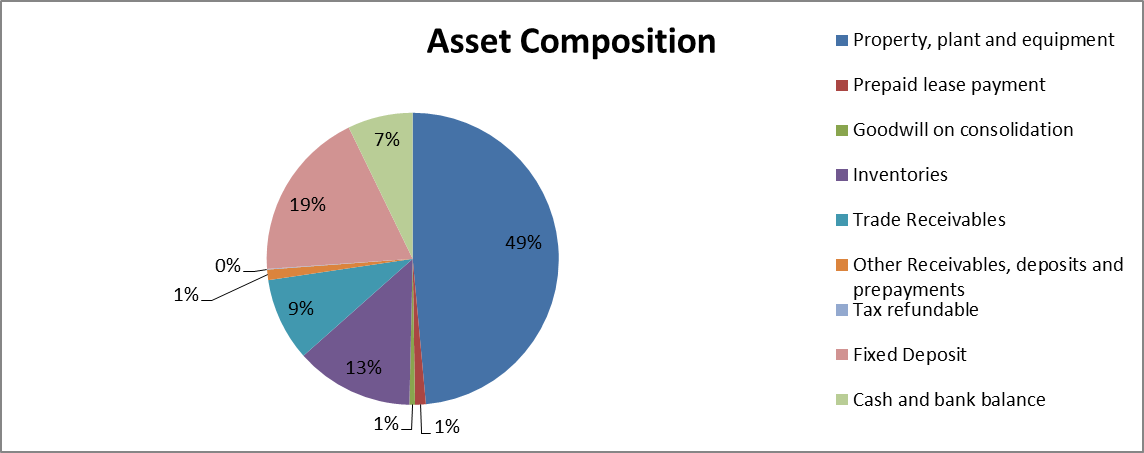

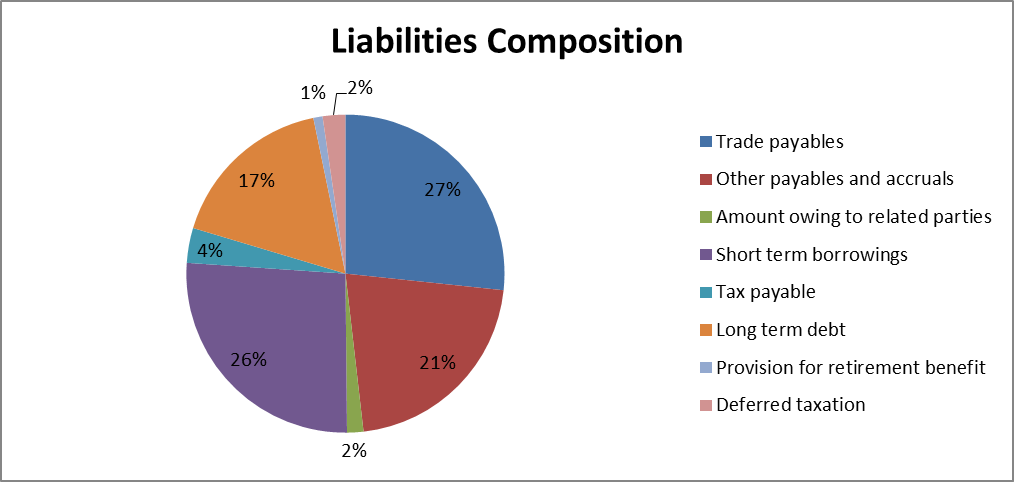

2. Strong Balance Sheet

Above was the balance sheet of Hevea Bhd as at 2015. As usual, property, plant and equipment had made up of most of the asset composition and follow by cash and fixed deposit which is more than 25%. The company currently had RM125million of cash sitting in their bank account compare to total debt of RM61 million. Besides that the total liabilities of Hevea Bhd was only RM135 million and most of it was trade payables. Hence there are no worries on the liquidity position on Hevea Bhd.

3. Strong Cash Management

We always said that ‘Cash is King’, it is not important that how much revenue a company would be able to generate but the ability to collect payment and payback supplier on times are matter. Hevea Bhd had done a good job in their cash management throughout the year. Based on their latest quarterly report, it only took Hevea Bhd around 60 days to convert their product to cash.

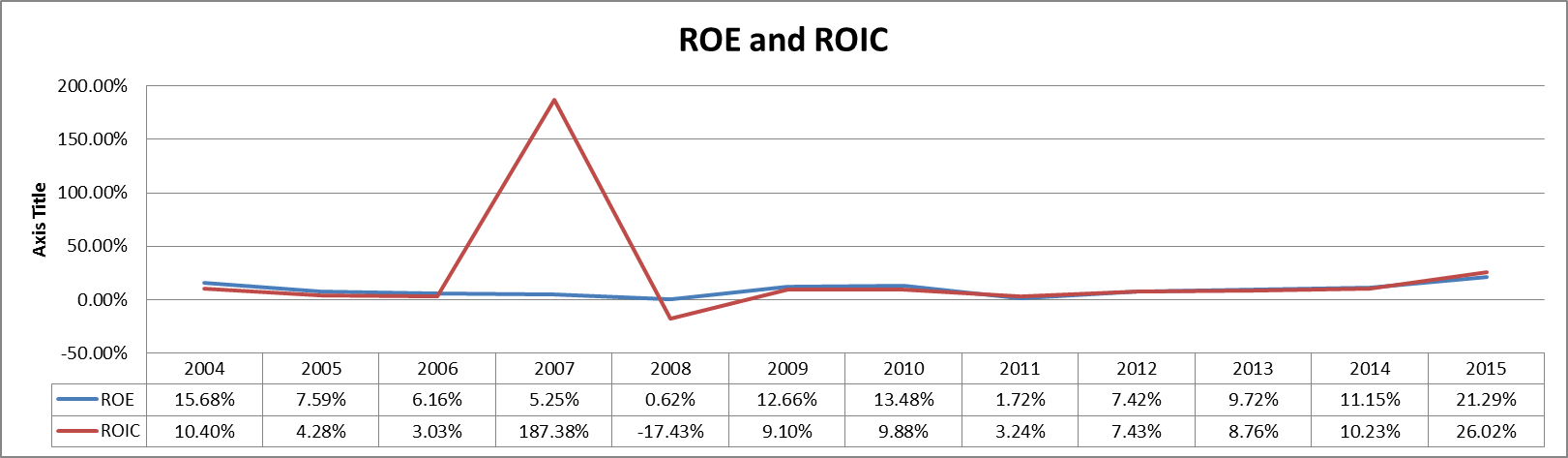

4. High Return on Equity and Invested Capital

The return on equity (ROE) and Return on Invested Capital (ROIC) of Hevea Bhd was doubled in 2015 compared to 2014. Apart from that, it was growing consistently after the company crisis in 2011. The high growth in ROE and ROIC had shown that Hevea Bhd was able to generate higher return for investor in long term period.

b) Outlook and Prospect Summary

Above are the excerpts of Outlook and Prospects towards Hevea Bhd from the management. Key points from the excerpt above were:

- Focus on Research and Development

- Allocation of RM20.0 million in 2016 for CAPEX Spending (RM8.0 million in upgrade facility, RM12.0million for expanding product range in RTA)

- Introduction of new furniture line (KREA Kids)

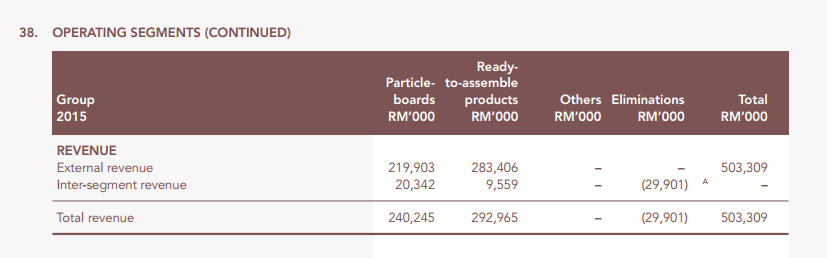

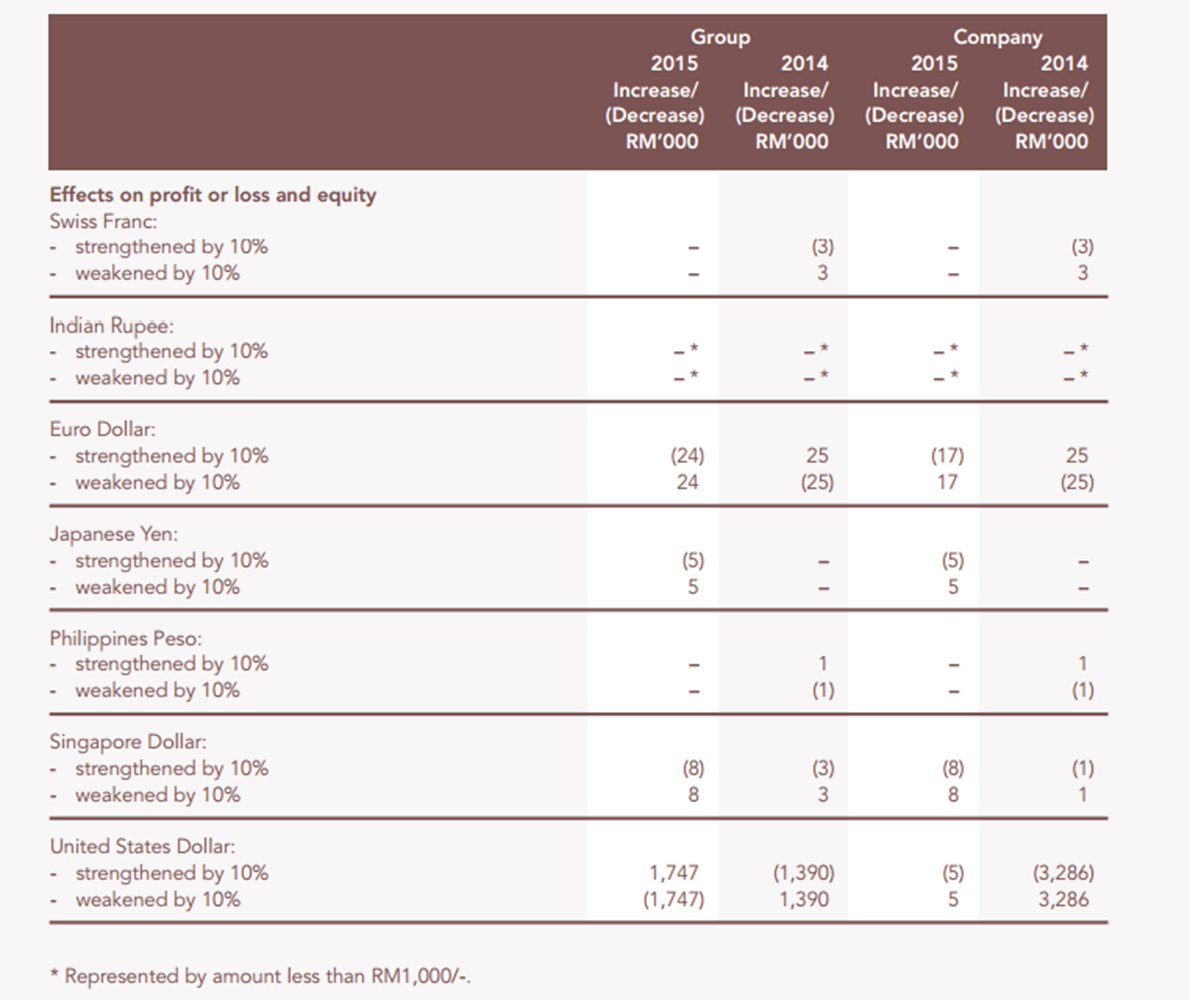

The RM12.0 million of CAPEX spending on expanding of RTA Furniture line was reasonable if we compare the revenue breakdown in 2014 and 2015.

The RTA product had contributed more than half of the revenue to Hevea Bhd. The RM18.0 million of CAPEX spending on RTA product line estimate will generate more revenue for Hevea in the future. Furthermore, the current net cash of Hevea in balance sheet are more than enough to support the RM20million of CAPEX Spending after repayment of all the debt. Hence, it is reasonable to forecast a huge improvement of cash and cash equivalent in the balance sheet in 2016.

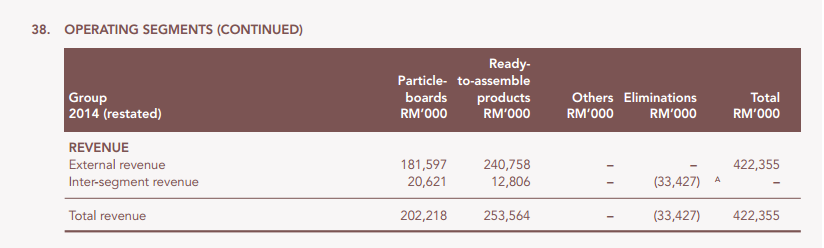

According to the country segmentation reporting, Japan was the largest customer of Hevea Bhd and followed by China. The sales of Malaysia only accounted for 7% of total revenue. The ratification of TPPA and coming soon Tokyo Olympic were estimate to generate more revenue for Hevea in the upcoming period. Besides that, the revenue growth in India and Australia in 2015 was 162% and 55% respectively compare to 2014 might have shown sign that Hevea successfully tap into Indian and Australia market that further diversify their revenue stream.

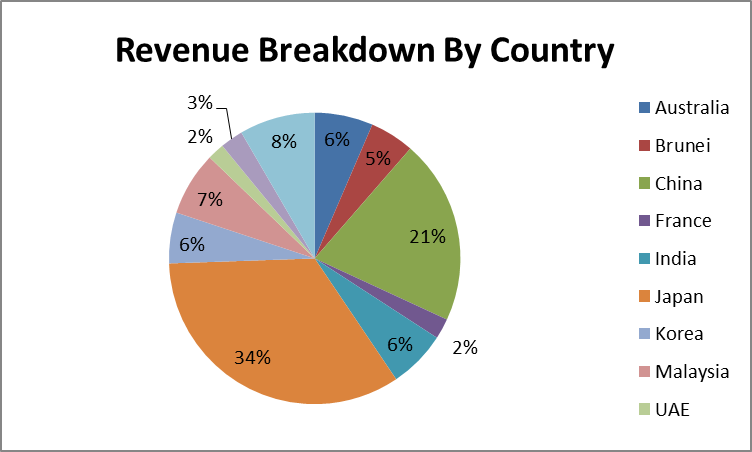

For those who are worry on the effect of foreign currency exchange on the profitability of Hevea Bhd, that would be unnecessary, because according to their annual report the 10% weakened in USD only decreased their profit of RM1.7 million. Based on the net profit of RM73.6 million in 2015 it means that 10% of weakened in USD only weakened around 2.6% of their net profit. Hence, unless the MYR suddenly strengthen 50% against USD, there is no worry on the foreign currency effect on the net profit.

c) Conclusion

In concluded, based on the closing price of RM1.23 today, Hevea had a P/E Ratio of 6.8 and P/B ratio of 1.46 which is cheap compare to it historical record and also future prospect. Hence, I would consider that Hevea is currently undervalue.

Disclaimer: I wrote this article myself, and it expresses my own opinions. The author does not guarantee the performance of any investments and potential investors should always do their own due diligence before making any investment decisions. Although the author believes that the information presented here is correct to the best of his knowledge, no warranties are made and potential investors should always conduct their own independent research before making any investment decisions. Investing carries risk of loss and is not suitable for all individuals.

More articles on Noob Investor

Created by noobnnew | May 13, 2016

Discussions

Sounds imteresting, the kid productct lines seems a good idea, will keep it into my watchlist :)

2016-05-09 19:38

Well written, keep up with the good work.

Who knows you may be the upcoming RicheHo, Shinando or Icon8888?

2016-05-09 19:39

already up 500% still undervalue....are u crazy? sell before drop below RM 1.00

2016-05-09 20:53

@Apollo Ang

Yes it is undervalued. While I'm too lazy, other sifus here might educate you.

2016-05-09 21:06

Let me state some fact about Hevea here:

1.It has EV/EBITA of 3.97 indicates that it's cheap/undervalued

2.The return of capital of it is 13.99% annually.

3. The cash yield of it is 11.8%, note that this is not profit but the free cash flow that it generates for 3 years!

Conclusion: Cheap company with efficient management along with good cash flow. Buy or not? your choice.

2016-05-11 10:01

optimushuat

Robertl, long time no see, he will come when hevea over rm1.30

2016-05-09 19:04