(This is a guest post and focuses on a micro cap. Don’t forget your own due diligence.)

As a value investor, you search for companies whose market values are significantly less than their intrinsic values.

This cushion between intrinsic value and market value is the margin of safety.

A business trading for less than net cash has the potential to be the ultimate margin of safety stock.

Why?

Take the company’s cash, subtract out all liabilities, and the market is valuing the company for less than this amount, that is something special.

It is about as close as you can come to buying dollar bills for 50 cents.

Introducing The Negative Enterprise Value Strategy

While there are slight differences in the definition of “enterprise value”, it’s the same as saying a stock with negative enterprise value trades for less than net cash.

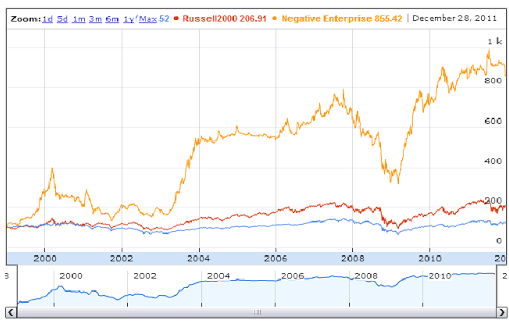

Old School Value already has a backtest on the Negative Enterprise Value strategy with great results.

Word of caution.

Most companies meeting this negative enterprise criterion are micro and small-caps, and plenty of issues.

So bigger market inefficiencies exist.

The key question you have to ask yourself for net cash stocks, however, is whether the market has a rational reason for the apparent undervaluation.

One of the stocks I’ve come across is Nutrastar (NUIN), a Chinese manufacturer of health beverages and traditional medicinal products.

Unbelievable Balance Sheet

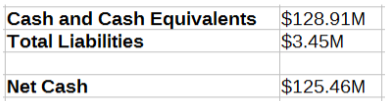

At first glance, a balance sheet valuation of Nutrastar produces a remarkable result.

Here are figures from the last reported quarter, March 2015:

Guess what the market cap of this company is.

Guess what the market cap of this company is.

$10.54 million.

Yes. I didn’t forget about a zero or misplace the dot.

That means…

The company is trading at an incredible 8.4% of net cash.

Expressed another way, Nutrastar could cease all business operations, pay off all debt, and walk away from all non-cash assets. The result would be the current $0.62 stock price transforming into over $7 if this company decided to liquidate itself.

What’s the Catch?

The market wasn’t born yesterday.

If a company’s price appears too good to be true, then you have to consider the possibility that you don’t know better than the consensus.

Particularly, the market may be correctly pricing in something like fraud risk. After all, the net cash figure is only good to the extent that the balance sheet can be believed.

Any rational analysis of Nutrastar, a Chinese company, should start by analyzing the potential for fraud.

If the reported figures are accurate, the company is a clear buy based on its balance sheet alone.

If the company is fabricating numbers, then that immediately becomes the most significant consideration.

Other factors like the future of the Chinese health drink industry, recent earnings trends, and increasing/declining margins are essentially red herrings.

So the question becomes: Is this company reporting accurate numbers?

If the answer is “No,” then why is there such an extreme undervaluation?

To answer the first question, let’s begin with the evidence suggesting that the company is a fraud.

Quick Look at Whether Nutrastar is a Fraud

First, Nutrastar is a Chinese reverse merger. In a reverse merger, a private company purchases control of a public shell company and then merges with this company.

It is a faster and less expensive alternative to an IPO.

Many Chinese reverse mergers have subsequently been determined to be fraudulent. In particular, the research firm Muddy Waters famously exposed a number of frauds in the Chinese RM space.

Second, Nutrastar does not pay a dividend, nor is it buying back shares.

This is a red flag.

The shareholder-friendly alternatives to holding on to a large cash pile are to pay a dividend and/or repurchase the highly undervalued shares.

Taking one or both of these actions would also increase investor confidence in the company’s legitimacy.

Or is Nutrastar Legitimate?

First, a common sense check.

While there have been highly elaborate frauds in the past, Nutrastar does at least appear to be a real company with pictures available online of their headquarters, stores, and product line.

They file for patents and show up in independent market research reports such as the one published by QYResearch.

Secondly, American value investor Richard Fearon of Accretive Capital is on the Nutrastar Board of Directors and has been rapidly adding to his position over the past year.

The day I began writing this post, in fact, he bought another 4.38% of the company, bringing his total holdings to over 12%.

While I have not been able to reach Mr. Fearon, he seems convinced of the company’s legitimacy based on his large holding and multiple recent purchases.

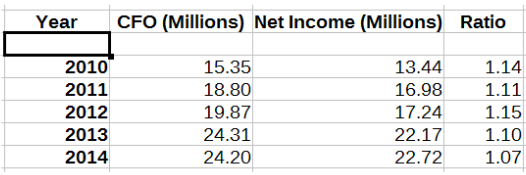

Thirdly, financial sheet ratios are generally favorable.

- The Beneish M-Score is -3.15, indicating – but not proving – that the company is not manipulating earnings.

- The Altman Z-score of 4.91 is in the safe range for bankruptcy risk.

- Receivables are consistent.

- Net income closely tracks cash flow from operations.

Lastly, all financial figures including the cash balance are audited by Crowe Horwath. To be clear, this is not definitive proof of anything. Auditors have been fooled before. But it is at least one form of independent verification of the company’s figures.

So What is the Cause of Nutrastar’s Undervaluation?

I believe the main answer to this question is that the company is a Chinese reverse merger not doing nearly enough to prove legitimacy to a rightfully-skeptical market.

There have been enough well-publicized fraud cases that most investors are not willing to touch any Chinese RMs, punishing any good companies along with the bad.

Note that this attitude toward Chinese RMs, while certainly reasonable, does create a potential contrarian opportunity.

The fraud concern cycle can even be self-perpetuating: the stock price falls because of the Chinese RM concerns; the further depressed stock price raises fraud concerns to investors; the newly-increased fraud concerns again lower the price.

In fairness to Nutrastar, government currency regulations and capital controls limit the conversion of CNY as well as movement of the cash out of China.

In fairness to Nutrastar, government currency regulations and capital controls limit the conversion of CNY as well as movement of the cash out of China.

Changes to such restrictions are one potential catalyst for realizing the significant value here if the company is legitimate.

No matter how it comes about, however:

Nutrastar must prove the existence of its cash pile to investors by actually doing something with the cash, ideally a dividend or share repurchase program.

Probabilty Calculation Showing Why I Bought Nutrastar

A happy conclusion to this article would be that Nutrastar is not a fraud and represents the buying opportunity of the decade. Unfortunately, that would be significantly too strong a statement.

My view is that there isn’t sufficient evidence in either direction.

While it is unlikely that the company is an outright fraud, it is certainly possible they have found a way to fabricate their cash balance and are misreporting other figures in their financial statements. Note, however, that this risk alone does not mean I shouldn’t buy the company.

Instead of just dismissing it, a good idea is to use a risk/reward framework.

First consider the worst case that the company is a total fraud, and will go to $0.

Let the probability of this occurring be P.

Next, consider the potential upside.

If Nutrastar is completely legitimate, a very conservative estimate of intrinsic value is net cash which is an 11.9x potential upside.

Suppose the probability of this occurring is Q.

Other outcomes are possible such that Nutrastar has an intrinsic value somewhere between $0 and $125M. But to simplify, I’m making the conservative assumption that the company is either reporting its figures accurately, or it’s a sham.

In that case, there are two mutually exclusive outcomes, and Q = 1 – P.

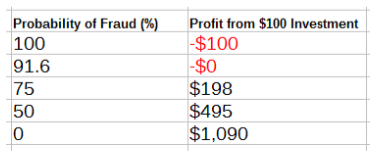

Suppose we invest $100 in Nutrastar.

With probability 1 – P, we turn our $100 into $1190, gaining $1090. With probability P, we lose our full $100.

The expected value of this investment is therefore positive if: ($1090) x (1 – P) – $100 x P > $0

Which simplifies to P < 91.6%. In other words, you’re going to make money on average from this investment if there is an 8.4% or higher chance that the company is reporting accurate figures.

This image should show you clearly what the odds are based on the probability of either being a bust or a boom.

This investment has a satisfactory risk/reward profile.

This investment has a satisfactory risk/reward profile.

Final Thoughts

This method of weighing potential outcomes with probabilities is a tool for deciding whether or not to buy companies that carries serious risk.

Don’t fall for risky breakeven investments because value doesn’t get realized.

But if you believe the market is pricing in significantly too high a risk of fraud (or another type of risk), this type of expected value analysis is the best tool to determine whether you are making a rational investment.

In Nutrastar’s case, I believe that it is an investment with a positive expected value, but with the risk it carries, I recommend allocating at small percentage only as it’s important to protect your capital.

Collin Moshman is long NUIN. He is a professional poker player and microcap value investor living in Rosarito, Mexico.

calvintaneng

Interesting article. Thought provoking.

This has always been the delimma of Value Investors.

Is it genuine or a fraud?

Are the figures real.

Are the receivables recoverable?

Are the assets of any true value.

Above all - can the Managementment be trusted?

If so why are they so incompetent?

A thousand questions rushed through our brains.

So many have be conned by Transmile, including Robert Kuok. Thousands have been fooled be Megan Media - the fake receivables, the fictious non existence blue ray disc factories - the total liquidation of directors' shares.

Where corporate governance is lax fraud is prevalent. Let there be draconian laws that instill fear against against outright fraud. During the Japanese Occupation those who erred have their heads cut off and placed on poles along main road juctions for all to see. Instant fear is instilled into all and sundry. So let China catch all crooks in high places and let them be shot with rifles.

Maybe, this might clear of fraudulent accounting. Unless this is done, criminals will still get away with light sentences.

And investing in a world of unknowing, a world of uncertainty will be an illusion.

No! No! No!

A thousand times No!

Walter Schloss has proven to all that investing is the way to go! Buying a basket of undervalue stocks and holding them until value emerge will bring the highest reward!

Yes, a million times Yes!

2015-08-08 11:00