This is an email that I sent to our VIP email list a few months back. If you want these kind of information months in advance, get on the VIP List Today.

So excited to share today’s VIP email.

Here’s a thought I want to start with.

“I don’t understand why business schools don’t teach the Warren Buffett model of investing. Or the Ben Graham model. Or the Peter Lynch model. Or the Martin Whitman model. (I could go on.)

In English, you study great writers; in physics and biology, you study great scientists; in philosophy and math, you study great thinkers…How is it that business schools get away with teaching modern finance theory as the backbone of investing?” (source)

In 1932, Ben Graham became a freelance writer for Forbes during the bottom of the Great Depression.

Talk about timing.

With the economy sinking, it would have been tough to write about stocks will go back up. But true to form, in the middle of crashes and people’s accounts getting wiped out, Graham wrote about why the market was cheap with a healthy dose of common sense and objectivity.

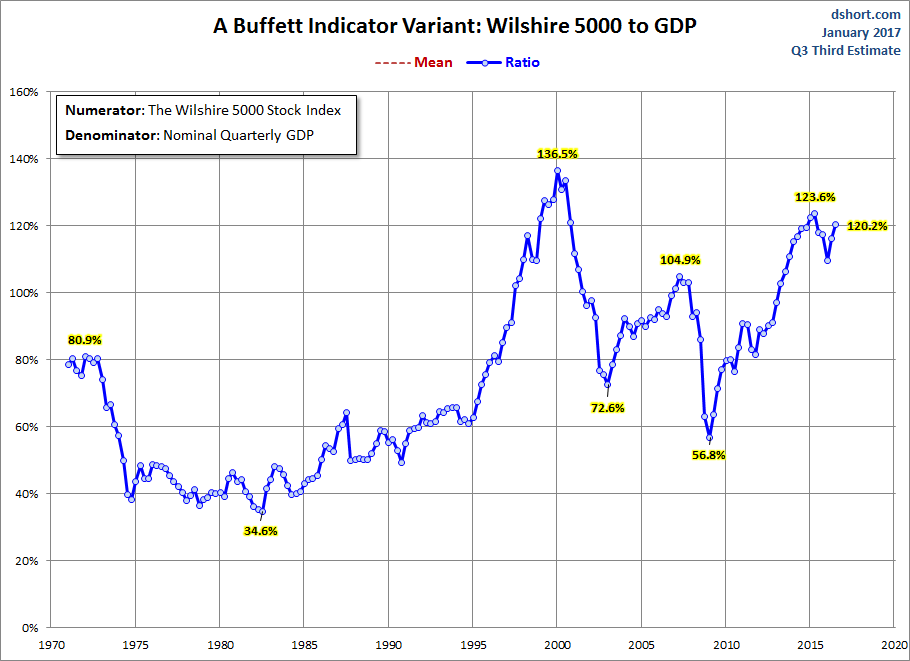

On the flipside, today’s market level is not cheap.

Buffett Indicator Chart Jan 2017 (source)

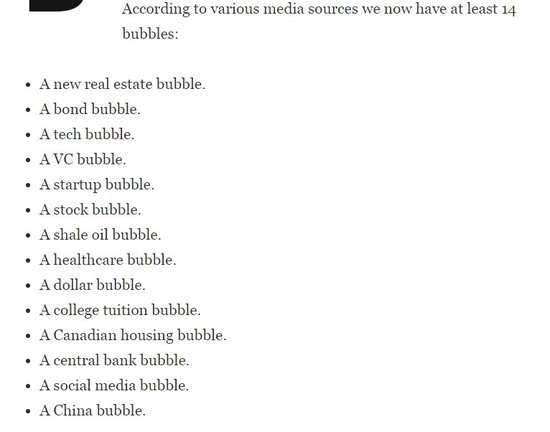

Additionally, in one of our past Old School links, one article talked about the current “state of of the economy”.

According to the “media”, we are in 14 bubbles.

Now I don’t know how true this is, but I do know that crashes, recessions and booms will occur. And it’s always good to be prepared.

This is where Ben Graham’s words will help.

Read the series of articles Graham wrote for Forbes and study from greatest.

Brief points from the first article:

- Markets are irrational

- Majority of investors are irrational

- Stock price does not dictate what will happen to the company

- Shareholders are small owners of the business

- Always look at the financial statements and assess whether the stock price makes sense

- Businesses on Wall Street are valued differently than private equity

- Stock prices can remain low for fear of future operating losses

Ben Graham’s 1932 Forbes Articles

- Inflated Treasuries and Deflated Stockholders (PDF)

- Should Rich Corporations Return Stockholders’ Cash? (PDF)

- Should Rich and Losing Corporations be Liquidated? (PDF)

Enjoy and let it sink in.