AirAsiaX (AAX - 5238) Dependency on the movement of US Dollar. Part 2 - Fuel Expenses.

radzi

Publish date: Tue, 06 Jun 2017, 06:14 AM

After writing about how forex gain, and forex loss is influenced by movement of US dollar, now I am looking at how US dollar depreciation is affecting the fuel expense.

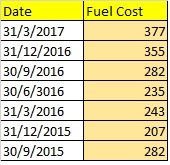

Much do we know that fuel constitute of 30% of AirAsia X cost and it is a significant cost. The trend of fuel expense for AAX has been worrying to me, as it looks getting higher as each quarter passes. Refer to the table below. The value is in term of million. Example, fuel cost in the first quarter of 2017 (Report on 31/3/2017) is RM 377 million (rounded to the nearest million).

A question that I do ask myself , what would 30th June 2017 fuel expense looks like ? Would it continue the upward trend ? or would it goes down ?

A trouble that I get to analyse this is getting the internal data. For example, the effective average fuel price (USD /per barrel or USD/gallon) in the same quarters, the volume of fuel consumed and effective average US dollar for each quarter.

Well, I simply dont have a hand on the most intimate data of AAX operation, So, I have to make do with whatever publicly accessible data for this analysis. Again, I turn to the same source of information and here, a correlation between MYR/US Dollar exchange rate and fuel cost is attempted.

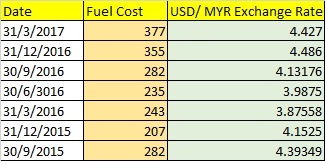

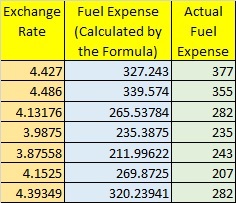

To be very open in my analysis, let me tabulate the correponding exchange rate with fuel cost as below:

These data are gathered from two sources :

(1) http://www.xe.com/currencycharts/?from=USD&to=MYR&view=2Y

(2) Quarter result of AAX at www.bursamalaysia.com

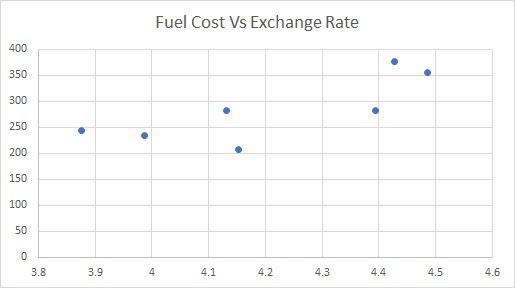

In order to better visualize the movement of fuel cost against exchange rate, let me just plot them in a graph, as below.

Y-axis denotes fuel cost in term of millions and X-axis denotes MYR/USD exchange rate .

It is quite interesting to know, that there is somewhat a linear trend between both variables, as US dollar appreciate, fuel cost does increase and when US dollar depreciate , fuel cost reduces.

Is this very true ? Can I take the graph as granted ? Again, I have to caress my crystall ball , and seek some "divine" answer. (LOL .. i used the word divine to create some dramatic effect, by no mean that it shows any relatedness to God or anyone in higher authority).

So, crystal ball , what do you say ?

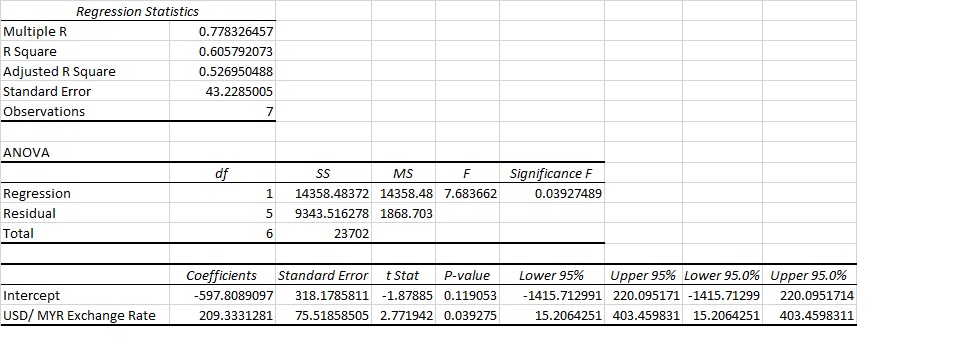

Zam ... zam ala kazam....And my crystall ball said that , even though exchange rate has some impact on fuel cost, it only explains 52.6% of the variation (movement) in AAX fuel expenses. So, the remaining 47% is explained by some other variables such as average consumed fuel price, hedging price , consumed volume and etc. Unfortunately , I dont have those data. Well guys, that prove one thing, this is not insider trading and I am neither an employee of AAX nor someone who have a hand on AAX data ( Though, if Tony Fernandes or Kamarudin Meranun needs a management consultant who can analyse their company to make decision based on data insight and make it run better in the futrre, I could help , with some consultancy fee .. will not charge as much as McKinsey or Boston Consulting Group charge, hahahaha)

And further to that, my crystall ball told me that; somehow there is 96% confidence that Fuel Price change linearly with USD/MYR exchange rate and 89% confidence of the intercept varies linearly.

Mathematically, the formula looks like this.

Fuel Cost Expense = 209 (Exchange Rate) -597 ......... Formula 2.

I hope you guys just dont use this formula as though it is the ultimate truth. Remember , I have told ya, this formula only explain 52.6% of the variation in fuel expense and not even touch 90% of the variation. At least, you can use it as a guide, with an assumption that you dont know the other independet variables.

To be fair, let me just tabulate how this formula fare compared to actual result.

Anyway, just to get a figure out of that, if I plug in exchange rate as 4.20 into formula 2, then I get fuel expense as RM 279 million. That is the best case scenario, in worst case scenario, I myself assume that the fuel expense is around RM 320 million especially as I know the fuel price is not as good as the in 2016. As a consolation, the fuel price is better than Q12017 and fuel expenses should be lower.

To potential investor, trade with care, but myself, I just dont care because sooner or later, exchange rate would not only touch 4.2 but will touch better than that.

Everybody has neurons in their brain, so let me say a proposition, if you have some money and you could get better return than keeping it in fix deposit within 6 - 12 months, would you consider investing in AAX for at least a 30-40% gain in your investment as the exchange rate improves profit look and earnings, and you have the chance to invest before anyone else got the wind. Let me answer it myself, I will.

*****'

A note about the author.

(1) He is a holder of B.(Hon) Engineering , MBA (Finance (Investment)), and PhD Eng. , well verse with the business framework used by McKinsey, Boston Consulting Group and Bain & Company.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Radzi's Articles

Created by radzi | Aug 22, 2017

Created by radzi | Aug 01, 2017

Created by radzi | Jun 12, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 05, 2017

elbrutus

well written...u got my vote...will definitely pay more attention to this stock..tq

2017-06-06 07:33