MUI Bhd. - Founder sold 15 million of his shares - BECAREFUL.

radzi

Publish date: Mon, 12 Jun 2017, 09:35 PM

One of my principle is not to buy shares of company when their owner, directors and major shareholders are selling.

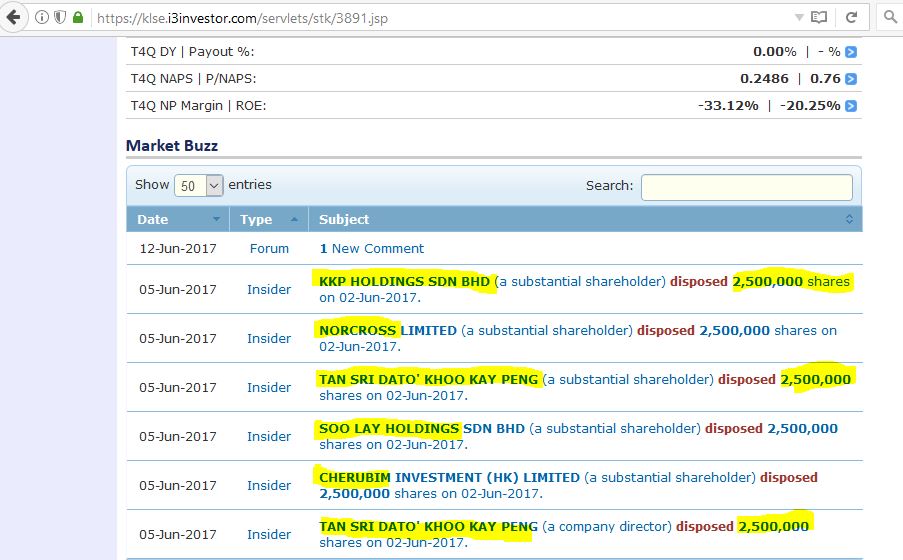

So, I post a screenshot of who is selling on the 2nd of June 2017.

You can see that Tan Sri Khoo Kay Peng sold directly 5,000,000 shares (2,500,000 + 2,500,000 = 5 million.

Then what bout KKP Holdings Sdn. Bhd. ? Nocross Limited ? Cherubim Investment (HK) limited ? and Soo Lay Holdings Sdn. Bhd.?

It takes no brainer that KKP holdings Sdn. Bhd. is Khoo Kay Peng Holdings Sdn. Bhd. And Nocross , Cherubim and Soo Lay Chairman is Khoo Kay Peng. Reference at link below.

http://www.hkexnews.hk/listedco/listconews/SEHK/2004/0415/00542/EWF106.pdf

In effect that means on 2nd of JUNE , Khoo Kay Peng sold 15 million of his shares. He has more than 140 million shares. You will never know when he will stop and he may sell when the price goes a bit higher.

So, Lagi Mahu Beli Ka ? (Still want to buy ?) . It is your money, your decision and your loss.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Radzi's Articles

Created by radzi | Aug 22, 2017

Created by radzi | Aug 01, 2017

Created by radzi | Jun 12, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 05, 2017

Discussions

Nobody want to buy a continuous loss making company when the founder is selling his shares.

2017-06-12 21:47

Mui so many asset and high NTA...but, we only can see and cannot take. How? Only Calvintaneng sochai dare to buy this stupid counter...KKP so stingy, I dont care your company worth 50b or 500b but minority share holder cannot benefit from it, forget about this stock.

2017-06-13 00:18

In time, it will float.

Lets say i think this company is worth at least RM1 (realistically, its like 1.5), if they dispose assets.

That's about 500% gain. Lets say it will take 10 years. that's a CAGR of about 25-28% per year.

Or, it can just clean up itself and become profitable again, at which point everyone will be rushing to buy in. Lets say it fly to 60 sen in this case, 5 year horizon. Thats almost 300% gain in 5 years or about 35-40% CAGR in 5 years.

Calvin is one of the few value investors here. Since he prioritizes absolute gain not relative gain.

I sold out my stakes at 25sen. Ill be buying in again soon. KKP is not dumb, either way, value will be realized before he dies.

2017-06-13 00:49

And MUI has a history of not being greedy and giving back money to shareholders. Like PMCORP did in 2015.

2017-06-13 00:49

i have invested before....then they strip metrojaya, sell the ampang land to own company, everytime change hands value increase.....we loose, KKP wins

2017-10-17 16:23

calvintaneng

Post removed.Why?

2017-06-12 21:43