How to Spot Value Traps, or WHY I WASTED 3 YEARS HOLDING THE VALUE INVESTING STOCK

Philip ( buy what you understand)

Publish date: Fri, 29 May 2020, 07:57 AM

Hello everyone,

This is Philip here. I have been thinking for a while, and an interesting question popped up in my telegram discussion group. One of the more popular questions is this:

Dear Philip, I have bought X company a for a few years, getting good dividends around 4-5%. I have been holding the stocks for 3 years, and the company seems to have good prospects, no debt, a lot of cash. But the share price just doesn't seem to go up. Why?

This is a very interesting question indeed. I have thought about this idea for 20 years now, and I think I can share my experience on this matter. I have bought my share of lemons.

You see, when I first lost money trading, I found the book intelligent investor by Ben Graham, which was promoted because of the success of his student, Warren Buffett. The concepts of this we actually simple, we find a business. We buy it with a margin of safety, below it's intrinsic value and voilà when the market in time realizes it's true value, the intrinsic value will reveal itself. To this end, Ben was defined by his 70% losses during the great depression, where the stock market dropped by 80% in the worse multi year depression ever. He became a very conservative investor, looking for a margin of safety in cash, assets and liquidation value in the business. This a was a very rational way of looking at things, especially at a time when 12 million people were out of a job, 20,000 businesses went bankrupt and 23,000 people committed suicide.

https://economictimes.indiatimes.com/industry/miscellaneous/market-crash-of-1929-some-facts-of-the-economic-downturn/articleshow/61166918.cms?from=mdr

In any case, when I lost my entire savings for the second time betting big on net assets, huge margin of safety companies like renong, aokam perdana and transmile, I started thinking about value investing more as a concept instead of a investing law.

Specifically, what is the inherent problems with the APPLICATION of value investing, besides the theory of it. Why doesn't value investing make me rich? Here are my thoughts.

When you do value investing:

1. Buy low PE companies because you are paying less for earnings compared to overpaying for them.

2. Buy a company with more assets compared to debts.

3. If possible, buy a net cash company.

4. Apply a huge margin of safety, meaning if the company goes bankrupt, you can still get out of it alive.

For me the turning point was reading up back then on this article comment by Walter Schloss, another student of Ben Graham ( and a superinvestor himself buying THOUSANDs of stocks). He had this to say:

Walter Schloss tried to explain just how impactful the 1929 experience was on Graham and others at the time and why crushing losses are so hard for investors to get over:

But Graham was concerned with limiting his risk and he didn’t want to lose money. People don’t remember what happened before and how things were. And that’s one of the mistakes people make in investing as well… People forget what things were like during the 1930s. I think Graham — because he lived through that period — remembered it, was scared it would happen again, and did everything he could to avoid it.

But in the process of avoiding it, he missed a lot of opportunities. That’s one of the problems you always have — you don’t really lose, but you don’t really make, either. I believe you should remember what took place — even if you weren’t around at the time. One of the problems of a lot of the people who went through the Depression — Ben Graham, Jerry Newman, and others — is that they keep on thinking that things will always be like that.

Even Graham used to say — and quite correctly — that you can’t run your investments as if a repeat of 1932 is around the corner. We can have a recession and things can get bad. But you can’t plan on that happening. People who did, missed this tremendous market.

Some people can do it. Most people can’t and I don’t think they should try."

This resonated very deeply with me, as to the core of why value investing doesn't work for so many people. The thing is, investing is about assuming risk. In a way, I always tell my children, investing is about gambling with odds that you chose to take. But make no bones about it, it is gambling. You can and will lose money from it. You can only limit your losses.

What I realized then from Walter Schloss comment was that practising deep value investing also limits your returns. Because you are planning for a total bankruptcy position protection, it is like paying an extra premium for end of the world protection on your insurance coverage. You can either invest with that idea that a huge depression will come, or you can invest by increasing your risk but have far larger gains.

HOW THIS HAPPENS IN REAL LIFE

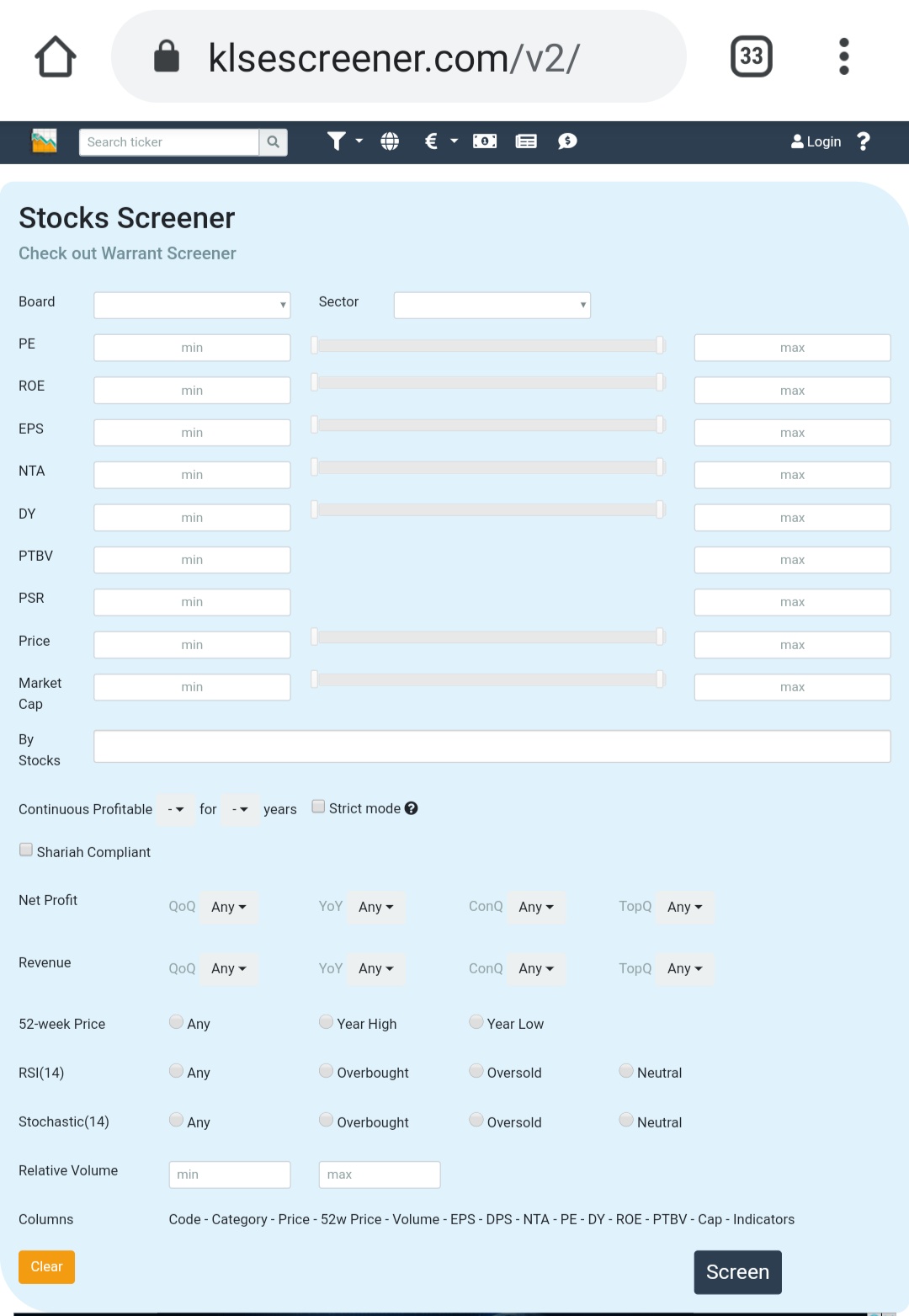

So let's say we practice deep value investing, the standard methodology becomes to use a screener to find these value stocks right?

Something like this:

https://www.klsescreener.com/v2/

However it quickly become apparent that if a stock has a good margin of safety, it will quickly be snapped up by smart investors as the barrier of research is so low. So what is left? These are the value investing lemons, the duds of the market. These are known as VALUE TRAPS.

Why is it called a value trap? This is simple. It is a company with good financial results year after year, but the share price and dividends are just stagnant. As a minority shareholder, these are the only 2 things you can rely on. Share price expansion and dividend yield because obviously you don't get director fees, management and operation salaries, the company car, esos and bonuses etc. Deploying capital can be a very painful exercise if the company does not see things your way and you can't effect change.

Anyway, here are the main causes of value traps in my experience from a qualitative view. These are based on good financial companies, not outright frauds because if you bought those, you are not doing value investing anyway.

1. Family owned business. This is very prevalent in Malaysia. You see the 1st generation working very hard, 2nd generation just maintains it, 3rd generation throws it all away. Most of these value traps you will find are run by the 2nd generation who are content to just keep things running. Just because the company CAN grow, doesn't mean they want to. It takes a lot of managerial capability to move companies forward, and not every 2nd generation has that ability. This is obviously different in the west, where there is line drawn between ownership and management. The children of Ford motors own the company, but William clay ford knows better than to make his children CEO. Alan mullaly has done more to save the company than any ten children of Ford. In Malaysia, most small companies do not think about succession plans other than to pass the business down to their children. The level of hunger, drive and passion to grow is never reflected in the financial reports, something which is very hard to quantify.

The most famous examples I can think of this are companies like LIIHEN, INSAS, HIMERIZ, ESCERAM, LAYHONG. The usual criteria for these companies are old ( Insas had been around since 1961, liihen 1994, layhong 1960s, esceram 2003), run by 2nd generation, and have a very slow growth and expansion plans. They also are very closed mouth during AGM and not very willing to tell investors much news. It becomes like, since we have a lot of cash, no need for private placement, RI and we can increase the compensation package at any point of time, why do we need shareholders kind of phase. these are still good companies mind you with good dividends, but growth of those earnings and dividends is an entirely different story.

2. The boy who cried wolf too many times. In this case, there are management that over promise but under deliver all the time. Yes they have a good running company with low PE and good financials and everything, however what is not reflected clearly is the track record of promises versus results. One clear example that comes to mind in recent months to me is JAKS. The clarity of the power plant is all well and good, but the story has already played out many times in the glowing praise over the steel factory, the evolve concept mall, the Star development project in PJ, and recently the power plant. If you look at the share price history, other than 2017 when KYY pushed the price up with margin to attract interest, and OTB in January 2020 with margin to attract interest, the share price of JAKS had been remarkably consistent. The market does not look kindly on private placements, rights issues, warrants dilution ( conversion price 60 cents, poor KYY).

3. Big fish in small pond. I have been introducing a new concept recently while babysitting my grandchildren. I call it the Pokemon theory. Imagine you have a Pikachu ( smallcap). For it to grow to the next tier which is Raichu (midcap), it has to go into the jungle to train up and fight other pokemon. It's not very hard to see other Raichu in the wild and to study how long it spent on the jungle before they " leveled up". So you kind of know for Pikachu to become a Raichu, what the steps needed to take and grow( getting a particular distribution order, building a new factory, getting that loan, following the footsteps and milestone of the comparison company). An example of this would be LAYHONG ---> Leong hup ----> QL. If you look at the history of these companies, you would easily see the progress pattern. For a layhong to pika into leong hup the milestone would be regional expansion out of Malaysia. For Leong hup to pika into a QL the milestone would be successful copying of new business units of new industries into fish, frozen food etc. For QL to pika into a CP the milestone would be end user supply (cp foods is the sole distributor of 7-11 in Thailand). For cp to pika into Tyson, they would have to break the China market. And so on so forth. The question to ask is if those companies can ever transform themselves, the classic big fish in a small pond. One example which I find is CCK. they have a good market dominant in sarawak, and grows as the population grows. But the difference between a PE 60 ql and a PE 9 cck is clear, you can see things growing and moving upwards, but at a pace that would not be financially exciting for long term investors.

I hope that you have got some ideas from my sharing, and I hope you learned something new today.

Philip

More articles on Investing Theory 6 - Intrinsic Value

Created by Philip ( buy what you understand) | Feb 14, 2019

Created by Philip ( buy what you understand) | Feb 06, 2019

Discussions

Philip ( buy what you understand)

Join me on telegram tme/philipcapitalmanagement and have a fun discussion . Don't forget to share your stock picks. We huat together!

2020-05-29 08:11

Philip ( buy what you understand)

One of the biggest proponents of value investing in i3 is kcchongnz. During his recent interview he put a very Graham like comment, " as long as you don't lose money, than any other outcome is good". But he gets upset each time I try to get him to show his portfolio like all the other superinvestors do who write books. His goal of not losing money is so strong that the loss of opportunities become apparent in the way he responds. I think that happens also to many "value investors" out there, who don't know the business that they are buying, the environment and the long term prospecrs, but only look at financials.

I may not have a master of finance or a financial planner license, but I do think about business far more than I think about making money.

2020-05-29 08:17

THIS PHILIP TALK LIKE SOHAI LOH...!!

IF SO EASY LIKE PHILIP SAY IN INVESTMENT WITHOUT CONSIDERATION OF RISK LIKE HE SAYS, WHY PHILIP, DON GO AND BORROW FEW MILLION ON MARGIN AND GO N WALLOP THE MARKET LEH ??

THE KEY IS THAT, THERE IS A RISK ELEMENT MAH...!!

WARREN BUFFET SAYS THE KEY 1ST RULE IS NOT TO LOSE MONIES AND KC IS RIGHT IN ADOPTING THE RIGHT BUFFET CONSERVATIVE PRINCIPLE MAH..!!

I THINK KC IS APPROACH IS A SAFER AND BETTER TECHNIQUE TO IMPART TO INVESTORS MAH...!!

AFTER ALL KC ALREADY RETIRE AND COMFORTABLE, WHY WANT TO LISTEN TO SOHAI PHILIP RECKLESS SUGGESTION LEH ??

Posted by Philip ( buy what you understand) > May 29, 2020 8:17 AM | Report Abuse

One of the biggest proponents of value investing in i3 is kcchongnz. During his recent interview he put a very Graham like comment, " as long as you don't lose money, than any other outcome is good". But he gets upset each time I try to get him to show his portfolio like all the other superinvestors do who write books. His goal of not losing money is so strong that the loss of opportunities become apparent in the way he responds. I think that happens also to many "value investors" out there, who don't know the business that they are buying, the environment and the long term prospecrs, but only look at financials.

I may not have a master of finance or a financial planner license, but I do think about business far more than I think about making money.

2020-05-29 08:46

Philip ( buy what you understand)

Do you even look at my portfolio? I put a note inside for every margin loan transaction leh. I am around 38% margin now. What you talking?

Your INSAS and QL now huge huge lead, get ready to treat Bak kut teh. I plan to bring all the kids from seri mengasih orphanage. Dec 31 2021 2 year bet don't forget ah?

QL - rm10 now ( from 6.9)

INSAS - 0.58 now ( from 0.69)

After 2 years... Who talk like sohai?

Please don't hide ya, Bak kut teh time and make the orphans sad.

>>>>>>>>

stockraider THIS PHILIP TALK LIKE SOHAI LOH...!!

IF SO EASY LIKE PHILIP SAY IN INVESTMENT WITHOUT CONSIDERATION OF RISK LIKE HE SAYS, WHY PHILIP, DON GO AND BORROW FEW MILLION ON MARGIN AND GO N WALLOP THE MARKET LEH ??

2020-05-29 08:51

Good morning Philip,

May I ask was companies like renong, aokam perdana and transmile a net assets, huge margin of safety companies? They look like gambling stocks rather than anything worth investing in?

What are assets? Goldeye said non-current assets like land, property, goodwill, PPE and etc are illiquid assets and can be considered as liabilities. Only liquid assets are considered as real margin of safety assets.

I agreed with you on family owned company where first generation work hard to build the company and second generation just try their best to maintain the company.

The questions of third generation (most are well educated) would they like to work hard or work smart? If they work smart they can hire the right people for the right jobs and hence grow the company without them working very hard.

QL is still first generation company will the company still be the same when come to second generation?

2020-05-29 09:06

it also means business sense as front and center, not business sense as a foot note.

2020-05-29 09:07

Philip ( buy what you understand)

Ql and yinson are 2nd generation success stories.

Aokam had 1000 acres of producing timber valued at 10% the market value selling at crazy prices to Europe and Japan.

As for renong,

https://www.wsj.com/articles/SB885153708408176000

https://www.theedgemarkets.com/article/special-report-truth-2001-sale-renonguem-finally-coming-out-0

3 billion in options contracts liquid enough for you? Supposedly Guaranteed payment?

Transmile major shareholder and founder was Robert kwok, a very smart investor.

I think on hindsight it is very easy to make fun of my past mistakes in investing based on value investing methodology. But if you were investing in those days, you would not know how to spot lemons. With fabricated accounts, fake and hidden money, and sudden losses out of left field, I find the correlations of sudden losses and Winfield holdings dubious " liquid assets" very worrying.

I think in the end you will learn the same lessons as me, except I learned them in my 30s.

>>>>>>>

QL is still first generation company will the company still be the same when come to second generation?

2020-05-29 09:18

looking at the environment, diversified portfolios is not compounding growth. It is holland.

The law of average works against all diversified portfolios.

2020-05-29 09:34

Dear Philip,

I am definitely not making fun on your past mistakes. I just want to clarified the liquid asset are equities(quoted stocks), fixed income (bonds) and cash equivalent are to be considered as margin of safety assets.

Nowadays the easy ways to game the system are purchase of inflated PPE, inflated revenue with huge receivable and announcement of huge contracts win.

2020-05-29 09:36

Philip ( buy what you understand)

Dear Sslee,

Is buying Xinquan for their 1 billion cash a good margin of safety? If that is your analysis then my mistake was even worse, securities commission, government and Dr mahathir personally guarantee to buy back my put option. Blind value investing at it's best.

>>>>>>>>>>

A few months later in January 1998, the Securities Commission, which reported to Anwar, forced Halim to agree to personally buy back the 32.6% block of Renong shares from UEM via a put option that was to be exercisable anytime within 12 months from March 2000, at an agreed price of RM3.1 billion.

2020-05-29 09:40

so Philip was victim of that Aokam scam? That time was heavily promoted by foreign brokers, Credit Lyonnaise.....Teh Soon Seng Era. Sky high price ..went bankrupt, restructured ( Credit Lyonnaise throwing good money after bad) and die again.

2020-05-29 09:53

aokam was investment thesis of that era. Tulipmania prices and collapsed.....and the foot prints of foreign brokers....comparing Aokam with the largest lumber companies of Canada................lol....

2020-05-29 09:57

haha Philip,

So we are now even, I got fooled by the huge bank deposit in China where a reputable Auditor just signed off as been audited and everything in order.

Xingquan AGM minutes: The cash in bank was verified by the external auditors who had obtained confirmation and printed bank balances statements directly from the various banks.

Auditor response with a positive yes when ask explain whether they checked the cash balance in the bank on monthly basis.

2020-05-29 10:00

sslee...............................the money is there....just that the company no more here..............

2020-05-29 10:05

Haha qqq3,

Your advisor KYY is dtill fighting his Xingquan case with his appointed law firm.

2020-05-29 10:25

Philip , Thanks for valuable value-trap write-ups !

Really learn a lot from that, pls keep it up and share with us your knowledge and experience !

2020-05-29 10:28

Philip ( buy what you understand)

Yes, so be careful about blond investing, doesn't matter liquid assets or ppe or cash in bank. Everything can be fooled if you don't actually know the business. Like hohup now doing the crown in KK Sabah here. The results is going to be worse than evolve concept mall with imago asianpac on one side and centre point next door and suriawang at the seaside. If look at financials you would think it is wonderful.

But if you scuttlebutt and visit Sabah and talk to locals, they will ask you....

You think this is Bukit Bintang meh?

2020-05-29 10:32

i just think maybe i mistake or wrong all depends on their own management n director want to expand their biz or not, mostly Chinese companies 保守, ex like Oriental debt free but it share not so much movement,

2020-05-29 10:50

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$€£¥

How long do you wait for a value share to out? There's no easy answer.

Ask raider, the biggest promoter of value traps!

2020-05-29 11:21

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$€£¥

It is always preferable to invest in compounders and growth companies than just any bargains or cheap non-quality stocks.

Given a choice:

Choose compounders and growth.

They are always better than lousy companies that are available at low prices.

Those who choose these lousy companies at low price may find many of them not so rewarding.

A few though rewarding, but they will soon realise that this strategy gives limited upsides.

Don't just focus on cheapness.

Always look for great quality growing companies to buy at cheap prices.

Seek out the ones that will give you the 10 baggers in 10 years.

2020-05-29 11:29

Integrity. Intelligent. Industrious. 3iii (iiinvestsmart)$€£¥

>>>>>

Sslee haha Philip,

So we are now even, I got fooled by the huge bank deposit in China where a reputable Auditor just signed off as been audited and everything in order.

>>>>>

SSLee

Your protection is to stay with QUALITY FIRST, then PRICE.

2020-05-29 12:00

y Sslee > May 29, 2020 10:25 AM | Report Abuse

Haha qqq3,

Your advisor KYY is dtill fighting his Xingquan case with his appointed law firm.

===========

for the red hips, they planned it even before IPO........

for KYY....he is being consistent........he loses in red chips, makes back on gloves.....on simple ideas.....a bit naive u say, but being naive has its advantages...........

2020-05-29 12:10

Oriental holdings and Hup Seng industries. Both well run & cash rich companies. I wont call them value traps, but they fit your description of legacy businesses built by founder and next generation sitting on it and not doing much. Good investment for defensive play, but wont excite the growth investors.

Had a chat with Mdm Kerk Chian Tung once about Hup Seng’s long term prospects and about reinvesting the huge pile cash to bring Hup Seng to greater heights instead of giving 100% profits as dividends. Had a very conservative answer.

2020-05-29 12:39

Philip ( buy what you understand)

Yes, but the key point here is without doing proper scuttlebutt, the value investor in you will just scream BUY! And while you are holding that, you miss out on the topgloves, QLs of the market. Knowing why you lost money is one thing, knowing why you aren't going anywhere is also just as important.

2020-05-29 12:55

Dear all,

For family run business it is very difficult to predict what the next generation will do when they take over the family business. Some go downhill due to family members grueling and fighting each other. Some felt contented as Malaysia/Kampung Champion as their wealth can last them many generations as long as they do not make big mistake. Only those hungers for more success and with ambition to grow the families run business into world champions will strive harder and get all the right people for the right jobs and remake the family company from good to great to wonderful company.

2020-05-29 13:00

i finally understood the pikachu analogy after asking my son. quite a useful investing analogy! haha

2020-05-29 13:13

Philip ( buy what you understand) > May 29, 2020 9:40 AM | Report

Is buying Xinquan for their 1 billion cash a good margin of safety? If that is your analysis then my mistake was even worse, securities commission, government and Dr mahathir personally guarantee to buy back my put option.

============

I remember the options but it as also a time of great political and economic upheavals.....and the value of promises by Halim..........

2020-05-29 14:51

Haha qqq3,

Care to explain why your microcap companies Kpower and SCIB outperform Serbadk?

2020-05-29 16:00

but Kpower up on results because nobody got any expectation.............lol.....looks like will continue to out perform serba which certainly has more facts and figures.

nb...Kpower/ SCIB will continue to see increasing revenue/ profits q by q

2020-05-29 16:37

Philip ( buy what you understand) > May 29, 2020 9:40 AM | Report

Is buying Xinquan for their 1 billion cash a good margin of safety? If that is your analysis then my mistake was even worse, securities commission, government and Dr mahathir personally guarantee to buy back my put option.

============

I remember the options but it as also a time of great political and economic upheavals.....and the value of promises by Halim..........or indeed promises to Halim because he is seem by then to be a greedy traitor. Halim was supposed to a nominee of UMNO not owner of those assets., and now refused to do national service when needed.

2020-05-29 16:45

illusion or reality both can make money, its all about character and attitude.

2020-05-29 16:54

Philip ( buy what you understand)

Philip mental model no. 56.

Pikachu!

>>>>>>>>>>>

David i finally understood the pikachu analogy after asking my son. quite a useful investing analogy! haha

29/05/2020 1:13 PM

2020-05-29 18:17

if buy cash for cash it is so silly

Exactly same as in Fixed Deposit, you pay RM1.00 and get RM1.00

////Is buying Xinquan for their 1 billion cash a good margin of safety?////

2020-05-29 18:20

boonwei98

Thank you for your sharing. It makes plenty of sense to me.

2020-05-29 08:09