OldSchool.com - Jae Jun

Measuring the Moat: Value Creation Checklist - Hurricane Capital

Tan KW

Publish date: Wed, 31 May 2017, 04:40 PM

Measuring the Moat: Assessing the Magnitude and Sustainability of Value Creation

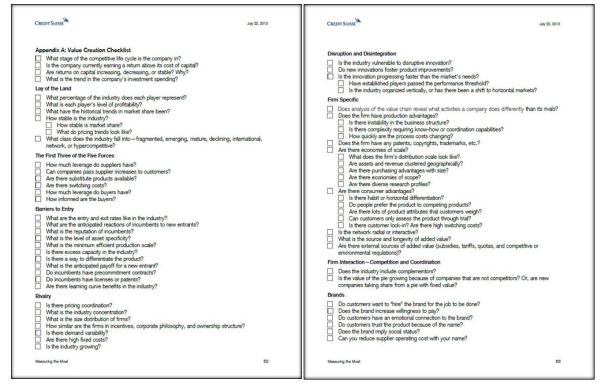

Below is an excerpt of “a complete checklist of questions to guide the strategic analysis” published in the paper Measuring the Moat: Assessing the Magnitude and Sustainability of Value Creation, written by Michael J. Mauboussin and Dan Callahan.

Value Creation Checklist

Value Creation Checklist

- What stage of the competitive life cycle is the company in?

- Is the company currently earning a return above its cost of capital?

- Are returns on capital increasing, decreasing, or stable? Why?

- What is the trend in the company’s investment spending?

Lay of the Land

Lay of the Land

- What percentage of the industry does each player represent?

- What is each player’s level of profitability?

- What have the historical trends in market share been?

-

How stable is the industry?

- How stable is market share?

- What do pricing trends look like?

- What class does the industry fall into—fragmented, emerging, mature, declining, international, network, or hypercompetitive?

The First Three of the Five Forces

The First Three of the Five Forces

- How much leverage do suppliers have?

- Can companies pass supplier increases to customers?

- Are there substitute products available?

- Are there switching costs?

- How much leverage do buyers have?

- How informed are the buyers?

Barriers to Entry

Barriers to Entry

- What are the entry and exit rates like in the industry?

- What are the anticipated reactions of incumbents to new entrants?

- What is the reputation of incumbents?

- What is the level of asset specificity?

- What is the minimum efficient production scale?

- Is there excess capacity in the industry?

- Is there a way to differentiate the product?

- What is the anticipated payoff for a new entrant?

- Do incumbents have precommitment contracts?

- Do incumbents have licenses or patents?

- Are there learning curve benefits in the industry?

Rivalry

Rivalry

- Is there pricing coordination?

- What is the industry concentration?

- What is the size distribution of firms?

- How similar are the firms in incentives, corporate philosophy, and ownership structure?

- Is there demand variability?

- Are there high fixed costs?

- Is the industry growing?

Disruption and Disintegration

Disruption and Disintegration

- Is the industry vulnerable to disruptive innovation?

- Do new innovations foster product improvements?

-

Is the innovation progressing faster than the market’s needs?

- Have established players passed the performance threshold?

- Is the industry organized vertically, or has there been a shift to horizontal markets?

Firm Specific

Firm Specific

- Does analysis of the value chain reveal what activities a company does differently than its its rivals?

-

Does the firm have production advantages?

- Is there instability in the business structure?

- Is there complexity requiring know-how or coordination capabilities?

- How quickly are the process costs changing?

- Does the firm have any patents, copyrights, trademarks, etc.?

-

Are there economies of scale?

- What does the firm’s distribution scale look like?

- Are assets and revenue clustered geographically?

- Are there purchasing advantages with size?

- Are there economies of scope?

- Are there diverse research profiles?

-

Are there consumer advantages?

- Is there habit or horizontal differentiation?

- Do people prefer the product to competing products?

- Are there lots of product attributes that customers weigh?

- Can customers only assess the product through trial?

- Is there customer lock-in? Are there high switching costs?

- Is the network radial or interactive?

- What is the source and longevity of added value?

- Are there external sources of added value (subsidies, tariffs, quotas, and competitive or environmental regulations)?

Firm Interaction—Competition and Coordination

Firm Interaction—Competition and Coordination

- Does the industry include complementors?

- Is the value of the pie growing because of companies that are not competitors? Or, are new companies taking share from a pie with fixed value?

Brands

Brands

- Do customers want to “hire” the brand for the job to be done?

- Does the brand increase willingness to pay?

- Do customers have an emotional connection to the brand?

- Do customers trust the product because of the name?

- Does the brand imply social status?

- Can you reduce supplier operating cost with your name?

https://www.oldschoolvalue.com/blog/stock-analysis/measuring-moat-value-creation-checklist/

More articles on OldSchool.com - Jae Jun

Revealing My Action Score Stock and the Dilemma of Selling - Jae Jun

Created by Tan KW | Oct 23, 2018

Priceless. Stock guide from a person with a few months of experience. - Old School Value

Created by Tan KW | Jun 14, 2018

Worried About the Market? Protect Yourself with Valuation - Jae Jun

Created by Tan KW | Apr 20, 2018