What You’ll Learn

- How Buffett thinks through and chooses his stocks

- Metrics to simulate Buffett stocks

- Screening example to find Buffett type stocks

There’s always 2 aspects of picking stocks.

- Qualitative analysis

- Quant analysis

Most people are good at one and only focus on one.

The best investors take time to dive into both.

We all want a simple and organized cheat sheet of what stocks will pick, but one of the key things to remember is that Warren Buffett (and Munger) have been around for a long time.

Sorry.

There is no cheat sheet. No such thing.

Buffett’s investment style has changed from when he was a young manager to now. Even today, he is constantly learning and adapting his investment style to the current economic environment to make the best smart decision with what he is presented.

There are arguments that Buffett isn’t as good as people make him out to be because of the deals and advantages he is presented with.

There’s some truth to that, but if you look at the entire picture, he is at a disadvantage of not being able to buy smaller under the radar companies.

In other words, Buffett takes advantages of what is within his circle of competence.

Everybody has got a different circle of competence. The important thing is not how big the circle is, the important thing is the size of the circle; the important thing is staying inside the circle. And if that circle only has 30 companies in it out of 1000s on the big board, as long as you know which 30 they are, you will be OK. – Warren Buffett

How Buffett Exponentially Improved His Stock Picking Skills

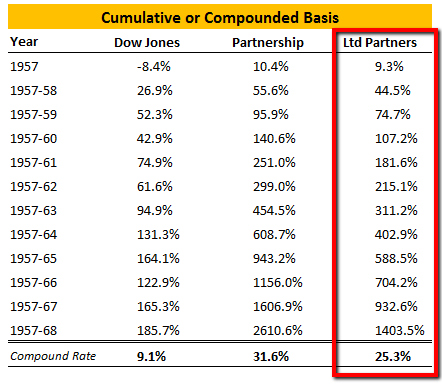

Buffett Partnership Returns

There’s a reason why Buffett claims that he is only 15% Graham and 85% Phil Fisher.

Phil Fisher was a growth investor and wrote the excellent Common Stocks and Uncommon Profits. Fisher was known to spend most of his time researching companies the “dirty way”. He was out on the streets in front of factories, talking to employees, talking to ex management, questioning competitors.

And when he bought a stock, he literally held it until he died.

Fisher was a man that wanted to buy the best of the best and allowed compounding to work its magic.

In 1998 during the Berkshire annual meeting, somebody asked Buffett how much of his stock picking reasons were qualitative vs quantitative.

Buffett then gave an example of where he made a deal with a shoe company, H.H. Brown, in 5 minutes.

How?

Buffett took 5 minutes, not because he is a super accountant. It took him a mere 5 minutes because he already had built up his internal database and understanding of the industry and economics of the business.

In the same meeting, the same person asked whether he bought a company where the numbers told him not to. Because I’m not Buffett, I try to stay away from the ones where the numbers say no.

But Buffett said that his best purchases (like General Re) have come from when the numbers said “no”.

What I get from this statement is that, qualitative analysis plays a bigger role than quant analysis.

The best buys are hidden in ugliness and requires understanding the business to figure out whether the business can roar back to life.

Here’s another example of an uncommon investment where he used common sense.

In 1986, I purchased a 400-acre farm, located 50 miles north of Omaha, from the FDIC. It cost me $280,000, considerably less than what a failed bank had lent against the farm a few years earlier. I knew nothing about operating a farm. But I have a son who loves farming, and I learned from him both how many bushels of corn and soybeans the farm would produce and what the operating expenses would be. From these estimates, I calculated the normalized return from the farm to then be about 10%. I also thought it was likely that productivity would improve over time and that crop prices would move higher as well. Both expectations proved out.

Road to Uncommon Profits

I have a question that I ask people regularly.

- Are you overwhelmed with information and opinions?

Everybody says yes and it goes to show how hard it is to focus on the right thing.

Buffett tells you straight up – to exponentially improve your stock picking skills, study the industries and economics of the business.

If you know the industry and business well, the numbers are easy to interpret.

If you know a lot about retail, you’ll easily compare things like cash conversion cycle, inventory turnover and margins to figure out which company is the best.

However, if you have no idea about how retailers work and try to make sense of the numbers, it’s tough.

One of my hobbies involves photography but I find it amazing how pros can take magnificent photos with cheap disposable cameras.

What most people don’t understand is that these pros understand what type of light, angle and composition makes the scene majestic.

This is the qualitative stuff that pros understand.

On the other hand, there are many people who solely focus on the specs of a camera and want the latest equipment without fully understanding the bigger goal of taking good photos.

So… How Does Buffett Choose Stocks?

In his early partnership days, Buffett used many strategies for outrageous returns.

He bought net nets, took activist roles, invested in special situations and was quite active.

To try and summarize one way of investing like Buffett, here’s an AAII article from 1998 that goes into great detail of the types of companies that Buffett likes to invest in.

Aside from the obvious Buffett mantra of investing in businesses, it discusses in good detail, the selection criteria for Buffett type stocks which you can apply yourself to find, analyze and value.

Keep in mind that this is just one practical approach to consider.

The Practical Warren Buffett Approach to Stock Picking

Buffett’s Philosophy and style

Investment in stocks based on their intrinsic value, where value is measured by the ability to generate earnings and dividends over the years.

Buffett targets successful businesses—those with expanding intrinsic values, which he seeks to buy at a price that makes economic sense, defined as earning an annual rate of return of at least 15% for at least five or 10 years.

Universe of Stocks

No limitation on stock size, but analysis requires that the company have been in existence for a considerable period of time.

Criteria for Initial Consideration

Consumer monopolies, selling products in which there is no effective competitor, either due to a patent or brand name or similar intangible that makes the product unique.

In addition, he prefers companies that are in businesses that are relatively easy to understand and analyze, and that have the ability to adjust their prices for inflation.

Other Factors

- A strong upward trend in earnings

- Conservative financing

- A consistently high return on shareholder’s equity

- A high level of retained earnings

- Low level of spending needed to maintain current operations

- Profitable use of retained earnings

Valuing a Stock

Buffett uses several approaches, including:

- Determining the firm’s initial rate of return and its value relative to government bonds: Earnings per share for the year divided by the long-term government bond interest rate. The resulting figure is the relative value—the price that would result in an initial return equal to the return paid on government bonds.

- Projecting an annual compounding rate of return based on historical earnings per share increases: Current earnings per share figure and the average growth in earnings per share over the past 10 years are used to determine the earnings per share in year 10; this figure is then multiplied by the average high and low price-earnings ratios for the stock over the past 10 years to provide an estimated price range in year 10. If dividends are paid, an estimate of the amount of dividends paid over the 10-year period should also be added to the year 10 prices.

How Buffett Analyzes Financial Statements

Combine the methods from above with how Warren Buffett analyzes and interprets financial statements and you have a powerful “Buffett toolset”.

A Buffett Screen?

If you are itching to take it one step further, how about applying this Buffett screen I found in a Seeking Alpha article.

- ROE: 5-year Avg. >= 17%

- Return on Invested Capital: 5-year Avg. >= 17%

- Pre-tax profit Margin: 5-year Avg. >= 1.2* Industry Avg. Pretax Margin: 5-year Avg.

- Price/cash flow ratio <= 0.8* Industry Average price/cash flow ratio

- Price/cash flow ratio >=0.1

- Debt to Equity Ratio <= 0.8*Industry Average Debt to Equity Ratio

- Income per employee >= 1.1* Industry Average Income per employee

What’s Your Buffett Stock Strategy?

This is just one of many Buffett type approaches. It’s a good template to start with which you can adjust to make it into your own.

The key point to remember is that an investment involves both qualitative and quantitative analysis.