Prediction of AAX Profit Before Tax for Q2 2017 (Result release August 2017) - An Analytic Model.

radzi

Publish date: Mon, 12 Jun 2017, 12:58 PM

Let's go through some analytic fun discussion today. In the previous blog, I predicted fuel expenses, forex gain/loss and revenue, all with different independent variables.

I guess you all are aware that AAX cost elements - Forex gain/loss and Fuel Expenses are dependent on exchange rate and we are expecting fuel expense going down and have forex gain when MYR appreciates..

Cost and revenue are only a part of equation on earning, that is Profit = Revenue - Cost. The expectation would be straight forward if I can show a mathematical model that correlates profit with fuel and other cost.

So, today, I will predict AAX profit before tax (PBT) based on the movement of independent variables such as forex and fuel cost.

First, I try to run an analysis to predict PBT from fuel expense.

Everyone knows - Fuel expense = Fuel price per barrel ( or gallon) x Volume used x Exchange Rate.

It is quite easy to get exchange rate data and fuel price data but AAX volume data has been elusive. To work with this insufficient information, I define an index called Fuel Index, where:

Fuel Index = Fuel price per gallon x Exchange Rate ........ Formula 1

It is clear from the above formula, I have omitted the volume variable because there is no way for me to get that data. My interest at this point of time is to test whether profit before tax can linearly correlate with Fuel Index.

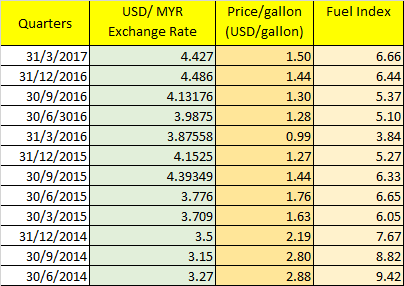

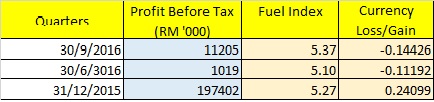

I show the data that I use in my analysis below:

The data above are sourced from these website:-

(1) USD/MYR Exchange Rate - http://www.xe.com/currencycharts/?from=USD&to=MYR&view=5Y

(2) Jet Fuel Price / gallon.- http://www.indexmundi.com/commodities/?commodity=jet-fuel&months=60

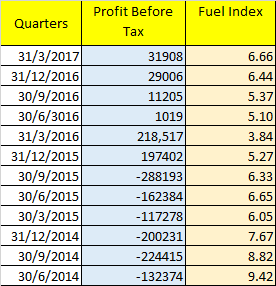

Fuel price data is the monthly average fuel price per quarter. After fuel index is calculated, I tabulate the profit before tax data that corresponds to Fuel Index, as below :

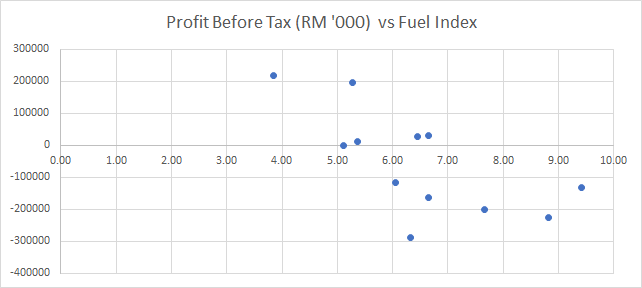

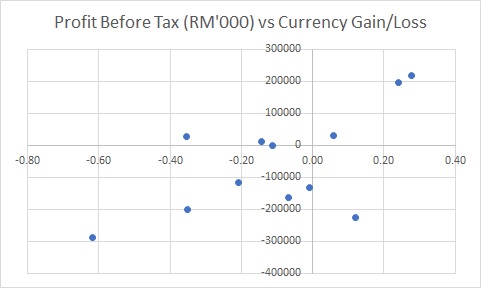

In order to visualize how Profit Before Tax varies with Fuel Index, let me show these data in the graph below:

The y-axis is profit before tax and the x-axis is Fuel Index.

From the graph , the profit before tax is inversely proportional to fuel index, that is PBT decreases as Fuel Index increases.

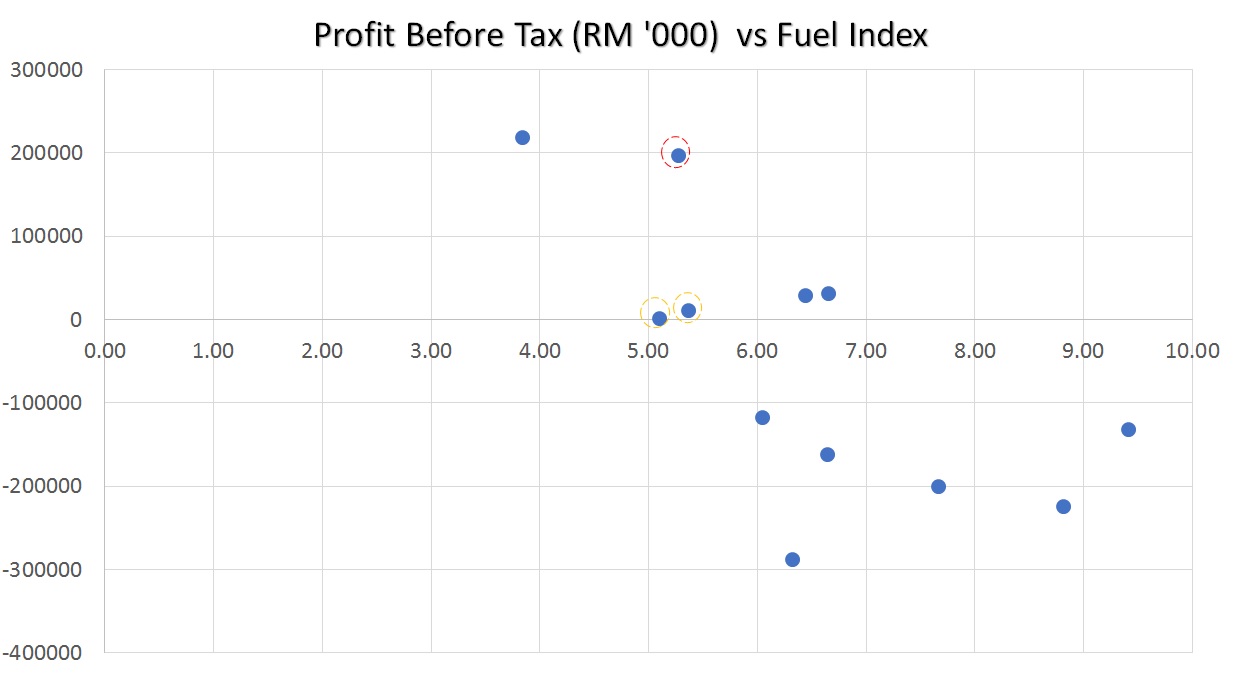

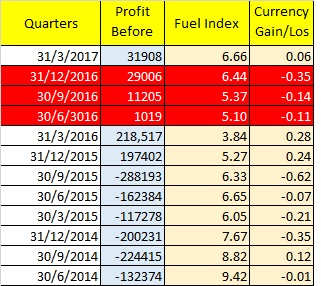

At current variables value , exchange rate = 4.26, and jet fuel price = 1.38, we get a vailue of 5.88. So looking in the fuel index region between 5.00 and 6.00, and the three data circled as in the graph below.

The y-axis is PBT ( in term of RM '000) and the x-axis is Fuel Index.

It is quite clear that in the 12 quarters under study, only 4 quarters the fuel index goes below 6 , and all of the 4 quarters , AAX recorded a positive PBT. The extreme is the one when fuel index goes below 4 , where AAX recorded more than 200 million PBT.

Since, we predict that fuel index is around 5 this quarter, the points that we are interested in is the points circled by the red and yellow dotted circles. So, let us look at some data.

At all the three point, extra-ordinary PBT is made when there is a 24 sen currency gain in the quarter. That means we need to include the currency gain in our discussion. In Q2 2017, we already have something like 18 sen currency gain. So why not look at PBT trend against the currency gain.

The y-axis is PBT ( in term of RM '000) and the x-axis is Currency Gain/Loss.

The general trend id that the PBT increases as currency gain increases and the PBT goes into loss when currency loss is recorded. Of course, there is some anomaly where , at a currency gain point, AAX got a very deep loss in profit before tax and at three currency loss points, AAX got some profit before tax. Why did that so ? And when did that happen ? Let's look at the data.

This a very interesting insight. Let me say that, the three anomaly which AAX made profit before tax even though it experience some currency loss are in the three last quarters of 2016. Comparing with quarters in 2015 and 2014, whenever currency loss is made, AAX made loss before tax. So, there is some fiscal changes or operational changes in AAX.

Another interesting insight, despite its choppy environment, AAX profit before tax trend is increasingly growing quarter after quarter from 30/6/2016 to 31/3/2017.

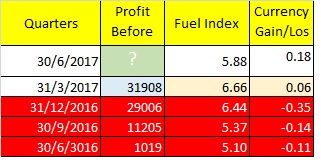

So, what is going to be next quarter Profit Before Tax ?? A question mark as in the illustration below.

So, again I go to my crystal ball ..."Mirror mirror in the wall, what is the most correct profit before tax amongst all ?". And the cyrstal ball gives me the following answer.

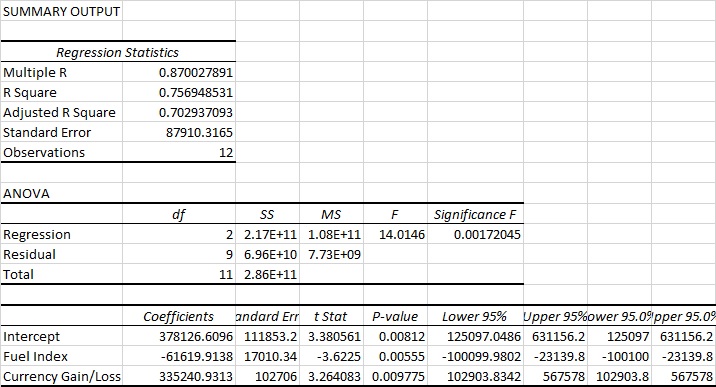

the following result of multiple linear regression says that 75% of variation in AAX Profit Before Tax can be explained by Fuel Index and Currency Gain/Loss.

The mathematical model is given as below.

Profit Before Tax = 335240 (Currency Gain/Loss) - 61629 (Fuel Index) +378126.

Why not we plug in the current currency gain 18 sen and , fuel index 5.88 into the equation to look what the PBT prediction looks like.

So, Profit Before Tax = 335240 (0.18) - 61629 (5.88) + 378126 = RM 76 million.

The model predicts a RM 76 million profit before tax for Q2 2017.

Ok readers, this is only a prediction. My crystal ball has explicitly said that this prediction covers 75% of variation of the PBT, so actual PBT may be less or may be more.

I hope this insight an give you some clue to make your investment in AAX. Happy investing.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Radzi's Articles

Created by radzi | Aug 22, 2017

Created by radzi | Aug 01, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 05, 2017

Discussions

bravo Radzi bro...complicated n lenghty for a layman like me...bottom line ..ur prediction PBT of 76m looks good against 2Q16...definitely deserves indepth lookin into AAX....btw r u also a AA investor ?? if so any calculations pertaining to its predicted PBT too ???

2017-06-12 15:04

acceso...no disrespect on ur comment but if u reckon radzi mathematical analysis is way off mark...then why dont u counter wt yours to show otherwise ??? wouldnt that be fair comment too ??come on...

2017-06-12 17:11

Q1 PBT was actually RM 31 m. The model measure PBT and. ot PAT. Tax for AAX a nit haywire. Sometimes , deferred tax give positive gain. So I exclude tax for prediction ourpose

2017-06-12 17:31

@elbrutus , acceso's comment only shows that he have no knowledge at all on the maths behind the analysis

2017-06-12 17:32

Hmmm?

Let Calvin Tan Research give you a very simple Maths kesson on AAX

According to AAX Website they have 22 AirBus A330 in use

See

https://www.planespotters.net/airline/AirAsia-X

One A330 = Rm900 millions

See

https://www.google.com.sg/search?q=cost+of+A330+airbus&rlz=1C1CHBD_enSG711SG711&oq=cost+of+A330+airbus&aqs=chrome..69i57.6575j0j8&sourceid=chrome

So 22 AirBus A330 = 22 x 900,000,000

= Rm19,800,000,000

That's Rm19.8 BILLIONS

How much is the yearly depreciation for Aircraft?

3%, 5% or 7%?

Ok, let's take the lowest depreciation cost

So 19,800,000,000 x .03

=Rm594,000,000 or Rm594 millions

How much depreciation for each quarter?

Rm594,000,000 divides by 4

= Rm148.5 Millions

YESSSS!!

Every 3 months the 22 A330 Planes will lose a value of Rm148.5 millions by depreciation alone.

Is AAX able to continue bleeding this hidden cost for long?

So how?

So you better sell all AAX shares first thing tomorrow morning.

Then?

Then buy these shares for safety

1) Mui Bhd (Mui bhd is an asset play. Mui real NTA is over Rm1.50 while AAX is only 25 sen (price below NTA)

2) PBA (this one rock solid with dividend)

3) CBIP (this one fast growth stock)

4) Pohuat (good results coming out soon)

5) DRB (powerful growth stock)

ACT NOW!

DON'T DELAY!!

YOU WILL BE GLAD YOU DID!

YAHOOOOOOOOOOO!!!!!!!!!

2017-06-12 17:54

Hmmm?

Let Calvin Tan Research give you a very simple Maths lesson on AAX

According to AAX Website they have 22 AirBus A330 in use

See

https://www.planespotters.net/airline/AirAsia-X

One A330 = Rm900 millions

See

https://www.google.com.sg/search?q=cost+of+A330+airbus&rlz=1C1CHBD_enSG711SG711&oq=cost+of+A330+airbus&aqs=chrome..69i57.6575j0j8&sourceid=chrome

So 22 AirBus A330 = 22 x 900,000,000

= Rm19,800,000,000

That's Rm19.8 BILLIONS

How much is the yearly depreciation for Aircraft?

3%, 5% or 7%?

Ok, let's take the lowest depreciation cost

So 19,800,000,000 x .03

=Rm594,000,000 or Rm594 millions

How much depreciation for each quarter?

Rm594,000,000 divides by 4

= Rm148.5 Millions

YESSSS!!

Every 3 months the 22 A330 Planes will lose a value of Rm148.5 millions by depreciation alone.

Is AAX able to continue bleeding this hidden cost for long?

So how?

So you better sell all AAX shares first thing tomorrow morning.

Then?

Then buy these shares for safety

1) Mui Bhd (Mui bhd is an asset play. Mui real NTA is over Rm1.50 while AAX is only 25 sen (price below NTA)

2) PBA (this one rock solid with dividend)

3) CBIP (this one fast growth stock)

4) Pohuat (good results coming out soon)

5) DRB (powerful growth stock)

ACT NOW!

DON'T DELAY!!

YOU WILL BE GLAD YOU DID!

YAHOOOOOOOOOOO!!!!!!!!!

2017-06-12 17:55

n if that is d case he/she shouldnt has made that irresponsible statement..bearing in mind that radzi put alot of effort into this analytical prediction...at least deserve more than a scantily sarcastic remark from him

2017-06-12 17:57

at the PBT level 1Q 2017 is $ 32 million.....Rad has shown enough workings to indicate PBT of $ 78 million or even higher is well within reach...........except for the seasonally weaker Q2........

with revenue of > $1 bilion a quarter.....and looking at currency and oil movements this quarter,.....it can surprise everyone.

2017-06-12 18:53

Rm78 millions is nothing if Company suffers a yearly mark down of Rm594 millions!

How come you guys don't know maths at all?

2017-06-12 19:09

Come on calvin, aax are using the aircrafts but are they owning all of the aircrafts? if yes, then why are they leasing?

2017-06-12 19:18

(b) Non-cancellable operating leases

The future minimum lease payments and sublease receipts under non-cancellable operating leases are as follows:

Group and Company

2016 2015

Future

minimum

lease

payments

RM’000

Future

minimum

sublease

receipts

RM’000

Future

minimum

lease

payments

RM’000

Future

minimum

sublease

receipts

RM’000

Not later than 1 year 1,024,614 315,396 987,113 293,769

Later than 1 year and not later than 5 years 4,094,546 1,261,582 3,920,000 1,206,650

Later than 5 years 3,893,976 954,762 4,700,684 1,214,852

9,013,136 2,531,740 9,607,797 2,715,271

The Group leases various aircraft and engines under non-cancellable operating lease agreements. The lease terms are

between 10 to 12 years.

See these figures

Not later than 1 year 1,024,614 315

Hutang due to lease (hire purchase) is Rm1.024 Billions a year.

All there in the AAX Annual Report if any honest fella bother to check it out!

2017-06-12 19:34

radzi bro...care to comment on calvintaneng allegation ???..seems excessive though...or like many sifus did emphasise...taking koko only

2017-06-12 19:48

Posted by elbrutus > Jun 12, 2017 07:48 PM | Report Abuse

radzi bro...care to comment on calvintaneng allegation ???..seems excessive though...or like many sifus did emphasise...taking koko only

Radzi?

He knows nothing about:

Margin of safety

Mui Bhd he said no good. He does not understand the deep deep value assets of Mui Bhd at all

And AAX just like Hubline are backed by metal planes as assets which will go rusty someday.

Better don't act smart like Wahahaha in Tekseng Forum

Calvin told Wahahaha to sell Tekseng above Rm1.00 and get out.

In stead Wahahaha was stubborn & bought even more Tekseng

In the end Tekseng crashed 45% & Wahahaha disappeared!!

So be WISE & QUICKLY WAKE UP NOW BEFORE TOO LATE

Calvin loves all you fellow i3 forumers

Don't want to see anymore suffering, ok?

2017-06-12 19:54

Calvintaneng, as far as i am concerned, operating lease involves no capitalisation of assets and thus no depreciation or amortisation. Therefore, how u came up with the depreciation figures? Where did u learn your half truth explanation skills? I will most likely avoid it

2017-06-12 20:05

CalvinTanEng is just spamming and asked investor to purchase MUI.

I know a chinese uncle bought his MUI at 0.28 and got trapped for five years. MUI is making 7 quarters of continuous losses. No uncle , auntie and friend want to buy that counter but he keep on promoting.

Why he promotes MUI ? So that Tan Sri Koo Kay Ping can disposed shares to pay settlement to his ex-wife ? On 5th of June, Tan Sri Kay Ping disposed 5 million shares. KKP Holdings disposed 2.5 million shares. Nocross limited dispoded 2.5 million shares. So Lay holding disposed 2.5 million shares. Cherebum Investment (HK) limited disposed 2.5 million shares.

Market react and MUI holding fall again from 25 sen to 19 sen.

So, run run , sell sell... dont buy MUI Holdings and other shares CalvinTanEng promotes because the major shareholders are disposing all those shares to pay off his ex-wife.

2017-06-12 20:07

If u eat what CalvinTanEng says , and buy MUI, you make immediate loss of 20%. Lagi mahu percaya ?

2017-06-12 20:08

Posted by MrPauper > Jun 12, 2017 08:05 PM | Report Abuse

Calvintaneng, as far as i am concerned, operating lease involves no capitalisation of assets and thus no depreciation or amortisation. Therefore, how u came up with the depreciation figures? Where did u learn your half truth explanation skills? I will most likely avoid it

There are 2 way of hire and hire purchase

1) Buy out right from Airbus. Take out loan from CIMB. Then pay CIMB monthly installment.

This is cheaper. But depreciation is borne by the purchaser

2) Hire a plane for a one year, 5 year or 10 year fixed period.

In this case pay more as depreciation will be on the leasor. In this case prepare to pay a much higher lease. At the end of lease AAX can buy the planes outright.

In both cases the planes are in use & there is bound to depreciation loss.

2017-06-12 20:10

You can see Market Buzz here and look major shareholders are disposing their shares like mad.

https://klse.i3investor.com/servlets/stk/3891.jsp

I have warned investors in MUI to take care of themselves, sell and run. Those who are stubborn now face the burning.

If you dont believe , check this link again.

https://klse.i3investor.com/servlets/stk/3891.jsp

2017-06-12 20:10

OK..airplane depreciated...but AAX going to sell airplane? Do u actually know airplane lifespan?

2017-06-12 20:12

Posted by radzi > Jun 12, 2017 08:08 PM | Report Abuse

If u eat what CalvinTanEng says , and buy MUI, you make immediate loss of 20%. Lagi mahu percaya ?

Calvin issue a buy call when Mui Bhd was 18 sen.

Star paper reported the divorce case.

Market chased it to 28 sen.

Now it retraced back near 18 sen & Calvin is buying even more.

Last time Calvin called for a buy on Pm Corp on 20th Sept 2013 even though Qtr reported a loss then

So what happended.

Pm Corp crossed 30 sen 3 times for 100% gain. Now all who bought Pm Corp at 15 sen already received 8 sen Cash Payout. All who bought Pm Corp at 15 sen on 20th Sept. 2013 are holding the share at 7 sen cost only

So Mui Bhd will unlock value as Divorce settlement unlock assets sale soon.

2017-06-12 20:15

It's ok.

Tan Sri KKP sold a little to legal fees.

Wait till the Actual Asset sales which will unlock Value

HYDE PARK CORUS HOTEL Alone is worth Rm1 Billions if sold.

Just watch

2017-06-12 20:18

Logically, KKP should buy more shares when he sells asset because all the dividend from his asset sale will go more into his account. But he sells his shares . Can you understand what that means ?

2017-06-12 20:21

KKP is selling his shares to unloack MUI Holding value. That is more correct.

2017-06-12 20:29

Posted by radzi > Jun 12, 2017 08:30 PM | Report Abuse

KKP sold 5 million shares. Indirectly, he sold 15 million shares though companies.

Where got?

You better check the figures more carefully

2017-06-12 20:35

Total no of securities after change

Direct (units) 0

Direct (%) 0.00

Indirect (units) 1,395,355,289

Indirect (%) 47.58

Total (units) 1,395,355,289

Total (%) 47.58

Date of Notice 02-Jun-2017

Indirect/deemed interest (units) 1,397,855,289

Indirect/deemed interest (%) 47.667

Date of notice 04 May 2016

Check up Mui Bhd and see

On May 4th 2016

Tan Sri KKP owns 1,397,855,289 Mui Bhd shares

And 2 Jun 2017 is 1,395,355,289 Mui Bhd shares

So the actual selling is Rm2.5 million shares.

Since KKP owns Mui Bhd shares through many cross holding companies there figures are repeated. But only 2.5 millions were sold.

Radzi is very dangerous and shallow

You better go sign up an investment course with KcChongNz now

2017-06-12 20:50

On 5th of June - KKP sold 2.5 million + 2.5 million = 5 million.

KKP associate company , check link below and do the math yourself.

https://klse.i3investor.com/servlets/stk/3891.jsp

2017-06-12 20:50

Some of what Calvin say is correct but most of them are wrong. Let us discuss Calvin's accusations :

(1) AAX operating 30 planes.

Yes, it is correct AAX is operating 30 planes. So, great Calvin, you have done a good job.

(2) AAX owns all the 30 planes such that its annual depreciation is RM 600 million (rounded figures).

Let's look at AAX annual account 2016.

http://www.bursamalaysia.com/market/listed-companies/company-announcements/5343605

In the annual report, it mentioned depreciation is RM 113 million but leasing is RM 846 million. So, what does that means ? It means that AAX leases around 85% of its plane and pay lease for 846 million. And it owns the rest and pays depreciation RM 113 million.

If you consider leasing cost as part of depreciation, then total annual "depreciation" is RM 846+113 = RM 959 million. Round it to RM 1 billion. Is paying RM 1 billion a big figure ?

Since Calvin is from Singapore, let us compare with Singapore Airlines.

https://www.bloomberg.com/news/articles/2017-05-01/singapore-air-may-land-unfamiliar-net-debt-spot-as-soon-as-2018

Singapore Airlines is going to land a USD $ 53 billion debt in 2018 or RM 250 BILLION debt. Assuming 5% depreciation rate, Singapore Airlines is going to pay RM 12.5 BILLION depreciation in a year. But its net profit per year is only RM 900 million (as good as Air Asia).

So, as a Singaporean , Calvin Tan. Is the debt Singapore Airline is taking worth it or not ????? You land yourself back in your accusation of AAX.

2017-06-12 20:53

Ok readers, since Calvin does not want to check, can you guys check what KKP did on the 5TH OF JUNE from the Market Buzz via the link below?

https://klse.i3investor.com/servlets/stk/3891.jsp

2017-06-12 20:55

Posted by radzi > Jun 12, 2017 08:50 PM | Report Abuse

On 5th of June - KKP sold 2.5 million + 2.5 million = 5 million.

KKP associate company , check link below and do the math yourself.

https://klse.i3investor.com/servlets/stk/3891.jsp

Posted by radzi > Jun 12, 2017 08:30 PM | Report Abuse

KKP sold 5 million shares. Indirectly, he sold 15 million shares though companies.

Both also wrong lah!

KKP only sold 2.5 million Mui Bhd shares only.

If you so stubborn & still post nonsense.

You better stop now & don't harm others here, ok?

2017-06-12 20:56

I think Singaporean Calvin Tan is discriminating. He say RM 1 billion debt by AAX is bad. Now, he will say RM 250 billion debt of Singapore Airline is good.

2017-06-12 21:11

Well, I think Calvin just does not know finance. If we show a Malaysian company AAX and AirAsia, all that come from him is the debt is bad. But when Singapore Airline is shown, he will say the mega super RM 250 BILLION debt of Singapore Airline is ok or good.

2017-06-12 21:18

Posted by radzi > Jun 12, 2017 09:05 PM | Report Abuse

Calvin, I will write a blog article at MUI forum and I will paste a screenshot of i3investor website showing how much shares sold on the 5th of June.

Better don't waste people's time.

Disposal is on 2nd of June

Reported to Bursa on 5th of June

For June 5th there is no selling at all

2017-06-12 21:19

Calvin distrust a Malaysia company and put high respect on Singapore Airline. What Singapore Airline do is to copycat AAX and Airasia.. How is that brown cow ?

2017-06-12 21:19

Yes Calvin, MUI is a bad counter. Read my blog article here.

https://klse.i3investor.com/blogs/radziarticles/125210.jsp

2017-06-12 21:36

Thanks valuegrowth, so 25% is owned. So, leasing cost is high. No wonder, AAX has an order of around 60 new NEO planes which will replace the leased planes in 12 years time.

2017-06-12 22:16

Sorry I deleted my original comments as it's wrong. AAX owned 6 out of their 30 aircraft in operation, the remaining 24 are under operating leases.

So for 24 aircraft under operating leases the monthly leasing rate is USD 710,000.

Consider the low age of their aircraft, the rate is reasonable.

A brand new A330 could cost about USD 890,000 per aircraft.

Their depreciation rate of USD 381,000 per owned aircraft is really on the low side. Could be due to bulk discount.

2017-06-12 22:20

I read, discount is around 50% because AAX bought the planes together with AirAsia.

2017-06-12 22:27

This calvintaneng really a sochai...haha...no wonder he rank bottom 10 stock pick.

2017-06-13 00:27

Calvin is not sorchai la. He is preaching investment for future generations la..

2017-06-13 11:47

buying into airasia x is buying into a business that you believe that can be turaround with sustainable profit. as air asia x has the same DNA as its parent, i hope it will be able to do it. at current price, i am paying only 50% of what the first investor had paid since ipo and right issue with free warrrant. the company had jsu turaround last year and i believe it needs a bit longer time to get everything in order, same like airaisa, in new market like india, philipines and japan, they are loisng money in the beginning.

2017-06-13 12:34

Radzi's analysis is a good attempt at providing some insight into the influences of fuel cost, and currency exchange rate on profitability. However, without the volume consumed (or, to be really meaningful, normalized consumption- as this includes the very important factor - USAGE EFFICIENCY), the result derived can be totally distorted. This will invariably leads into a case of "statistics lies". I amnot saying that you are intentional about it, but the akibat (result) is thus.

2017-06-14 10:46

As for MUI,we can be sitting around for a long time to wait for the durians to drop. But, too often, major shareholders always find ways to bleed out the values until there is only bone left - only to benefit themselves, but screw the minority shareholders.

2017-06-14 10:50

Blur2investor - thank you. If you carefully look at Summary Output Image - Correlation (R Square) is 0.75, which means 75% of the variation in PBT can be explained by this model. 25% of the remaining variation need to be explained by other variable such as "Volume Consumed" and etc. etc. So, statistic explicitly says that the model is 75% accurate , which quite good. If you can get the "Volume" information data, then point the website to me, and I will update the model with new data, and update this result online.

2017-06-14 11:41

Radzi we need someone like you to give us update. We i3forum member are always welcome you. Thank you so much.

2017-08-06 16:37

hopetobecorrect

radzi, there is one cost increases that will become fixed cost(quite huge) commencing from Q12017 which is the pilot salary. what is your comment on this?

2017-06-12 15:04