Is Gunung Capital worth the hype?

Jay

Publish date: Thu, 08 Dec 2016, 02:15 PM

Short answer, most likely no.

Summary of Gunung

Price has shot up recently and caught my attention, so i did some quick check on it. Here's some quick summary:

1. Involved mainly in transportation biz, e.g. ferrying participants for National Service and other government related stuffs, like our armies

2. Major shareholders are politically connected

3. Main biz is suffering especially since NS has been deferred (that's why the losses)

4. The main talking point about Gunung now is for their entry into mini hydro power plants. They ventured into it few years back, first 14MW plant about to commence operations based on the prospects commentary in quarterly report

So what's so special about Gunung

What has caught investors' imagination is the company mentioned that they have total 140MW capacity for hydro projects which is very sizeable for a RM100m market cap company. 140MW could potentially generate RM300m revenue, if 10% profit RM30m, PE 3 times, wow!

Hold your breath.

When things sound too good to be true, they often are. So I try to trace back what has happened in this company over the years and one big fact automatically invalidate my previous paragraph.

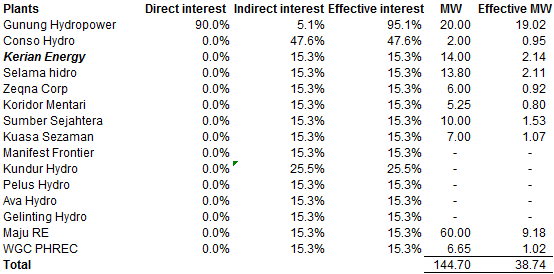

Effective MW is much lesser

140MW is misleading. Most of the plants were owned by Gunung through a 30% JV via its 60% indirectly owned subsidiary via a 85% owned subsidiary so effective stakes mostly around 15.3% only. A quick calculation, total capacity is 144.7MW, but Gunung's effective stake is around 38.7MW.

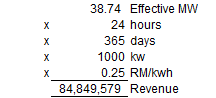

if we assume 24/7 operations with no wastage, 38.7MW x 24 hours x 365 days x blended 25c tariff = RM85m revenue when all fully completed and running.

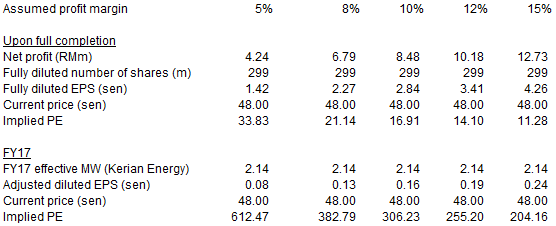

I'm not very sure about margins for this kind of mini-hydro plants, but I suppose these utilities biz generally will generate good EBITDA but net profit will be eroded by depreciation and interest expenses (all these won't show in Gunung's P/L because the stakes do not qualify for consolidation). So margins are unlikely to be fantastic, but let's just simulate different scenarios.

If all plants fully completed and running efficiently with decent margins (>10%) then the current price won't be excessive (PE 11-17 times, a bit on the high side for a small cap but acceptable for utilities biz), however currently management only indicate that one 14MW plant will commence soon (effective stake 2.14MW) while others are still work in progress. If we only take that single plant, then current market price is giving PE of >200 times. Which means market seems to have priced in a few years ahead, which in my view is risky considering that we don't know exactly when these plants will be coming online and their profitability.

Upside/downside risk to my calculations

Upside:

i) Higher than expected margins

ii) Few more plants yet to get PPA

iii) Possibility of acquiring bigger stakes in those plants (if price is right)

iv) New contracts for its transportation biz

Downside:

i) Core operations still struggling, so losses will offset utilities contribution ( I didn't take into account the current core biz)

ii) Delays in the building of hydro plant

iii) Lack of control over these JVs may mean that operations or costs may be out of company's control

iv) Learning curve in terms of propert maintenance and upkeep of these plants (in my illustration, I also assume 24/7 full year round which is not possible for maintenance)

Conclusion

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on Jay's market diary

Created by Jay | Nov 17, 2018

Created by Jay | Nov 05, 2018

Created by Jay | Oct 14, 2018

Discussions

the info are all extracted from the annual reports and the announcements back in 2013 when they purchased the subsidiary. you can refer there. the problem is Gunung doesn't disclose a lot about the details and progress. Since the total MW fits the 140MW described in annual report, I think it should be reasonably correct

2016-12-11 08:43

Thank you Jay. Good to have people like you here...

Articles like these are the most valuable in i3.

2016-12-12 21:10

Thx Jay for the break down. Hope u will do one in the future for Toyoink, which I found that might be more integrity sense after Mfcb.

2016-12-12 21:35

toyoink is similar to Jaks. I heard there's some issues with the Vietnam government as well as funding that's why the power plant after so many years is still a no go

2016-12-16 01:05

I'm not sure about the replacement value per MW but I can safely tell you that Gunung's EV definitely is nowhere near RM380m

1. Gunung MW is not 38MW

Like I mentioned, only when it's all fully completed, then there's around 140MW in which Gunung's stake is around 38MW. now I'm afraid most of them are far from completed

2. Investment needed first

Money don't come out of nowhere. You have to invest first in the hydro plant. The investment has to come out from cash/equity or borrowings.

3. Borrowings are not consolidated

The JVs most likely will fund the plant with borrowings but because JVs are not consolidated, the borrowings will not be shown in Gunung's financial statements. so actual indebtness is much higher at the hydro plant company level. those interest cost will eat into the plant profit once they are operational

2016-12-16 01:15

On paper, it is a is a minority stake in the various JV's, but gunung will have to most likely fund the entire capex. That's just how these contracts work

2016-12-16 12:47

not sure about their structure, but usually JVs the partners have to inject some equity and the rest based on borrowings. RM10m/MW is probably estimation, getting some excess funding just in case would be safer for the company.

another thing to note is usually those partners in those JVs are silent partners who may not have funding capability by themselves, i.e. cronies. so usually gearing up as high as possible is to minimise their equity injection. I'm not sure the RM550m are they referring to debts for certain JVs or all JVs or just borrowings for their part in the JVs

anyway, I wouldn't try to use EV method since so many inputs are not clear

2016-12-16 14:31

Siew Jian Bin

Very good comment! May I know where did you get the info that Selama is 13.80MW? I thought is 20MW. Also Maju RE for 60MW? I have no idea how to get the figure. I really appreciate your hardwork in preparing this article which I need it very much in order to make my decision to buy more or keep the share for future, tq!

2016-12-09 10:24