Most of you know that I’ve finally taken the leap to run old school value full time.

Boy was it humbling to be encouraged by so many people who I’ve never met in person.

What’s more, you shared my excitement which makes me even more determined to make old school value a better place for value investors.

Couldn’t have been a better start to living the American dream.

But the past two weeks have been a blur.

My wife also runs a business and I’ve been working for her. Selling her products at a local show here in Seattle.

Thankfully she sold close to a thousand of her products in 5 days so that was amazing.

But with all the time spent standing, talking and just thinking at the show, I couldn’t help tie some things back to investing and stocks.

Here are 3 lessons I took during my first two weeks of unemployment on business and stocks.

Lesson #1: Understand How to Invest, Not What to Invest

Running multiple businesses has helped me understand how to invest, and not what to invest.

It’s obvious, but there is no such thing as a get rich quick business or investing strategy.

It’s a time consuming and laborious process.

But that’s the huge difference between the “how” and the “what”.

The how is for people desiring long term wealth.

The what is for people who want short term profits.

Of course I wish our products would fly off the shelves, sell millions and become a household name.

But for every successful product out there, there are thousands of hours of work put in behind the scenes that you never see.

It’s the same with picking stocks.

When you come across somebody who makes stock picking and analysis look so simple, it’s because that person has spent hundreds of hours studying, reading, thinking, learning, applying and improving his process.

Compare that to the most common method of picking stocks and the expectations that come with it.

- Hear or read about a stock somewhere

- Buy some shares

- Go brag about it to friends expecting the price to go up

- Wait a a couple of weeks to classify it as a long term investment

- Do it again and become filthy rich

You’d be surprised how many people think like this.

Value investors willing to improve their process and analysis skills are the minority. Everyone else just wants “money, money, money”.

So how do you learn how to invest for long term wealth?

Learn accounting: Have you see the episodes of Shark Tank or The Profit where the business owners don’t even know basic accounting?

Without understand the basics of accounting, investing in stocks is an uphill battle.

Accounting is the language of business. And if the stock market is a marketplace for businesses, you need to talk the talk.

It’s always a good idea to brush up on the basics now and again too.

Check out my recommended list of investment books.

Specifically, read the following two books to learn the basics of accounting.

Learn Financial Statement Analysis: If accounting is the language of business, financial statement analysis is the ability to interpret and understand it.

Knowing the relationship between revenue, inventory and accounts receivables is valuable.

Understanding what the business is telling you when raw materials goes up with finished goods going down is insightful.

Being able to compare numbers and avoid value traps and failing businesses is a godsend.

Here are some resources to help you with financial analysis.

- 4 timeless articles on financial statement analysis

- This is How Buffett Interprets Financial Statements

Lesson #2: Debt Sucks

Debt will suffocate a business.

My wife and I made a bad business decision about a year ago where we got into debt.

Because we weren’t able to generate the returns we were expecting with the loan, the business was put in a dangerous situation.

Literally only $1,000 or less was left in the bank account and we had to continually tap into our own savings to keep it afloat.

For small businesses and small caps, debt sucks.

If things hadn’t improved and we didn’t aggressively pay back all the debt, I wouldn’t have been able to quit my job.

Take a look at the debt struggles going on with RadioShack. Their debt load is strangling them into bankruptcy.

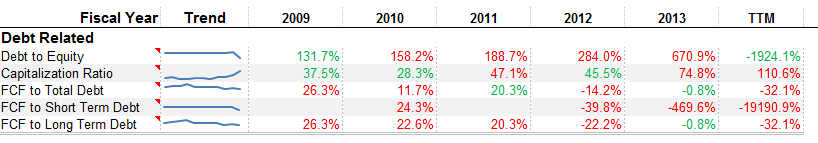

Here are some ratios that I use to check the debt levels of a business.

Capital Structure Ratios of a Business | Source: old school value

Instead of doing a simple debt to equity ratio, split up the debt between short term and long term as shown above to get a better picture of the debt and capital structure.

Check ability to pay back debt | source: old school value

But having a little debt isn’t bad.

Even AAPL has debt.

But AAPL is overflooded with cash and the debt is peanuts compared to its liquid assets.

So a quick and easy way to determine whether debt is manageable is to check whether FCF can pay off debt.

After all, earnings doesn’t pay off debt.

Cash does.

In the case of RadioShack, if you just look at FCF to Total Debt, you can get the wrong impression that they are having a single bad year.

But the FCF to Short Term Debt shows that they can’t generate cash to pay off the debt.

A very bleak picture.

Debt sucks.

Additional reading: 20 balance sheet ratios to determine a company’s health

Lesson #3: Cash Rocks

On the flipside of debt, cash is the almighty king.

Cash provides;

- time

- flexibility

- ability to make good decisions

- potential to grow the business

The difficulty my wife and I have with running a product based business is handling inventory.

We don’t have the operations and efficiency to make it easy at this point.

After all, inventory is cash that’s just sitting there.

That’s why the cash conversion cycle is so important to analyze businesses. Two same businesses where one converts quicker is a much superior business.

If inventory isn’t selling and you are low on cash, rash and bad decisions are made.

But with a large cash hoard, you can outlast the tough periods and place focus on growing the business.

Peerless Systems (PRLS) is a great example.

It was a net net cash box with no operations and they did nothing for years.

Just sat and sat… and sat.

And finally when a deal they liked came by, they jumped on it.

Cash is and always will remain king.

No company or person ever went bankrupt having too much cash.

3 Simple Lessons Reaffirmed

- Learn and enjoy the process and not just the rewards

- Debt sucks

- Cash rocks

I’m sure there is nothing new here, but with my new situation, it has definitely given a refreshing look at my current situation to run a better business and to analyze stocks more effectively.

calvintaneng

This article is only 50% correct. The name Old School is a misnomer. 2 weeks experience to form an opinion is only half baked. It should be called "Newbie Inexperience".

Is all Debt bad? Should a person or business go into debt?

Answer is both Yes & No

No if you borrow to consume. It is wrong to borrow just for consumption alone. This is the fatal mistake of yuppies. Buy over expensive flashy cars with borrowed money.

Wrong on 2 fronts

1) Paying high interest to consume.

2) Holding a fast depreciating asset.

But Debt Is A Good Thing If You Use It Wisely

Take Public Bank's Chief Mr. Teh Hoong Piow.

He is offering you a 3.6% interest for a One Year Loan From You. So Public Bank is taking on debt. Lots of it!

Suppose you lend to Public Bank RM100,000 for a fix rate of 3.6% pa.

Public Bank now owe you RM100,000 Plus RM3,600 Interest =RM103,600.

By hook or by crook Teh Hoong Piow will have to pay you RM103,600 when time is up.

Now Public Bank has taken debt. So bad for Public Bank?

Nonsense! Public Bank in turn lend out borrowed money (borrowed from you) & in turn loan it to Listed & Unlisted Companies, Govt Servants, Doctors, Lawyers, Engineers, Businessmen, House Buyers, Car Buyers & All Others at 6% to 10% interest. For credit card - as high as 20% interest & interest upon interest.

Public Bank Took On More Debt To Make Even More Money !!!

So Good Debt Is Good Because You Borrow Not to Consume BUT TO INVEST IN PRODUCTIVE CAUSES!

You Must Learn To Differentiate Between Good & Bad Debts

By Calvin Tan Research

2014-10-31 10:30