QL Resources Expensive But Great Things in Place

omightycap

Publish date: Wed, 03 Aug 2016, 05:30 PM

QL Resources is a high growth company which is famous in marine products and livestock farming where it became one of the most prominent food supplier to the Malaysian market doubling in size in terms of market cap in just 5 years.

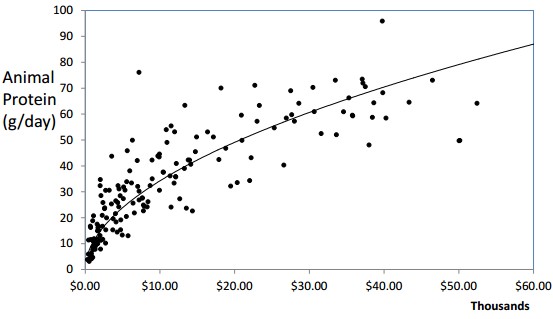

Again, this is another consumer product counter that we are investing in and there is a very good reason for that. The demand for protein is expected to rise with the rise in income per capita. Protein supply shortages seems to become a foreseeable problem in the next 15 years. It had been proven that there is a positive correlation between GDP growth and consumption on animal protein. Research concluded that “poor eat more starchy foods, wealthy eat more meat, fruit, vegetables” seems to hold.

Increasing population, emerging economies, improving life style and recognition of protein’s role in a healthy diet became are the few factors in rising demand for animal-derived protein. This problem could turn into an opportunity for livestock and fish farm operators with growing presence in SEA. The growth in the SEA region is expected to outdo most Asian countries in the near future.

The Business

| Marine Products Manufacturing | Integrated Livestock Farming | Palm Oil Activities |

|

Surimi 25,000 MT in Malaysia (largest) 10,000 MT in Indon |

3.2 million eggs – Malaysia 1.3 million eggs – Indon & Viet |

1,200 HA mature in Sabah 20,000 under development in East Kalimantan |

|

Surimi Based 40,000 MT in Malaysia (largest fishball range) |

20 million chicks in Malaysia 20 million chicks in Indonesia7 million broilers in Malaysia |

600,000 MT Palm Mill in Tawau 500,000 MT Palm Mill in East Kalimantan |

|

Fishmeal 25,000 MT in Malaysia (largest) 10,000 MT in Indonesia |

600,000 MT animal feed |

Palm Biomass Boiler Technology (Boilermech) |

QL Resources currently lead the market for surimi products in Malaysia. Obviously there are competitors in the overseas market such as CP Foods of Thailand and the strategy to target the Indonesian market seems favorable rather than directly competing with CP in Thailand which to be exact one of the largest in Asia.

At the moment, marine products consist of 66.89% of total EBITDA while livestock segment is 28.46%. The remaining 4.65% comes from palm oil products.

Upcoming Development

Below lists the upcoming development where projects are in plan or already been executed. This provides a clear picture of where to expect revenue growth would come from.

| Location | Type | Completion | Status | |

| 1 | Kulai | Frozen Surimi-Based | 2016 | Operational |

| 2 | Hutan Melintang | Chilled Surimi-Based | 2018 | Under Construction |

| 3 | Unknown | Fronzen Products | 2018/2019 | Planning |

| 4 | Tuaran | Frozen Products | 2018 | Under Construction |

| 5 | Surabaya | Surimi-Based | 2019 | Land Reclamation |

| 6 | Kota Kinabalu | Broiler | 2017 | Under Construction |

| 7 | Tawau | Livestock Processing | 2019 | Planning |

| 8 | Raub | Layer Farms | 2019 | Under Construction |

| 9 | Indonesia | Feed Mill | ? | Planning |

| 10 | Family Mart | Convenience Store | ? | Joint Venture |

Valuations

Trading at PE of 28 which is well above the industry average of a tat less than 20 for consumer products, I believe the valuations are over on the expensive side and indeed we are buying at a premium versus other counters which are possibly undervalued.

Unlike international brands like Nestle or Dutch Lady, the premium that one pays shouldn’t be higher than those major brands. CP Food in Thailand is only demanding a PE of 17, so why are we paying so much premium for this stock?

The discovery process of this stock happened this way. Looking at most counters which went on a major correction after the FBMKLCI dropped more than 100 points from the 1700s range, there weren’t any major correction for QL Resources. This increased my curiosity and started just simply reading the development ahead in the annual report.

Much to my amazement, the market is right once again for not following the sell-off like the broad market. The list of upcoming projects that are already in progress and some in the midst of planning are convincing enough that this company is set for a robust growth ahead.

This is where scale comes in where it had found its secret of success and plans to replicate it quickly covering more places in Malaysia and spreading the business to Indonesia and Vietnam. Already proven with the industry know how, the business finds its easy to repeat such success in the coming years.

Below is an estimate of revenue and earnings in years to come.

| Location | Type | Estimated Revenue Added | EBIT | ||

| 1 | Kulai | Frozen Surimi-Based | RM 0.00 (since it’s a migration) | – | |

| 2 | Hutan Melintang | Chilled Surimi-Based | 25,000 MT | RM 611.55 M | RM 121.33 M |

| 3 | Unknown | Fronzen Products | 25,000 MT | ||

| 4 | Tuaran | Frozen Products | 15,600 MT | ||

| 5 | Surabaya | Surimi-Based | 15,000 MT | ||

| 6 | Kota Kinabalu | Broiler | 600,000 birds annually | RM 1.07 M | RM 445.12 K |

| 7 | Tawau | Livestock Processing | 35M bird processing | RM0.00 (assumed to be intersegment revenue) | – |

| 8 | Raub | Layer Farms | 125M eggs annually | RM2,260.17 M | RM 94.02 M |

| 9 | Indonesia | Feed Mill | 100,000 MT | RM 16.87 M | RM 701.79 K |

| 10 | Family Mart | Convenience Store | Likely to be operating at a loss for the first 5 years | ||

With known operations ahead, the growth for earnings was estimated to add around RM 194.47 million. That brings the EPS to 30.97 cents per share for FY2020 holding all variables constant. Knowing the value of the EPS, it meant that we can estimate that we are actually paying a forward PE of 14 times earnings which I have no problems with.

In fact, the estimation did not factor in inflation on food prices 4 years from now and the potential plans of acquisition or upcoming projects that might complete before 2019 ends. There are still a lot of re-rating possibilities for this company but in the meantime, praying for no disruption to the well-being of the company’s biological asset would bring us to the estimated EPS growth which is set to double by 2020.

Cash Flow & Balance Sheet Strength

The cash flow generated over these years had increased at a CAGR of 10.41% over the last 5 years. That brings the cash balance for the company amounting to almost RM250 million which is plenty of liquidity for CAPEX benefits ahead.

The company had started to reduce its debt to equity levels below the 50% level which is a good sign for the long term. Debt reduction allows lower cost and higher positive cash flow in the future as well as opening up more opportunities for investment or acquisition.

There isn’t any major concern on items listed on the balance sheet and do not require further questioning on absurd valuations for its assets. The equity value based on its balance sheet was reported to be RM1.6 billion or 3.42 times book value. Again, over on the expensive side but not a concern if revenue estimate holds.

I know there are cheaper consumer stocks out there but the potential and growth abilities that it already shown in previous years could be replicated on a larger scale entering overseas markets.

Rather than investing in a company with cheap valuations without plans to invest more into the business, picking one which appear to have a robust revenue growth laid out seems to be a better choice.

Like our page to get more these https://www.facebook.com/omightycap/

Make the next post easily visible from your Facebook!

You can visit us at http://omightycap.wordpress.com

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

2024-11-25

QL2024-11-21

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL2024-11-18

QL