Vivocom: to buy or to avoid

Jay

Publish date: Thu, 27 Oct 2016, 07:40 PM

Welcome to another piece of the to buy or to avoid series. Forgive me if I’m a bit rusty as I haven’t blogged for some time. From my last experience with MBSB, please stop here if you can’t take some harsh facts and critical comments on your “precious company”.

Background

Today the company is Vivocom, or formerly known as Instacom. It gained prominence last year due to sharp upwards price movement after it announced the acquisition of Neata, holding company of Vivocom. Thereafter, the acquisition is completed, CIMB initiated coverage with sky-high valuation, proposed placement, proposed change of name, good quarterly results, streams of orderbook announcements, proposed bonus issue etc. Those who are interested of the backstory can go read it up yourself.

My views back then

I warned investors in Vivocom (or back then, Instacom) page that it was way overpriced after it shot above 30c. I also highlighted why I though CIMB’s initiation report was pure garbage (I rarely use such strong word) and cannot be relied on. After that, it fell below 25c before going above 30c again. Then, the price started to trend down and after 1 for 4 bonus issue, now it’s at 18c.

So why am I revisiting

Partly because of the mention of small mid-cap in the recent budget and the price has retraced significantly (even after accounting for bonus issue, >35% from its peak). I always try not to be emotional on investments, although I felt it was overvalued back then based on my rough calculations, it could still be a good investment if price has fallen below its fair value.

So on its financials

Orderbook strength

What Vivocom’s supporters often highlight is its strong orderbook. I always hear figures like RM2bn-RM4bn. To be honest, I never really bothered listening. Why? I know Vivocom didn’t win any large infrastructure projects (I do track those) so it’s quite difficult for them to amass orderbook of such size without being awarded such contracts. But now since I’m analysing let’s check out the details.

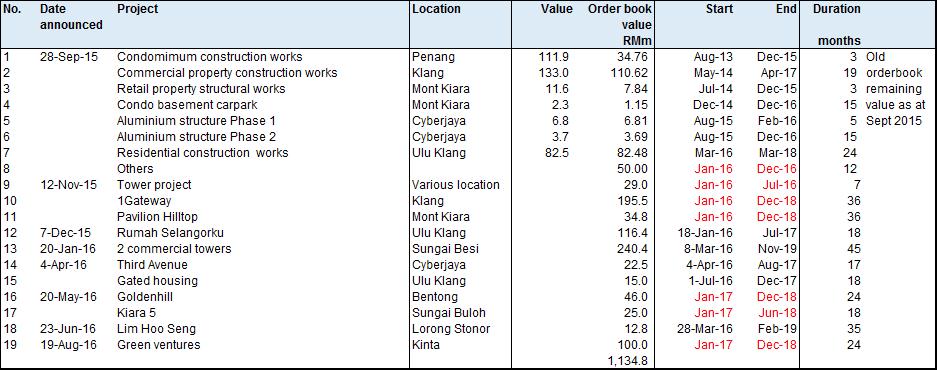

From Sept 2015 which was the date of circular for the Neata acquisition until today, the contracts awarded are about RM837m. Based on news last year, the MD mentioned they have orderbook around RM400m, which remaining value is around RM300m back then. All these combined, orderbook will be around RM1.1bn before deducting those recognised in 4Q15-2Q16 results. The list is shown below.

Some commencement date are not stated so I just assumed those announced in 2015 will start Jan-16 while those 2016 starts in Jan-17. This is important for projection later.

Wait, I thought it’s much higher?

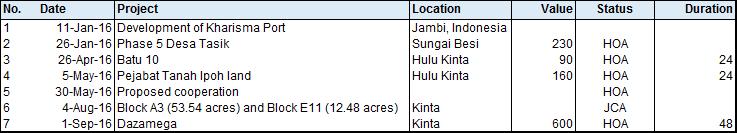

The fact is, it’s not. Other announcements you saw are Heads of Agreement, Letter of Intent, Joint Collaboration Agreement etc. None of them are legally binding and nothing materialise after initial announcement. For example, in Sept 2016, there’s a HOA for RM600m project in Kinta, Perak.

In it, there’s a term “the Parties are not obligated to proceed with the Proposed Development unless the terms and conditions of a final agreement is agreed upon and executed by 30 Sept 2016, unless further extended by mutual agreement between the Parties”.

Well, there’s no further announcement since then, so in layman’s term, there’s no mutual agreement between the parties and the project is a no go. Same for a few other HOA where there’s a deadline. Some did not, but no further announcement most likely means the project hit road-block or Vivocom was not selected as contractor. Again, the list is shown below.

What about those analysts’ reports?

I did say they were garbage, didn’t I? CIMB initiated coverage back in Nov 2015 and state that Vivocom’s outstanding orderbook was around RM1.8bn when the MD in press conference said was around RM400m. I read through his list in the report, most of them have commencement date in 2016 or 2017 and weren’t announced anywhere. So either he’s a clairvoyant that’s able to see into the future with certainty or he can’t even differentiate between orderbook and tenderbook. The most recent report states that Vivocom’s orderbook stood at RM2.2bn. Other houses also have sky-high orderbook stated in the report, some more than RM3bn.

So who should you trust?

Good question. Trust yourself and no one else. Not even me. I may not have hidden agenda like others but I could make mistake as well. That’s why my approach is always gather info from different sources and try to reconcile them and see if they fit and makes logical sense.

From the list I gathered above, I try to gather against what management said. Back then, circular has about RM350m, MD said RM400m, that’s close. Now I get about RM1.1bn, in the latest quarterly results under prospects, company mentioned similar figures instead of some sky-high figures. Check. What does it mean? Means I will trust my RM1.1bn figure.

And again apply your logic. Trust management and their published quarterly results more than you trust analyst. Because what management said or published, they could incur personal liability if it’s deemed misleading investors. Analysts? Their long winded disclaimer page usually will absolve them of any such liability and for so many years, I have never seen any analyst being taken action against before.

Could there be some omissions?

Yes it’s possible that company may have won some contracts without announcing. That’s why when the difference is between RM350m and RM400m, I gave it a pass. But when it’s RM1.1bn vs RM2.2bn, I just can’t convince myself without sufficient evidence. Besides, again if you look at my list above, company announced contracts with value as low as RM10-20m, do you think the company will not announce contracts that have ballooned their orderbook by RM1bn?

Oh, maybe you omitted those infrastructure projects that CRCC is going to win and subcontract to Vivocom?

If it’s in the future, then it’s not certain and is definitely not in your orderbook. Again look at my lists above (for the umpteenth time J), almost 100% of orderbook as well as those HOAs are related to property development. Which means Vivocom has no track record and most likely no expertise in undertaking infrastructure construction project.

But GeorgeKent was once also a water meter company right?

And of course in Malaysia the bolehland, you can always win contracts without expertise and subcontract it. But first thing first you need to be able to win the contract to subcontract. Vivocom can start winning infrastructure contracts like GeorgeKent if they have directors who are golf buddy with Najib, but last I check, they don’t. So if it’s CRCC winning the contract, will they subcontract to someone who can do the job or subcontract to Vivocom to sub-sub-contract to another party, you be the judge.

Bottom line, Vivocom is just another property development contractor so don’t put your hopes up on some cruel lies brandied around by those analysts.

So what’s the fair value?

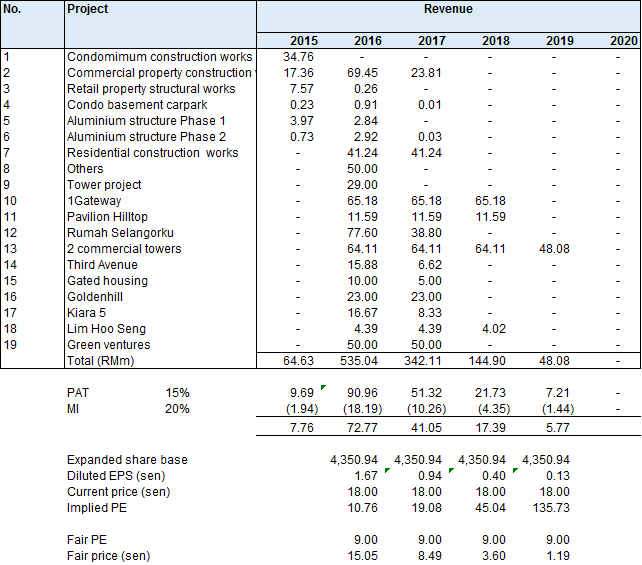

Based on the lists I compiled, verified against other sources, now I can come up with a revenue and profit projection.

If you look under 2016, it does look like the first 2 quarters numbers fit. I used a simple net profit margin assumption of 15%. Usually large construction projects margins are around 6-9%, for Vivocom since it’s smaller scale property development, I give it a higher 15%. Property developers usually earn around 20-25% profit margin so contractors/subcontractors should earn less. For first 2 quarters, average net profit margin was around 19%, I don’t think it’s sustainable and 15% should be fair (as developer will need to earn something as well). Minority interest is applied as don’t forget, Neata that was acquired is a 78.6% owned subsidiary.

What do the numbers tell you?

To sum it up, despite the steep fall, the price is not astronomically expensive like last time but is not cheap either. The implied PE (blended 2016-2017 around 12.5 times) is high given that it’s a small-cap property contractor. The only good thing is that it has no sales risk like property developer, if not its fair PE should be even lower (given the current property environment).

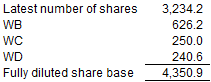

It also tells you that based on secured contracts, 2017 is going to look like a bad year compared to 2016. To maintain the same revenue and profit level as 2016, they need at least another RM200m sales. Since construction usually lasts around 2 years or more, which means at least another RM400-500m new contracts. Every year to keep revenue above RM500m, they will also need to keep winning close to RM500-600m contracts, which is no mean feat. But that’s the price to pay when you are a RM600m market cap company.

Recommendation

Stay away. Unless the price fall to lower levels or if upcoming contract wins surprises on the upside.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

I hope that everyone can keep their comments here civilised. don't simply accuse companies of fake contracts or con counter unless you can show evidence. if it's just your suspicion, please keep it to yourself. facts will prevail, so just stick to facts will do. thanks..

2016-10-28 00:08

thank Jay, i agreed with you. 700k sold and cut lost to hevea and jtiasa. made it back and waiting for vivo to come to below 15 sen

2016-10-28 07:13

Jay we need people like you. Thank you for the info. Hope in the future will get more news from you.

2016-10-28 09:36

jay, you are assessing to the current instant of vivo of which it maybe true to the certain extent of the current situation but future prospect was not in the picture, thus there might not be 100 percent accurate in term of growth factor in vivo.

anyhow well done. keep it up.

2016-10-28 10:23

smartly, every company also can have future prospects; so is not really a good indicator in general for any counter. For Jay, he emphasized more on CONFIRMED orderbook. LOA has time limit and/or Vivocom may not successfully get the projects. In a nutshell; if comparing company A, B, and C, than compare with reliable indicators such as CONFIRMED orderbook only for all A, B, and C company. Unless if you said you have crystal ball to see A, but no crystal ball for B and C company, than I rest my case.

2016-10-28 11:01

of course everyone can have different approach. some prefer companies which they think have good prospects which market cannot accurately capture now. such approach usually carries high risk high return

2016-10-28 13:54

so we can assume that the projection based on Jay tabulation is until 3Q2015 and didn't take into any further announced projects?...............so the fair value of 0.16s or whatsoever is valid until 3Q2015?

So this is half baked story and projection?..............if in the world of investment and you relied on half baked stories and projections................you're dead meat.

2016-10-28 14:04

don't waste my effort in putting up the lists. even after nicely put in table the date of announcement also can miss then you can blame no one but yourself...

2016-10-28 14:23

Dont mis lead people la, this is the one active stock in Bursa and i3!!! and this counter is for speculator only!!! DOnt stupid until believe this counter can fly xD

YOu rather watch Opensys then this stupid VIVO xD

Whoever watch something related with VIVO will get greatest explore, and gain viewed!!!! Please do something contribute, dont simple want to gain viewed !!!!

Thank you xD

2016-10-28 14:27

Who buy who die and just wasting time, all people already in and out this counter. My suggestion is to in some potential market rather than this Penny stock.

Dont waste your time and effort to wait,,,, then lose money and time in the end of the day.

2016-10-28 14:41

most of the HOAs have expired, so I think it's better to look forward to other new contracts. the fair price will only last for 2016, which is coming to an end. 2017 onwards are not secured yet. they need to keep winning contracts, if not the profit will start to drop from next year. if market price is close to fair price that means there's no margin of safety. many things can go wrong for any company, not getting new revenue, delay in projects, margin compression etc. which is why it's best to avoid company with no margin of safety

2016-10-28 22:45

Mr Jay, I think you make a big mistake. Please validate the HOA direct with Vivocom official with a simple call. I can very confident my list of order books is accurate and stood at approximately rm3bil up to today. Maybe u are not a shareholders and you don't even have a courage to do so. Vivocom as project delivery partner with crcc is still waiting award for crcc on Gemas Johor double railway and other new project.

2016-10-29 08:44

Be responsible when you wish to write something and be honest if you wish to publish something that may affect innocent investor.

2016-10-29 08:47

@CKNYAM the one who misleads trying to accuse others or misleading

I have noticed that you have been trolling a lot of pages in this forum hard-selling vivo based on your "orderbook" so if you are butt-hurt by the facts presented, it's your problem.

1. Please understand what is orderbook. Orderbook is CONFIRMED orders with contractual obligations if one party backs out. When your list has HOA, automatically your RM3bil figures has no credibility

2. Read the HOAs, it's not that long. Like what I highlighted in the article, most of them have deadlines, if deadline has passed, no announcement of contract and no announcement of extension, what do you expect? If it's still on, then Vivo is in violation of listing requirements for not making timely announcement

Let me dumb it down for the likes of you:

If a company wants to hire you and say let's discuss our terms and by end of the month, we shall finalise and sign an employment contract. If not, you are not obligated to work and I am not obligated to pay you. After end of the month, no contract was offered. Are you hired? Will you report to work?

3. Yes I'm not a shareholder and I don't bother to call them. Why? From my experience dealing with corporate figures, many people can say many things. But when you ask them to commit in writing, they will change tune or chicken out.

Why don't you request your company to commit themselves in the next QR to state what is their orderbook? Not orderbook+HOA, JUST orderbook.

4. CRCC links have been explained in the article. If you choose to believe that CRCC will subcontract to Vivo to sub-sub-contract, that's your own choice.

Bottom line,

- If you can't even tell contract from HOA, or orderbook from tenderbook, you are not even qualified to talk about this stock

- It's one thing to plead ignorance when you troll i3 with your "orderbook" but if by now you can already tell the difference, you still continue to troll the forum with the same lousy list, then your intentions are very clear

- Like I mentioned in my last article on MBSB, if you want to argue based on technical charts, rumours etc. go ahead. If you want to challenge my facts or arguments, please show your side of facts and arguments. Don't go whining "you are wrong, I'm right" like kindergarten kids

To other readers, if you notice @CKNYAM trolling other pages again to promote Vivo, feel free to post my comment here or even links to this article. Let the readers decide and prevent people from falling into traps set by irresponsible characters posting inaccurate facts

2016-10-29 10:19

Its good sharing by everyone here, my leason is trust myself not even what the big bank analysis said. I think value sharing and discusion here is the purpose, blindly follow will just risking my own hard earn money.

2016-11-01 07:57

made an error previously. fully diluted shares should be more than 4b, so diluted EPS revised down. for 2016 I also adjusted margins to be higher than 15% as first half margins were relatively high. all in, the analysis shows that vivo's FV shd b even lower than previously estimated

2016-11-29 16:41

Vivocom clearly a scam stock now as evident by CIMB's hoax report. Everyone will stay away now.

2016-11-30 23:22

Vivo comrades you don't know have to follow Vivo haters here. What they said here not true. At least recent slide not due to Vivo directors selling unlike some hot counter like Ekovest, etc.

2016-12-01 03:42

it's sad that even after facts are laid bare in front of you, still in denial. wake up, none of Vivo directors own any shares except Anne, who has also ceased to be substantial shareholder since Sept, so she can now sell quietly without disclosing. Vivo is a company which its own directors also don't want to hold shares

2016-12-01 13:13

non of the directors hold share ? how to see ? isn't Annual Report disclose their holdings ? if really NO, then bye bye lo

2016-12-01 22:44

now it's 15.5c compared to 18c when I wrote this. my fair value is 15c, so only recommended to enter at below 12c so there would be sufficient upside

2016-12-07 10:28

You didn't include the project in Bandar Tasik Amanjaya worth RM758mil (four phases with each phase has a contract value of RM189.5mil, duation 36 months, and the phases may run concurrently). It's a confirmed contract.

http://www.suaraperak.com/single-post/2016/08/04/MB-Inc-Bina-4000-Rumah-Mampu-Milik

It should add RM252.67mil revenue for 2017, 2018 and 2019 respectively.

2016-12-07 19:55

Speaking of diluted eps, obviously people who are holding the warrants won't exercise all their warrants immediately because by doing so they will suffer a loss. The maturity date of Vivocom's warrant:

WB: 08 Sep 2018

WC: 22 Jan 2020

WD: 08 Jul 2020

2016-12-07 20:14

if you bother reading earlier comments, i already mentioned the RM190m spread over 3 years will add about 0.2c eps annually. in that case, 2017 eps will be around 1.1-1.2c

just look around all the property projects, every developer are being cautious now. do you really think they will launch more than 1 phase concurrently in this kind of market? why would the developer risk holding inventories by launching multiple phases together? perak housing market is not outperforming the other states, just because it mentioned it may be launched concurrently doesn't mean it will. it's more likely they won't unless there's unusually high demand in perak

on diluted eps, there's only 2 scenarios, one is they expire worthless or warrant holders may covert before expiry to enjoy the upside or salvage whatever value left. either way it will cap the upside of the stock. just imagine you are owner of a biz, you think it's worth x amount but someone else has the option to take a % from you, do you think when you calculate your net worth you can conveniently ignore the option? especially when the option will take almost 25% of your biz. only if the option has indeed expired, then you can breath easily

2016-12-08 08:35

another troubling thing I didn't highlight in this article previously is that none of the directors hold any shares in this company (Anne has ceased to be substantial shareholder, actual % unknown now)

when the company keep on doing placement, bonus issues etc. and has such a huge share base (>3 billion), you wonder why none of the directors bother taking the opportunity to get a piece of the pie? especially when price has corrected over quite some time

it shouldn't be a major factor in valuing the company but is a point worth considering

2016-12-08 08:43

When director hold shares in company and sell off their share for profits, investor will comment director has no confidents and also unload his share. When director not holding any share for to avoid conflict on interest, you said they are manipulator. A coin with two side of side. Bunch of bull shits.

2016-12-08 09:00

When Vivocom downtrend reversal, be prepare to write another grand mother father story.

2016-12-08 09:01

it's called alignment of interest, it's the same reasoning why companies give ESOS to retain employees. imagine your active biz partner doesn't want to hold shares, don't you feel a bit concerned?

unless Vivo surprises in terms of new contract wins, if not it looks like the party's over. price overshot fundamentals, so correction is just normal

2016-12-08 09:08

You still need to list the Bandar Tasik Amanjaya project as a confirmed contract for not misleading the readers.

In fact the affordable houses are still in high demand despite recent property slowdown.

I wouldn't say we shouldn't worry about the diluted eps forever but just it's not a matter for at least 1 year from now, and you know many things can happen in one year. That is just for WB that will be mature on 08 Sep 2018. The maturity date of WC and WD are in 2020.

I think you just illustrated an extreme worst circumstances. I don't think the price has overshot its fundamentals, unless you want a lot of margin of safely like ICAP fund manager Tan Teng Boo. I would say your article is just for reference. Everyone should do their own works.

2016-12-08 16:21

Previously I didn't include it because it lacks details so you don't know if the developer are going ahead with it.

It's not just demand but financing, just look at loan application and loan approval rates for residential houses you will see the grim picture. And affordable segment are those that are most hard pressed in financing

You can't dismiss something just because it is not happening yet. It is there hanging over your head, someone will come for your company if it does well

I haven't even got to the extreme worst. Look at Q3, revenue slowed down considerably. Worst case would be most of their orderbooks are stalled (as property developers struggle to sell), revenue delays and margins contract to normal industry rate like 12%. that's the worst

But of course you should do your own work. If you still want to invest that's your own money

2016-12-08 17:55

Period of job award to complete range 24 to 36 months. Vivocom as subcontractors are not bothering how much developer has sales all their units or not. Vivocom has to make sure the project is not delay and Bill according to projects complete percentage . So don't add that slow sales risk into Vivocom. They complete how much the project and they claims the revenue.

2016-12-08 18:35

Revenue q3 drop has been explained in the report that different cycle billing. Maybe q4 will pick up back the suppose revenue in q3. But they still make better revenue and profits on last 4 quarter comparing previous result. Don't write until Vivocom is a pn17 or engage with a lot wind up petition company

2016-12-08 18:40

CKNYAM, this will be the last time I respond to careless comments from you. you can't even read my comments correctly, it's this kind of attitude that lead you to take HOAs etc. as part of orderbook and unshamefully spam the whole forum

i already mentioned before they don't have direct sales risk in the article. what I'm saying is they are still indirectly exposed to developer's sales risk and the overall property industry. if your customer having difficulties to sell the houses and ask you yo delay the construction, would you still go ahead and construct?

q3 may or may not be a blip, especially if you exclude sales from other segment, construction plummeted a lot. but I didn't change my forecast, did I? I said that would be the extreme worst case, which I haven't assumed

just because I said it's not worth this price doesn't make it a PN17. I guess in your small mind, all stocks with very low price are troubled company.

grow up and start paying attention to details

2016-12-11 08:50

Time will tell it all. When Vivocom share price start appreciate, see who to grow up. U had failed in Pesona. And next U will failed again.

2016-12-11 12:38

CKNYAM

Anyway thanks Jay

2016-10-28 00:04