What is the Intrinsic Value of the Universe?

Philip ( buy what you understand)

Publish date: Wed, 06 Feb 2019, 04:03 PM

Hi All,

and I wish you a very happy Chinese New Year 2019. As I believe that after 3-4 years of economic destruction in Malaysia, this is the year we will turn the corner and start enjoying high capital gains and great increases in your stock portfolio.

It is important that you learn to grasp to concept of Intrinsic Value.

I must admit that I am no expert in this field and that I am no fund manager or trained educator. However I believe I have the results to show, and that what I explain is simple and would make sense to the retail investor, which you can use as your Prime Fundamental Concept (before you add on the FA of P/E,CAGR,P/B,ROE, E/P, Quick ratio, Current Ratio, Gearing Ratio, then add that to TA of momentum, buy interest, volatility, beta, alpha, zeta,SMA, stochastics, etc etc etc). You can pay your RM6K education to learn those indicators from many sifu, but first of all all those indicators can only help you identify criteria's, not a good stock.

You must first know what you are looking for.

What that in mind, lets set the stage. Literally.

After you finish listening, try to understand a few main points of this. Investing is like the universe, it is always expanding, getting bigger, more complicated, more interesting. If you are stuck only using certain metrics in investing, you will find that you will soon start losing money (KYY made a lot of money with his golden rule in 2015, then lost so much in jaks, xinquan etc. Shows you how difficult investing can be.)

Any sifu who tells you just to follow some indicators , pluck in figures a to b, get results C and voila make money? That is an idiot you should avoid. You have to learn how to monitor your stock. What metrics to monitor? I have a few, but everyone can build their own. But it is important you understand how a business works, for you to apply your metrics.

To understand this, you need to understand the UNIVERSE!!!(kinda)!

When the universe first starts, it start out as an idea by God.

Then there is a conviction, a motivation to make things happen.

Then you have an explosive push where the universe expands and grows. As anyone who understands propulsion, there is an ebb and flow (business losses and profits) while it tries to move further out into the cosmos.

But as it reaches further out, it start to stabilize, and planets form and cool down, allowing for humans to exist and prosper (dividends).

And as you go further out still, you notice things are starting slow down, white dwarves and black holes appear. Things start to fall apart, stars and suns are being absorbed by other stars.

Finally, you have the decline of the universe.

OK, NOW THAT STORYTIME BULLSHIT IS OVER, JUST REMEMBER THAT EVERY BUSINESS YOU WILL EVER OWN WILL HAVE A SIMILAR LIFECYCLE.

If you were to use just 1 metric or indicator to measure the entire lifecycle stage of a business, you are doomed to fail in stockpicking. You need to learn how to use different metrics and different indicators to know what prices to pay for, and when to buy your stocks.

In the beginning there was Benjamin Graham:

He had a very novel idea born out of the one of the greatest stock crashes in history, the black monday of 1924 and subsequently the great depression. He was the first to coin the term Intrinsic Value and Margin of Safety. His concept was very simple, in a age where most businesses was either dead or dying, many businesses were valued not on their future growth (who would dare look at growth during the Great Depression), but on their liquidation value (what you get out of it if it goes bankrupt). Back in those days many companies were going bankrupt, so much so that Ben decided on a concept of margin of safety, namely buying a business based on its net asset and cash value as a means of safety. If you share price was below that amount, when things stabilize or liquidate, you will get your returns. Easy.

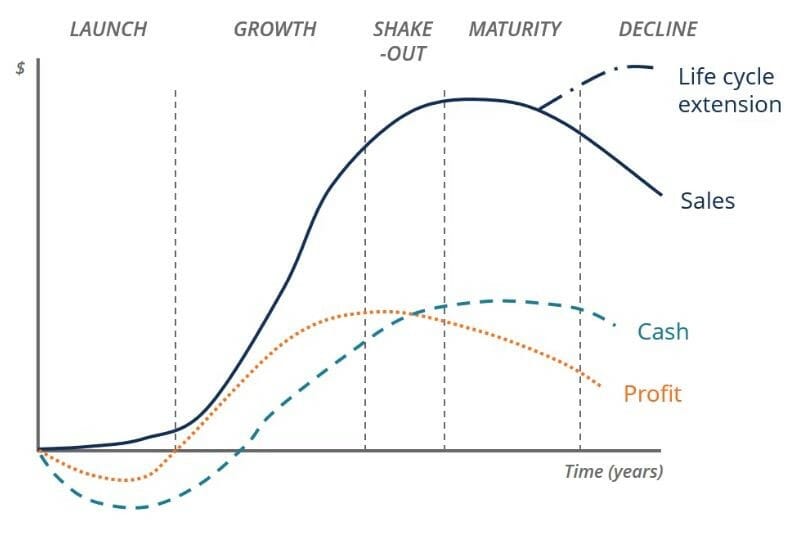

If you look at my graph (right at the end where businesses are either in recession or declining), sales will be down, confidence will be down. However the plant, property and assets are still there. Cash unitilized will also be there. It is like a rabbit waiting for the sun. When the sun begins to shine again, you will have more rabbits and business will flourish. If it doesn't shine, at least you can still eat your rabbit.

However the usage of this concept grew scarce as time passed by as more and more of the investing public realized that equities were far superior to bonds and assets in the long term, and more and more people began to pile money into equities. Individuals were moving away from the great decline of the depression and into the growth period of the investing Age.

Enter Charlie Munger:

Charlie is a very smart man.

How smart?

He was smart enough that he was able to convince and change his partner Warren E Buffet who was investing in undervalued stocks and margin of safety to start improving his strategies. And Warren was very successful at it. Warren had started his partnership in 1956 during the boom with 103K of his own and family and friends money and had been investing it for 13 years, turning it into 105 million in assets. But by 1969, he realized that stocks were too expensive (via his margin of safety rule), and had decided to close shop. At that time there was a slew of accounting shenanigans and mergers based on false accounting and misleading people. It was a time when a lot of charlatans were prevailing on Wall street and being praised by Wall street. Warren buffett then completed his takeover of Berkshire Hathaway (mostly because he was pissed at a dishonest management), became its chairman and did things his way.

From 1969-1977 warren continued to buy undervalued companies selling below book value with a huge margin of safety:

Shares Company Cost Market

220,000 Capital Cities Communications, Inc. ..... $ 10,909 $ 13,228

1,986,953 Government Employees Insurance

Company Convertible Preferred ........ 19,417 33,033

1,294,308 Government Employees Insurance

Company Common Stock ................. 4,116 10,516

592,650 The Interpublic Group of Companies, Inc. 4,531 17,187

324,580 Kaiser Aluminum& Chemical Corporation ... 11,218 9,981

1,305,800 Kaiser Industries, Inc. ................. 778 6,039

226,900 Knight-Ridder Newspapers, Inc. .......... 7,534 8,736

170,800 Ogilvy & Mather International, Inc. ..... 2,762 6,960

934,300 The Washington Post Company Class B ..... 10,628 33,401

We select our marketable equity securities in much the same way we would evaluate a business for acquisition in its entirety. We want the business to be (1) one that we can understand, (2) with favorable long-term prospects, (3) operated by honest and competent people, and (4) available at a very attractive price. We ordinarily make no attempt to buy equities for anticipated favorable stock price behavior in the short term. In fact, if their business experience continues to satisfy us, we welcome lower market prices of stocks we own as an opportunity to acquire even more of a good thing at a better price.

http://www.berkshirehathaway.com/letters/1977.html

And would have continued to do well, but he was slowly wising up, due to Charlies idea of Intrinsic Value,

To Charlie:

Intrinsic Value means the entire net cash outflow of a company from today until its terminal value discounted back for interests and cost. What does this mean? If you take a look at my graph from shakeout to maturity, there is a curve of when a business is expected to be profitable(or until the utility is gone). So the value you should be paying for a company shouldn't be just for the liquidation, but if you find a company where you could predict how well it will work out within the business cycle, you could ignore the problems inherent in certain business (or growing ones) because you knew that in the long run, the profits return will outweigh the amount you were spending on the business.

Warren was starting to catch on, albeit slightly slower. At Charlie's prodding, he actually paid more than what he was comfortable with in taking over sees candy for 25 million ins 1972(today sales is at 400 million per year, and returned 1.65 billion in profits). Nebraska mart was also a success, bought for 55.3 million in 1982(the texas store sells 1 billion a year).

But warren being warren, was still learning his own way. His biggest investments were still in businesses that were undervalued (Insurance businesses ) because they had underwriting losses, but the command of float was his (meaning the opportunity for growth was unlimited). Warren is also a smart man. His rate of learning is incredible.

Enter Warren Buffett:

''Ben would not have bought any of the stocks we own now,'' Buffett says. Ironically, Graham would undoubtedly have avoided buying Berkshire Hathaway shares as well. As of the first week of March, the company was trading in the vicinity of $7,200, down by more than $1,500 from its peak last year but still the most expensive listing on the New York Stock Exchange. At that price, Berkshire's stock fetches 1.8 times book value. Buffett says that book value does not accurately reflect the true worth of any holding, but it remains extremely unlikely that Benjamin Graham would have invested two cents in the company of his most prominent disciple. - New York Times, 1990 archive

By 1978, Warren had his vice chairman Charlie Munger join him, and they began to change their way of investing. Gone were the investments in intrinsic value based on liquidation and assets. They began to value more on management, business durability over longer periods, and competitive advantage of a business that you were reasonably sure could earn money 30-50 years from now.

And how could you question? Geico has had a strong business durability, even today it is the 3rd biggest insurance company in the USA, with a profitable underwriting income (but even more profitable float income), Coca cola is a company with huge long term growth prospects.

Warren buffett had changed from a investor who held cheap undervalued stocks to one who held quality companies paid at fair prices long term (or as fair as could be found, owing to the fact that the investing public now had the internet and could find all the ratios and margins of all the companies in the market in a blink of an eye) In the old days, you had to wait a week to be mailed the annual report of a company, today you couldn't buy a quality company at below earnings or book value.

The information age has arrived

Enter Peter Lynch:

Peter lynch was brilliant fund manager, he was the manager of the Magellan fund at Fidelity from 1977 to 1990. Remember when Warren buffett left in 1969 because he could't stand wall street? In his tenure for the magellan fund for 13 years, he had made it the best performing mutual fund of ALL time. Yes, a mutual fund. Increasing the assets under management from 18 million to 14 billion dollars.

Personally, I do believe it was a combination of the timing (information and travelling costs had gone down dramatically, mobile phones, pagers, fax machines increasing the number of retail investors), the growth of the economy (reducing manufacturing costs but increasing population demand for goods) and also great stock picking skills.

But peter lynch was the natural extension of this concept of the growth side of intrinsic value.

His famous mantra for intrinsic value is to buy undervalued stocks within his circle of competence. He always says, invest in what you know. Not simply buy stocks in the company that you work in, but to understand the businesses within your industry, your core competence, and your business knowledge and to use that as your margin of safety.

Lynch uses this as a starting point for investors:

Lynch popularized the stock investment strategy “GARP” (Growth At A Reasonable Price), which is a hybrid stock-picking approach that balances Growth investing potential with the discipline of Value investing, which works best at the growth cycle of a business (from my chart way up above)

He stressed the importance of the underlying business enterprise strength, which he believed eventually exerts itself in the company's stock price performance when holding the stock for the long term, and paying a reasonable price relative to the company's market value.

In short, how Peter Lynch measures the intrinsic value of his stock is by a price to earnings Growth measure. An extreme concept of this would be if you had a time machine and you went 100 years into the future and found a stock (lets call it amazon) for example that had grown its earning by 15% averaged out yearly over 100 years. So if you went back to 2006, even if the stock were currently asking for PE50 it would have been a reasonable price to pay relative to the company's market value.

Of course how you managed to find that time machine (or crystal ball) should be a question you would ask Peter Lynch.

He averaged 29.3% returns over his entire period managing the magellan fund.

I hope you learned something:

Philip

Special ang pow: extra piece of advice that I find is consistent with almost all the stocks I currently hold in bursa:

From Berkshire Hathaway owners manual:

In line with Berkshire’s owner-orientation, most of our directors have a significant portion of their net worth invested in the company. We eat our own cooking. Charlie’s family has the majority of its net worth in Berkshire shares; I have more than 98%. In addition, many of my relatives – my sisters and cousins, for example – keep a huge portion of their net worth in Berkshire stock. Charlie and I feel totally comfortable with this eggs-in-one-basket situation because Berkshire itself owns a wide variety of truly extraordinary businesses. Indeed, we believe that Berkshire is close to being unique in the quality and diversity of the businesses in which it owns either a controlling interest or a minority interest of significance. Charlie and I cannot promise you results. But we can guarantee that your financial fortunes will move in lockstep with ours for whatever period of time you elect to be our partner. We have no interest in large salaries or options or other means of gaining an “edge” over you. We want to make money only when our partners do and in exactly the same proportion. Moreover, when I do something dumb, I want you to be able to derive some solace from the fact that my financial suffering is proportional to yours.

How many stocks do you know where the boss is also working alongside with their investors treated as their partners?

I have a few. And I have been with them for a long time.

More articles on Investing Theory 6 - Intrinsic Value

Created by Philip ( buy what you understand) | Feb 14, 2019

Discussions

I rarely recommend books or blogs, but as very big fan of Howard Mark since the old days reading his memos,I highly recommend.

You can read some more info here.

Buy the book, it outlines what I am trying to say in understanding intrinsic value far better than I can articulate.

https://klse.i3investor.com/blogs/www.eaglevisioninvest.com/192499.jsp

2019-02-07 18:17

Warren regretted not investing in Amazon too. He said he knew it was a wonderful company, but the price asked was to great.

He was both wrong to be right and right to be wrong.

2019-02-09 07:35

Coke was the highest P/E stock Warren Buffett had in his portfolio.

KO traded over 50 times earnings during 1998. And Buffett didn't sell his shares.

2019-02-09 07:50

It is important to remember that he bought in 1988, when coke was actually cheap because of some bad decisions. At the time, was a contrarian investment case.

But even if he did pay to buy more in 1998, he would still not have let his shareholders down.

2019-02-09 07:51

Not that I'm telling you to go buy QL, but I'm just proving you wrong.

More facts you are wrong, and pe and valuation are 2 didn't things:

Warren bought and held:

Suncor Energy Inc. (USA) (SU): 478.78

Axalta Coating Systems Ltd (AXTA): 106.42

Liberty Media Corp (LMCA): 132.74

Of course at his stage, it would have been much more difficult to sell stocks without causing a big rip in panic selling.

2019-02-09 07:56

What is fair price? That's The question you should ask.

No one ever expected Amazon to be a trillion dollars company, except those who were willing to pay pe350 for it back in the day.

2019-02-09 07:58

Phillip,

If you paid 50 dollars for a company that make 1 dollar every year, you would have. 50 dollars in 50 years, or 3.8 dollars when 50 years worth of future cashflows is discounted back to present value. 92.4% destruction in value, unless there is growth. The only way you get 10% earning yield, is if earnings grow 50% per annum.

Buffet bought sees candy at roughly 6PE. Not 50

The only time he paid more than 25 times earnings (coke he bought at 20 times or so, held at 50 times and he admitted its a mistake. Precision castparts 20 times), was in turnaround or startup scenarios, GEICO and netjets.

Not 50 times earnings at all time high earnings.

===

(S = Qr) Philip for that last part,

assuming if you were thinking pure long term:

if a stock was asking for PE50, and you had earnings of 1 dollar, yes you would have 50 dollars of earnings in 28 years. But imagine in 100 years you would have 1.2 million earnings. Yearly. the power of compounding.

Do you think you will be able to buy a quality stock at a cheap price?

Warren originally was only willing to pay 20 million for Sees candy. (Charlie thought 30 million was a fair price in 1972). Imagine if Warren followed ben graham concept of margin of safety, he would have wasted 10 million opportunity cost to get 1.6 billion in cash flow return ( on a business that had 85 million earnings yearly)

06/02/2019 16:23

2019-02-11 14:30

Using pe as simply a conjecture if value as I said is a way of missing out on companies like Facebook, Amazon, Netflix and Google, all of which Warren said are quality companies but he missed, even thought he knew that they write a companies run by amazing management.

One thing you have to realize, Warren admits that he did not buy those companies because they were outside his circle of competence.

But as a millennial, should you avoid buying Amazon? Is it out of your circle of competence?

Warren has said before, if he was younger and Berkshire was smaller he would certainly have bought Amazon.

In an age where the competition is far more fierce due to ready information, one must be smarter in learning what stocks to buy.

You cannot use the same p/e ratio for ALL industries. The acceptable p/e for tech versus say banking is different.

You cannot use the same p/e ratio for all countries. The interest rates and monopolies and inflation rates are different.

Investing is an art, not a science. In mixing different colors, using different feels, using an the techniques at your disposal, you get a beautiful painting. A great painting and a cheap painting may use the same color red, but behind the microscope you see that the beautiful painting had many pigments layered over that turned into the color red.

If you turn investing into a simple science, then missing new groundbreaking companies is assured.

2019-02-12 07:18

Any level 1 thinker would have skipped Amazon at all cycles of it's growth and said it was overvalued. Even today many investors would not understand the earnings yield in paying pe150 for Amazon.

But those who practise level 2 thinking know what they are looking for.

I myself am a new investor in thinking deeper on a stock. I may be wrong on my stock choices to hold or buy more. But I find it funny that those who keep telling me to sell my QL like choivo and sslee just because it is currently pe50 are also those who have never bought a single share of QL in it's entire history since 2009.

But second level thinking states how can you measure intrinsic value of a company without putting in measurements of management quality ( think Warren buffet in Berkshire, is PE50 to pay in 1977 too high?) which is the ability to open new earnings streams for the company, The intrinsic value of monopoly ( if you think paying rm150 per kilo for white prompfret had nothing to do with QL and it's ability to export seafood to China is no sign of Monopoly....) How about the intrinsic value of being lowest cost producer in a huge market? ( How else would you value Amazon?)

I definitely agree in NOT paying to much for a company. But those analyst who said paying 80 cents for YINSON was too much? Or paying rm4 for YINSON today is too much? There is a reason why they are analysts, and the rest of us are investors.

Do you think analysts and remisiers act on their own analysis of stocks?

2019-02-12 07:40

Disclaimer here, let me be the first to rebut raider by saying in no shape of form so I think QL is remotely similar to Amazon. I am just pointing out the argument that you cannot reduce intrinsic value to just a few formulaic decisions. That is why every year a new guy ask during the brk annual meeting how does Warren and Charlie measure intrinsic value they never give a straight simple answer. It's not because they won't give it to you because they are grumpy old men, it's because you can't simply apply one simple formula to everything. Even DCF is the closest, but that is merely a simple framework for understanding, they don't write and calculate it exactly, is simple more of an estimate than anything else.

Yes the concept of the lemonade stand is great. Intrinsic value is how much you can get out of the entire business throughout is entire lifetime.

Easy. But if you use simple DCF to evaluate a whole company wholesale, would you have bought Berkshire in 1999 during the tech bubble?( Or even knew how many new earnings streams would be introduced?)

Exactly. Using DCF as a true to God formula ( instead of a mental framework) is a wild goose chase.

2019-02-12 07:51

Ding dong...because some factors DCF is not considered...is just a estimation calculation

2019-02-12 08:03

universe is expanding leh...

in the end, everything the end

no margin of safety

lol

2019-02-12 08:13

Haw Liao! Exactly, different stage of expanding got different margin of safety. Different industry different measurements. Each company is different.

That's why when somebody tells me they have 30 stocks in their portfolio I scratch my head.

Either they are very pro or I very stupid.

I spend around 1 hour to digest an annual report and try to guess where the company is going. What the CEO is doing. What the company is achieving or not.

Most " investors" read annual/quarterly report, skip to the middle part for the cash flow, financial statement and revenue profit/loss and think they know the company. Can calculate the intrinsic value Liao.

I read the front part, middle part and back part. And most times I still don't understand the company future.

2019-02-12 08:22

>>>

Posted by (S = Qr) Philip > Feb 12, 2019 08:22 AM | Report Abuse

Haw Liao! Exactly, different stage of expanding got different margin of safety. Different industry different measurements. Each company is different.

That's why when somebody tells me they have 30 stocks in their portfolio I scratch my head.

Either they are very pro or I very stupid.

I spend around 1 hour to digest an annual report and try to guess where the company is going. What the CEO is doing. What the company is achieving or not.

Most " investors" read annual/quarterly report, skip to the middle part for the cash flow, financial statement and revenue profit/loss and think they know the company. Can calculate the intrinsic value Liao.

I read the front part, middle part and back part. And most times I still don't understand the company future.

>>>>

Very true.

Both qualitative and quantitative assessment.

Chairman's and CEO's reports are must read sections.

You can learn a lot from them too.

2019-02-12 08:32

The best way i can put it, all investing is about betting on the future.

each company has a series of probable future. Some are more probable than others. But sometimes shit happen. But if it was an improbable future then no choice lo.

Your margin of safety, intrinsic value become useless.

The art is in trying to find a good probable future for your business. The better the management, the more probable it becomes. The easier the business, the more clear your future becomes.

What are the chances a well run company will continue to do well in the future?

Very high.

What are the chances a badly run company will continue to report losses? Very high.

Is it possible to have a turnaround? Yes definitely.

Is it probable? That is why I will never buy companies like jaks and carimin and DAYANG and talam and binapuri and naim. The probability of it happening is singing that is difficult for me to measure. Most investors buy on hope

Yes, they may have a turnaround, and may have big success. But Majority if the time, one or 2 good years does not change the intrinsic culture or quality of a company to perform over the long run.

2019-02-12 08:33

Philip,

Can you help me here on QL?

1. How much capex for setting up Family Mart?

2. What is the ROI projected for Family Mart?

Of the capex spent last 3 years, how much was spent to grow Family Mart (capex for growth) and how much to maintain preexisting businesses (maintenance capex)?

2019-02-12 08:39

>>

Yes, they may have a turnaround, and may have big success. But Majority if the time, one or 2 good years does not change the intrinsic culture or quality of a company to perform over the long run.

>>>

Agree. Need deeper understanding.

Some successful turnarounds:

Hai O from 1990s (gruesome) to 2005 (good).

Penta from gruesome to good (recently).

Guan Chong gruesome to good to gruesome to good (from 2008 to now). Exactly as Philip wrote above.

2019-02-12 08:48

Choivo,

Why would you pay for a company with zero growth? If earnings grew by 15% every year consistently, you need to look at compounded growth. That is how I buy my companies, I look for management who are able and willing to use retained earnings to do more as a business than I can as an individual. That's why I don't buy REITs.

If your earnings grow 50% per annum COMPOUNDED that would be far more than your 10% earnings yield. I continue to buy and hold QL because I believe in it's power of long term compounding ability. ( Historical 15% average revenue growth, 12% ROE). I believe moving forward at ql size growth will be more of a long gestation of capex followed by growth spurt in revenue and earnings.

I put great store in quality of management and business competitive advantage in my compounded growth probabilities.

Buying into simple, understandable business within my circle of competence gives me clarity.

I give you an example: there is a simple calculated probability( not certainty) where I can give a reasonable estimate ( inflation, palm oil prices, regional replication, new business units into precooked meal etc) where QL does 8 billion yearly revenue and 500 million earnings 10-15 years from now. They have the financial capability, management capacity and overall market industry size to achieve this.

For Time, where do you see this company going 10-15 years from now? What are the challenges, what are the incoming new technologies that will displace, how are it's financial capability, government interference. What is the probable future that time will find 10 years from now? Have you given it a thought in that sense?

Is the business clear enough for you to understand this?

Has the management shown a propensity to act faster and better than it's competitors?

The past gives it an indication, the current intrinsic value gives you an idea. But if you think you can apply DCF to get an accurate value

of returns off the entire lifecycle of time, that would be very dangerous, no?

>>>

If you paid 50 dollars for a company that make 1 dollar every year, you would have. 50 dollars in 50 years, or 3.8 dollars when 50 years worth of future cashflows is discounted back to present value. 92.4% destruction in value, unless there is growth. The only way you get 10% earning yield, is if earnings grow 50% per annum.

2019-02-12 08:56

u are paying 11bil for company that is making roughly 200mil even if it grow by 10% every year which is considered superb performance. u will only get your return of 11bil 20 years later. U are still not making money after 20 years.

looking at its pattern of growth i would say 6% per annum is reasonable and u will start getting back your money after 26 years. Entering at this price is it feasable

2019-02-12 09:09

Hi 3ii,

For the information you require, I would have given it but since Ricky and choivo pissed me of previously I will show you how to get it but not for free.

The information can be gotten from maxincome resources sdn bhd final audited accounts.

You can purchase sdn bhd audited report via ssm. You just need to start an account registered with ssm. However you can only get latest financial accounting.

If you want 5 years with you need to register with ccriss. Is pretty expensive, so unless you have a wife who is a bank manager it might be slightly difficult.

For maxincome you only need 3 years worth though. All I can summarize is the capex requirement is lower than originally thought. The maintenance expenses averaged out is very low. And the revenue generation or unit is magnitudes in order compared to 7-11. In fact you don't need a financial report to see that. Just a simple check would tell you 7-11 seems other people's ice cream, other people's food, other people's drinks. Family Mart carries majority is private label items, fresh food and self processed soft serve ice cream. Which would have been earnings returns?

Can you help me here on QL?

1. How much capex for setting up Family Mart?

2. What is the ROI projected for Family Mart?

Of the capex spent last 3 years, how much was spent to grow Family Mart (capex for growth) and how much to maintain preexisting businesses (maintenance capex)?

2019-02-12 10:17

Godhand, your math is way wrong.

You are paying 11 bill for a company with 3 billion assets, a share in boilermech, 15000 hectares of palm oil land. A lot of properties that have not been restated in value. Tons of goodwill, biological assets. A well trained team of workers, 2000 employees. A 25 year long term franchise in family Mart. A gateway into international markets like Japan, Australia and China. A monopolistic business which is hard to compete with ( ask layhong). An integrated industries that does Marine, palm oil and poultry which everyone will always need ( unlike a Mercedes Benz), a 20 year history of never losing money. A shariah compliant company with easy access to Islamic funding.

Oh yeah and a company that generate a growing earnings of 200 million a year.

That is what you are paying pe50 for.

You are funny if you want to buy a quality company just for it's earnings.

>>>

godhand u are paying 11bil for company that is making roughly 200mil even if it grow by 10% every year which is considered superb performance. u will only get your return of 11bil 20 years later. U are still not making money after 20 years.

2019-02-12 10:27

If you sell this company 20 years later I'm sure you get much more than just 11 billion... Or you think land and properties and wisma QL will just amortize into smoke?

2019-02-12 10:29

Sure mah....if u put monies in fixed deposits after 20 yrs already double mah....!!

Posted by (S = Qr) Philip > Feb 12, 2019 10:29 AM | Report Abuse

If you sell this company 20 years later I'm sure you get much more than just 11 billion... Or you think land and properties and wisma QL will just amortize into smoke?

2019-02-12 10:35

I mean chew on this.

In 2008, ql did 1.3 billion in revenue, 80 million in earnings, 350 million in net assets.

In 2013, ql did 2.15 billion in revenue, 130 million in earnings,880 million in net assets.

In 2017, ql did 3 billion in revenue, 200 million in earnings, 1.737 million in net assets.

Today, last quarter it had the best quarter revenue of ALL time with 920 million revenue in ONE quarter. And I estimate it will hit 1 billion in revenue this quarter ( crazy I know).

Why would you punish a company for performing beyond expectations? Is it the worry that a company that keeps going up only has one direction left to go? ( Down?)

When you see that a company has the foresight to acquire family Mart and do regional expansion? No losses, no reduction in revenue. Smart investments within its circle of competence?

You sell it just because it is PE50? Come on. See the context.

How many of you have a share in Berkshire Hathaway A? I do. For all the comments on margin of safety and value investing, I think 90% of the i3 community has never put their trust in Warren buffet, because they think his share is expensive and overpriced.

Those who did get rewarded.

2019-02-12 10:47

U need to understand loh....in early yrs ql trade at PE 15x to 22x mah...!!

Now trading above PE 50x...mkt already anticipated paying premium mah !!

Nothing left on table for new buyers mah...!!

Posted by (S = Qr) Philip > Feb 12, 2019 10:47 AM | Report Abuse

I mean chew on this.

In 2008, ql did 1.3 billion in revenue, 80 million in earnings, 350 million in net assets.

In 2013, ql did 2.15 billion in revenue, 130 million in earnings,880 million in net assets.

In 2017, ql did 3 billion in revenue, 200 million in earnings, 1.737 million in net assets.

Today, last quarter it had the best quarter revenue of ALL time with 920 million revenue in ONE quarter. And I estimate it will hit 1 billion in revenue this quarter ( crazy I know).

Why would you punish a company for performing beyond expectations? Is it the worry that a company that keeps going up only has one direction left to go? ( Down?)

When you see that a company has the foresight to acquire family Mart and do regional expansion? No losses, no reduction in revenue. Smart investments within its circle of competence?

You sell it just because it is PE50? Come on. See the context.

How many of you have a share in Berkshire Hathaway A? I do. For all the comments on margin of safety and value investing, I think 90% of the i3 community has never put their trust in Warren buffet, because they think his share is expensive and overpriced.

Those who did get rewarded.

2019-02-12 10:52

Posted by (S = Qr) Philip > Feb 12, 2019 10:47 AM | Report Abuse

How many of you have a share in Berkshire Hathaway A? I do. For all the comments on margin of safety and value investing, I think 90% of the i3 community has never put their trust in Warren buffet, because they think his share is expensive and overpriced.

================

margin of safety and value investing are popular words with analysts / teachings.....because these are easy to teach......and analysts/ remisiers, sifus......these are not investors and they got no patience one.....Analysts churn out ideas freely and fast........Their objective is to churn out ideas that sounds convincing....making money was never their priority......

go ask KC whether making money is his priority...or his priority is to sound learned and educated.....

2019-02-12 10:56

Although definitely I am telling the majority of i3 investors to please don't invest in QL. Short it if you like Bring it's price down to pe35 or even pe10. But do it when the story changes, when the business starts to lose money. When their investments start failing. When all the chickens and fish start disappearing.

Those are all possible ( but not probable) outcomes.

But if the story has yet to change, why sell?

I'd like to sell all my stocks too. But every time I measure my opportunity costs versus other market stocks, I realize I still end up holding the same ones.

Having said that, I might actually begin to sell my public bank position after 7 years.

2019-02-12 10:58

U look at insas earnings yield already exceed 15% pa with NTA Rm 2.54 and net cash holding exceeding Rm 300m, and with INARI 19% holding exceeding the whole insas mkt capital, why do investors want to waste time gambling or speculating on QL that can only give u an earnings yield of less than 2% pa loh ??

Yes Insas is investment certainty bcos of obvious margin of safety due to huge undervaluation v QL speculative investment bcos of huge overvaluation mah...!!

In QL u speculate whether the stock can continue to grow whereas Insas already already there earnings huge decent return mah...!!

Posted by (S = Qr) Philip > Feb 12, 2019 10:47 AM | Report Abuse

I mean chew on this.

In 2008, ql did 1.3 billion in revenue, 80 million in earnings, 350 million in net assets.

In 2013, ql did 2.15 billion in revenue, 130 million in earnings,880 million in net assets.

In 2017, ql did 3 billion in revenue, 200 million in earnings, 1.737 million in net assets.

Today, last quarter it had the best quarter revenue of ALL time with 920 million revenue in ONE quarter. And I estimate it will hit 1 billion in revenue this quarter ( crazy I know).

Why would you punish a company for performing beyond expectations? Is it the worry that a company that keeps going up only has one direction left to go? ( Down?)

When you see that a company has the foresight to acquire family Mart and do regional expansion? No losses, no reduction in revenue. Smart investments within its circle of competence?

You sell it just because it is PE50? Come on. See the context.

How many of you have a share in Berkshire Hathaway A? I do. For all the comments on margin of safety and value investing, I think 90% of the i3 community has never put their trust in Warren buffet, because they think his share is expensive and overpriced.

Those who did get rewarded.

2019-02-12 11:02

Berkshire hathaway is doing extremely well mah...if u cannot afford to buy, u can buy msian insas hathaway...it is doing as well as berkshire hathaway with a decent earning yield of 15% pa loh...!!

This insas is the safest balance margin of safety stock with div yield 3% pa...whereas Berkshire u get no dividend loh...!!

Posted by qqq3 > Feb 12, 2019 10:56 AM | Report Abuse

Posted by (S = Qr) Philip > Feb 12, 2019 10:47 AM | Report Abuse

How many of you have a share in Berkshire Hathaway A? I do. For all the comments on margin of safety and value investing, I think 90% of the i3 community has never put their trust in Warren buffet, because they think his share is expensive and overpriced.

================

margin of safety and value investing are popular words with analysts / teachings.....because these are easy to teach......and analysts/ remisiers, sifus......these are not investors and they got no patience one.....Analysts churn out ideas freely and fast........Their objective is to churn out ideas that sounds convincing....making money was never their priority......

go ask KC whether making money is his priority...or his priority is to sound learned and educated.....

2019-02-12 11:10

contrarian can churn out just as many ideas.....

and since real margin of safety comes from smart execution and not from NTA.....

contrarian play offers a big enough universe to trade....and better...

2019-02-12 12:06

intrinsic value of the universe...............the universe is surely bigger than Bursa..............got to go international like Philips.

2019-02-12 12:19

this trend to international investing is irreversible.....so much so.....the-incredible-shrinking-singapore-stock-market is unavoidable.....and Bursa also same fate..........

https://www.bloomberg.com/news/features/2019-02-11/the-incredible-shrinking-singapore-stock-market

2019-02-12 12:21

.and Bursa also same fate..........

small caps getting lower and lower as there is not enough interest.....

so, what is margin of safety?

2019-02-12 12:49

You can't change investors like from skipping investing in small capstocks. The monitoring is loose, the accounting is shoddy and cowboy, and bursa is basically non-existent. If investors like sslee can get fooled by xinquan and bursa does nothing to follow up or protect the quality of it's listed companies in it's bourse, retail investors themselves must see the underlying risk and invest with more margin of safety in the business itself, not the accounting reports.

One of the big faulty prime concepts investors have is in trusting the external accountants filling of events. Or even bursa confirmation of listings.

If it sounds too good to be true, it usually is.

2019-02-12 13:03

small cap businesses are suffering like shit.....eg...Cepco....

https://klse.i3investor.com/servlets/stk/fin/8435.jsp

2019-02-12 16:06

(S = Qr) Philip

for that last part,

assuming if you were thinking pure long term:

if a stock was asking for PE50, and you had earnings of 1 dollar, yes you would have 50 dollars of earnings in 28 years. But imagine in 100 years you would have 1.2 million earnings. Yearly. the power of compounding.

Do you think you will be able to buy a quality stock at a cheap price?

Warren originally was only willing to pay 20 million for Sees candy. (Charlie thought 30 million was a fair price in 1972). Imagine if Warren followed ben graham concept of margin of safety, he would have wasted 10 million opportunity cost to get 1.6 billion in cash flow return ( on a business that had 85 million earnings yearly)

2019-02-06 16:23