AirAsiaX (AAX - 5238) Dependency on the movement of US Dollar. Part 1 - Forex Gain/Forex Loss.

radzi

Publish date: Mon, 05 Jun 2017, 05:20 PM

This is the first time I am writing a blog article. I am a lazy person to share these type of information because it is more easier to write in the comment section.

And basically I am writing for the fun of it after a subscriber by the name "acceso" claimed I am talking rubbish. Well, I think that sort of comment comes about because of a person ignorance of financial and analytics method. So, why not share to enlighten.

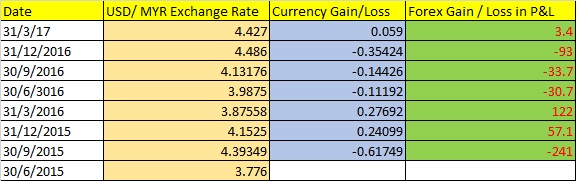

Before I start, I guess everyone knows that Airasia X (AAX) account could be turned up or turned down by the appreciation or depreciation of US Dollar against our Ringgit Malaysia. For those who are still blur about this , I attached some of the data for you to look at.

These data are gathered from two sources :

(1) http://www.xe.com/currencycharts/?from=USD&to=MYR&view=2Y

(2) Quarter result of AAX at www.bursamalaysia.com

It is quite a pain in the neck to structure this data within 10 minutes. So, just take this analysis as an act of charity hoping you guys will pray that my investment will get exponential growth in the future.... hahaha.

If you look at currency gain/ loss column , it means the difference of USD/MYR Exchange rate between two different dates. If you cant get it by yourself, by any mean just contact me in the AAX forum section.

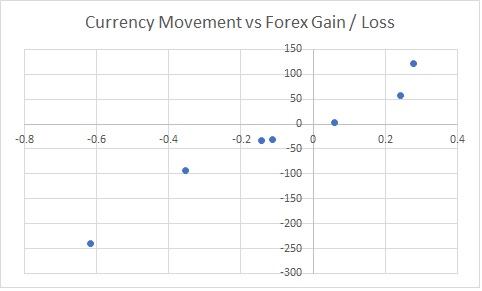

Anyway, I doubt that data makes sense to you guys unless I show it in the graph below.

Y-axis is the forex gain or forex loss made by AAX corresponding to currency gain (in term of sen) in the x-axis.

It is easy to see from the graph that whenever , MYR appreciate, forex gain is positive and whenever MYR depreciate forex loss is incurred. The relationship is somewhat linear . So, what you do ? Try to take a ruler and put a line across the most sensible points ? Hahahahaha . Well ,that is not smart enough.

Analytically or scientifically, you can do this through simple linear regression. Let me just caress my crystal ball and see what is the result of my analytics tool.

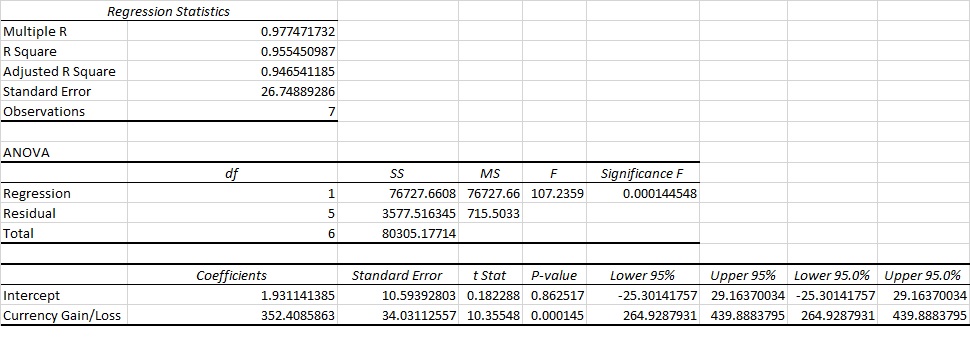

My crystall ball says that the 94% of the movement of Forex Gain or Forex Loss could be explained by the Currency Gain or Loss. (You can assume that the 6% is error from reading the data from the graph or slightly different value is officially used by AAX.

And the formula comes out as this.

Foreign Exchange Gain = 352.4 (Currence difference) + 1.9 .............. Formula 1

Well, that is interesting , right.

So assuming that the currency appreciates to 4.22 (30 June 2017) from 4.427 (31 Mac 2017) , a difference of 0.207, then you take this value and plug into Formula 1 above.

Then you will get , foreign exchange gain as

Foreign exchange gain = 352.4 X 0.207 + 1.9 = RM 74.84 million.

In my comment, I have tone down the value to RM 60 million to take consideration into error. When you look at error, It can have positve or negative bias, so when I toned done to RM 60 million , means that it is between RM 60 million to RM 88.8 million range, with most expected value as RM 74..84 million.

So, any question ? Do you like this sort of analysis or do you have any better suggestion. Let me know in the comment section.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

More articles on Radzi's Articles

Created by radzi | Aug 22, 2017

Created by radzi | Aug 01, 2017

Created by radzi | Jun 12, 2017

Created by radzi | Jun 06, 2017

Created by radzi | Jun 06, 2017

Discussions

Investors go by core earnings, bro, not forex gains or losses.

In core earnings, AAX's sensitive mainly to jet fuel costs. See its Q1/3/17 results which tanked.

2017-06-05 19:13

Eyewitness, from a certain perspective you are correct. From my perspective, the first and easiest step is to show how currency affect forex gain/loss. If you care, to look out, AAX result in 2014/and first three quarters of 2015 and Q42016 were tanked down by forex losses.

My next analysis would be how movement of US Dollar will affect leasing cost, maintenance cost and fuel cost. Remember fuel cost constitute 30% of total AAX cost. Any favourable MYR appreciation will reduce fuel cost and increase core earning. I just hope I got the data and some brainy spark to get a good model.

2017-06-05 19:23

I would like to see it from Cubic equation. The bigger the appreciation (x-axis),loss/gain would go loss/gain exponential. The larger fluctuations gain/loss of currency range for that period. it will move exponentially.

2017-06-05 20:10

Equityengineer; I could do cubic, exponential, Weibull, logarithmic, and other non-linear equation.. etc. But theory does not support that relationship and data does not lie. So, I have to reject your request.

2017-06-05 20:29

I do agree that if rm/usd is able to appreciate to 4.20 then things will start to look better. And if able to move further up to 4.00 that would be fantastic given that everything else remain constant

2017-06-05 20:43

Mr.Pauper, u r right. Currently RM /USD is 4.26 and looking at the trend, it is having appreciation trend, and may go to 4.20 soon, whether it could be captured within Q2 reporting time is not yet known.

2017-06-06 05:01

I think this is a very well done article and methodology.

My regret is I did not look carefully at 2016 quarterly results. If I did, I would realise Q4 results is very much within expectations.

market cap at 50 sen would be $ 2 billion. PE 10 requires a core profit of $ 200 million, PE 8 requires a core profit of $ 250 million...a tall order.

2017-06-06 09:06

stockmanmy : I share your concern and I will go through it and address it later. My first wish 9 months ago , OPEC does not apply any cartel but they did, and AAX (Kama and Benjamin) adopted increasing market share strategy which does not bode well for profitability. They want to become market leader in the expense of profit. If I am the CEO , I would do differently. Obviously I will meet Peter Bellew and Chandran Rama Murthy to discuss the industry future.

Anyway, that is the past. What about the future ? I will do some more analysis which include time series to predict future profitability. I know two things for sure. Malaysia ringgit will improve considerably in the future. OPEC cartel has become lethargic, oil price even drop more after Qatar was dissociated by Saudi. So, looking forward, there is light at the end of the tunnel. Whether the tunnel is long or shorter, it is the market that decides. I shall analyse if profit USD 250 million or more is achievable or not. My intuition says - it is achievable. That is why I have bought and will continue buying.

2017-06-06 09:19

RojakInvestor

thx for the formula. cheers for the effort

2017-06-05 17:52