Constructors? I’ll stay away, maybe for good...

omightycap

Publish date: Tue, 14 Jun 2016, 03:58 PM

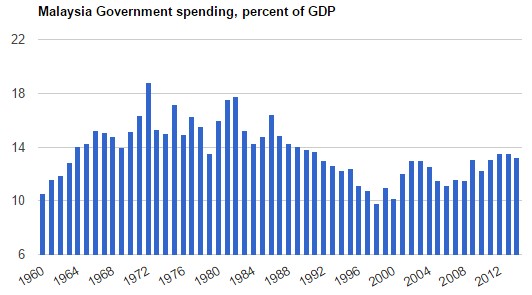

One of the most common theme that research houses are pushing is the call on buying construction related companies. As far as I can remember, I don’t recall government spending so much money at one go on infrastructure development. Referencing this to historical data, it is one of the highest since year 2000 compared to where is it now at levels from the 1980s.

Due to an economic slowdown round the world and bad sentiment post GST implementation, the forecast for economic growth dropped from 5% to 4% in just one year. Running low on ammo to spur the economy using monetary policy, the government would need to take the lead in spending creating the initial spark that runs the economic engine.

Oil being the back bone for our economy could not generate enough tax dollars for the government. Jobs market were also affected with the fall of oil where job cuts create less taxable dollar for the government as well.

When things slump, it seems that infrastructure investment would provide the best payoff for everyone in the future. The ripple effect of infrastructure investment creates opportunity for multiple industries. This promotes jobs availability and increase the sentiment for spending among citizens in the country.

Call it artificial as you may buy the artificial promotes a lot of natural growth within the economy. A slight improvement in consumer’s sentiment would create massive natural growth for a country especially the consumption effect comes mainly from consumers rather than government spending or exports.

Note that for 2014, households’ share of Malaysia’s GDP consist of 51.4% compared to government spending at only 13.6%. Investment is the second largest where it comes in at 25.7% and finally net exports of only 9.3%

Not buying into this theme

Observing the markets for almost 6 months since the start of 2016, I found that no matter how many contracts were awarded, the stock price doesn’t react at all to the news. The stock pricing reacts in such a way that “I already knew its coming”.

Take for example counters like Gamuda, a pure constructor rather than a conglomerate like IJM. Winning contracts after contracts for the KVMRT2 project doesn’t seem to be able to push the stock up by much. The huge quantity of backlogs seems to have market uninterested in it. Most probably the market had taken that into account since there aren’t many candidates out there that could undertake a huge project like MRT or Penang Transport Master Plan.

Notably, it seems like only a handful of cases which in the event of an award announcement pushes the stock price up. A good example would be Sunway Construction early this year that received a MRT contract propels the stock up. In short, the market assumes that major large cap construction companies should be expected to pocket a few of these major contracts by the government to fill their order book but not smaller constructors.

PE doesn’t matter

I came to realize that most the construction stocks do not trade at high price to earnings multiple. Thinking about it, it doesn’t really matter how much a contract is worth as the revenue recorded comes in only when the progressive payments are made.

In fact, it is hard to tell when the progressive payments are coming in unless you are part of the construction team. A regular retail investor has zero idea to what a 30% completion looks like which usually demands the first progressive payment. That said, the irregular volatility in revenue and earnings bothers me to use PE as an estimate as a comparison scale between firms. Very low price to earnings multiple might signal that the order books are running low or recently a large payment had been realized for a contract. Other than that, it doesn’t really tell you the value for the individual company.

At times, it is hard to do a value estimate where contract values are recorded today but the fluctuation of material prices happens in the next 3 – 6 years after the contract passes on. It is hard to gauge the actual value of the contract based on the profitability that it is expecting now.

Growth Problems in the Long Term

Recurring income or continuous product demand are some of the usual income that maintains the revenue quarter after quarter. Problem with construction companies is when the order book depletes and all of a sudden an economic slowdown hits, it would likely affect the company’s earnings which I felt that holding a constructor for long term might turn into a threat for your portfolio.

If the debt management within the company isn’t satisfactory, then it would likely have growth problems such as limited new technology adoption or worst of all, asset liquidation. It is hard to avoid problems like these when economic health goes south and we definitely can’t avoid from this issue implying that the theory of business cycle isn’t challenged at the moment.

Construction of properties and infrastructure could be considered seasonal rather than constant which makes it hard to gauge the profitability for a constructor. This creates a problem for an investor as well trying to figure out what the right price to earnings multiple to pay for.

Special Cases

As said earlier, recurring income is an important element to stabilize one’s income. A good construction company who possesses a fixed stream of income could turn out to be a special case. At times, a company might stumble upon a good project which generates plenty of income from toll collection. This is positive to a construction company’s future where its initial investment would turn into a cash cow for the long term.

LITRAK’s LDP is a common example where the cost of the project isn’t that high but the payoff is just excellent due to factors like location and demographic. Demographic plays an important role because it is only logical that an area with higher income residents wouldn’t go through the fuss of avoiding tolls.

Property developers with commercial complexes are an exception too. Commercial spaces provide a constant yield which grows the stock and turn it into a dividend yielder in the long term. The problem is the volatility in the stock price for the short to medium term which kept retail investors away.

Conclusion

I guess it really hard to squeeze out every bit of info about a constructor and that makes it really hard to time an entry or even hold on to a huge drop after a bad quarter. There are just too many unknowns and I believe that it is best to stay away even if research houses are massively pushing this theme.

You might not agree with what I’ve just said but the next time you come by a constructor with low PE, low debt and high margins, you might want to stop and rethink what I’ve said here. Is it really cheap?

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com

More articles on O'Mighty Capital Articles Archive

Discussions

comparing with IJM which is another major contender for MRT. At least its doesnt have stuff like plantation in its portfolio which is totally out

2016-06-14 20:21

hpcp

Wake up la, Gamuda a pure contractor?

2016-06-14 16:56