Dude, Classic Scenic is the classic dividend play

cephasyu

Publish date: Mon, 20 Jun 2016, 12:48 AM

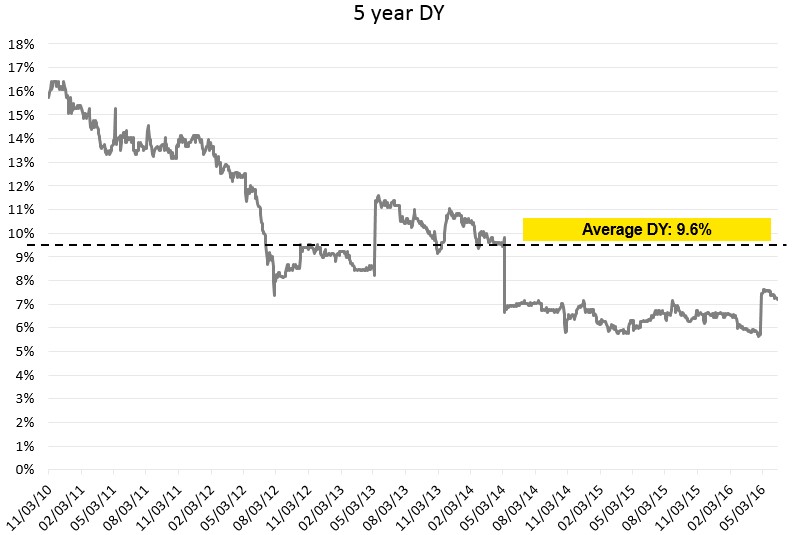

Classic Scenic Berhand (“CS”) is a wooden picture frame manufacturer based in Rawang. They operate 6 factories employing 420 employees in 500,000 sq. feet of area. CS has a reputation in the investment community of paying out handsome dividends. At current, it has a healthy dividend yield (“DY”) of 7.14% at the time of writing. Over the past 5 years, they have paid out an average of 106% of earnings which implies that in order to have a higher yield, CS needs stronger earnings.

This article suggests that while CS currently has a healthy dividend rate, it is worth cautioning that 7.14% is on the lower side historically and it depends on the future earnings of the Company.

CS’ business is plain and boring, buying wood to manufacture a variety of picture frames which are sold mainly to the US (75% of revenue), Australia (12.7%) and Malaysia (12.3%).

Over the last 5 years, CS has gained favor in the market, advancing from 48c in 2010 (unadjusted for dividend) to RM1.40 at the time of this writing.

As mentioned earlier, while CS’ DY of 7.14% is considered healthy, it is worth noting that the company’s 5 year average DY is actually 9.6% with periods where the DY was as high as 16%. Most of you may think “what the heck? I would’ve ‘sai lang’ (all-in) when DY was 16%,” however in 2010, the world was a different place where most stocks were still nursing from the economic crisis fearing a double dip. Also, CS did particularly poorly in 2009, with the lowest earnings in 5 years.

Since CS pays out most of its earnings, PE is the other side of the coin of DY. Therefore similarly, with the current PE of 13 it is slightly higher than the 5 year historical average of 12.4.

Looking at quarterly revenue for the past 5 years shows that the company has relatively flat revenue and earnings with the exception of the latest 2 quarters with higher net margin and profit. This is mainly due to the effect of the USD strengthening. So yes, this company is affected by the strength of the USD.

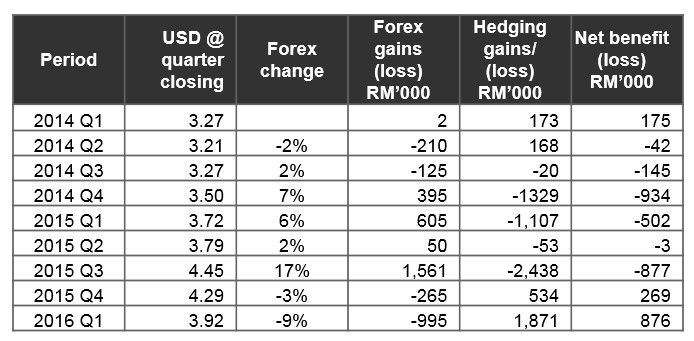

A good question though would be why did the USD impact only show in Q4 2015 and Q1 2016? The main reason is because CS hedges their position very heavily. Let me demonstrate in the table below:

I know that numbers scare some of you (I don’t think you should be an active investor if this is true), so the short conclusion is that when the USD strengthens, CS will experience a net loss due to the over-hedging position.

If you look at 2015 Q3 as an example, in that Q the USD strengthened 17% on 30 Sept ’15 versus the closing on 30 Jun ’15. CS registered a forex gain of RM1.5mil, with a corresponding loss of RM2.4mil or a net impact of -877K. This means that if the USD has an upward trajectory, CS will suffer balance sheet losses and vice versa.

However, the forex and hedging impact should not be confused with the effect of a stronger USD on sales of products to the US. While CS experiences forex and hedging gains or losses, it also experiences a thicker margin if USD strengthens. Therefore, overall a stronger USD is beneficial for CS.

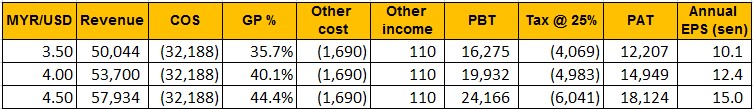

Please notice that the stronger USD increases the gross profit margin in a linear fashion. Many people miss out on the fact that forex gains impacts both the balance sheet (“BS”) and P&L of export companies. Also, you don’t have to memorize that math equation, but keep that in the back of your mind as we will need to use to compute assumed gross margins later on.

When the USD strengthens for an export counter, it affects the BS items denominated in USD. Imagine if you held 1 USD at the beginning of 2015 which was worth RM3.36, it would be worth RM4.29 by the end of 2016. You have just experienced a windfall gain of RM0.95 without doing anything. However the gain is one off. This is usually recorded in the additional disclosure notes.

However, you need to also account for the impact of P&L. If you used to sell one ice cream cone for 1 USD, you earned RM3.36 at the end of 2015 and RM4.29 at the end of 2016. If the RM continued to stay at 4.29 to the dollar, you would still earn the additional 95c for every ice cream sold. This is not one off and I have read many articles which ignore this aspect of margin expansion if the USD continues to stay strong.

For clarity, let me explain what will happen to CS if the USD moves in 3 directions:

- USD weakens – CS will register a windfall in hedging gain more than the forex losses, however margins will be compressed

- USD remains the same – CS will continue to maintain thicker margins

- USD strengthens – CS will register a windfall hedging loss which is more than forex gain, margins will further improve

Business case

So what’s the point? Should you buy or should you sell? Well first of all, I’m not entitled to tell you that. However I can give you clues that might help you to form your own conclusion. Since all (or more than all) of CS’ earnings will be paid out as dividends, it is important to be able to have an as much as possible educated guess of where earnings will be moving forward.

Your decision should depend on the following factors:

- Do you think people (especially in the US) will continue to use wooden picture frames

- Where do you think the USD will be relative to MYR?

- What is your risk appetite? What discount rate would you demand of CS?

Will people (especially in the US) will continue to use wooden picture frames

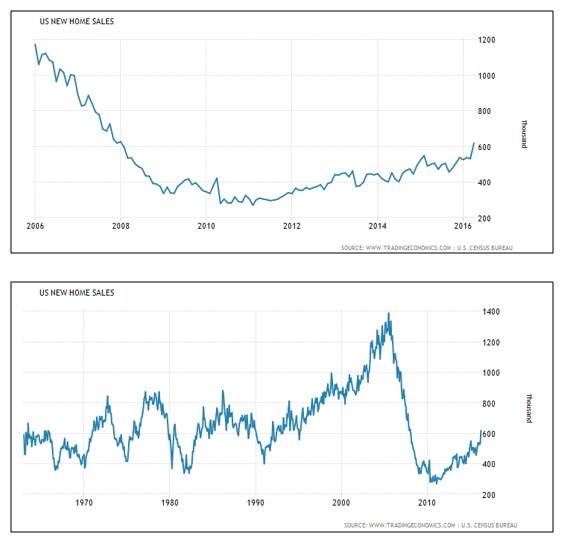

Both the charts above show the home sales in the US with the first chart displaying 10 years and the second displaying 50 years. Home sales in the US is my best guess of a proxy on the possible demand for wooden picture frames since it would make sense to buy picture frames to hang pictures only if you have a house to hang it in. Since the sub-prime crisis of 2007/08, new home sales took a big hit and beginning 2011, new home sales have improved.

However, new home sales may not be relevant if the newer generation of US home owners are less interested in hanging physical pictures on walls with pictures on their Facebook walls being the cheaper and more convenient option. For the valuation model later, I will assume no growth/ decline in sales for CS.

Direction of the USD

Frankly, I would have a better chance predicting the time of my death compared to forex movements. A country’s currency has so many factors which drive supply and demand with the US being the most factors as the most influential currency in the world now.

In summary, my (incomplete) opinion of the USD relative to MYR will be affected by:

- The US monetary policy as dictated by the Fed which is now influenced by the US recovery

- Price of oil

- Global fears (USD is often seen as a safe haven currency)

- Our home grown 1MDB/ political (un)certainty – at least this gives us local ability to affect our currency (albeit usually in a negative way)

For the valuation model, I will provide 3 scenario of long term USD rates relative to MYR at:

- RM3.50

- RM4.00

- RM4.50

Risk appetite

Finally, the last question is what discount rate you would demand from CS. Since CS pays all its earnings as dividends, you could also ask what the dividend rate you would demand is.

Investment bankers and financial academics usually compute this using the CAPM model (google this if you’re an investor and are unfamiliar). It deems that the riskier the asset (stock), the higher return should be demanded from it. However, the issue is that “risk” is a very slippery concept and the method of measuring risk is by using beta which just means what is the volatility of the price movement of the stock relative to the broad stock market. I find this idea slightly… odd.

Since this is subjective, I will assume the 5 year historical dividend yield of the company to be the expected risk rate of 9.6%. I do agree that this is extremely subjective, and you might argue for 7% or 8%, but it would be difficult to justify any rate at all. However I will offer multiple discount rate scenarios to identify the TP of your choice, so fret not my dear reader :)

Valuation

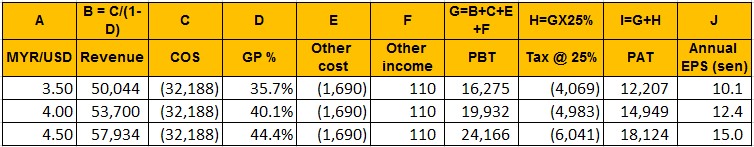

Firstly, it is important to estimate future earnings. As mentioned above, the following are the assumptions

- Use 2015 Q2 to 2016 Q1 cost of sales as proxy for sales volume (pretty much the same historically)

- Gross margins correlation with USD follows the equation y = 0.0876x + 0.0652 (please refer to the appendix if you wish further clarity)

- Gross margins reduction by 1.5% due to increase in minimum wage starting in July ‘16

- MYR/USD at 3.5, 4.0 and 4.5

- Ignore balance sheet impact for movement in forex

Let’s do a sense check of the numbers. Is 12.4 FY EPS reasonable if the MYR/USD is at RM4? Looking at the latest Q, EPS was 3.5c or an annualized 14c while the average USD was RM4.20 which means that the computation is reasonable. A more detailed explanation is provided in the appendix.

I know I sound like a broken record, but from the high dividend payout ratio, you can expect that the dividend should be the same as EPS. Therefore if your long term view is that the USD will be at RM4, annual dividend should be at 12.4 cents or a DY of 8.9%.

The next question is the valuation of CS which depends on your opinion of the risk of the company.

This table displays the worth of CS depending on your long term view of the USD and the discount rate required. For example, if you believe that the long term MYR/USD is 4.00 and you demand a discount rate of 9.6%, CS should be worth RM1.29.

Another example, if you believe that the USD will be worth RM4.50 in the long run and demand a discount rate of 5%, then CS would be worth RM3.01 to you today.

Conclusion

We are entering an ever increasing volatile global economic environment. I believe that in these times, investors will start to focus on strong cash flow dividend yielding defensive counters. Is CS one of them? CS definitely has strong cash flow and has a high dividend yield of 7% with fantastic managers that know that if they cannot yield higher returns in business, they might as well give investors back cash in the form of dividends. In fact, CS was recently on the Edge at 4th place for top 20 dividend stocks which have 10 years of continuous positive free cash flow!

However, do I think the business is defensive? This is a point of contention. I remember reading LC Chong mentioning the curious fact that wooden picture frames aren’t often bought but for some reason, every house you visit seems to have them. I think that the business will always be there, and the US housing recovery may help sustain the sales of wooden picture frames. However I do acknowledge the threat of the trend moving towards digital photos and minimalist lifestyle with less “stuff”.

My personal opinion that the USD will continue to remain at about RM3.80 and that CS needs a discount rate of about 7%. That would place it’s valuation at about RM1.60 to me. However, please do keep in mind that I am assuming that the company is able to maintain its strong margins but with no growth. I have been wrong plenty of times before, so do use your own assumptions!

Happy investing ya’ll

cephas

Appendix

y = 0.0876x + 0.0652

For those who haven’t been to school in a long time, this equation simply means that to calculate y which is gross margin, simply multiply the RM/USD by 0.0876 and add 0.0652. The line is the best linear representation of the data points.

The formula was used to determine the gross margin given the assumed RM/USD of 3.50, 4.00 and 4.50.

In addition, gross margins are reduced by 1.5% due to the increase in minimum wage.

PAT computation

- COS (cost of sales) is the first assumption, which was derived from the previous 4 quarters. This is an indication of sales volume which in this model is flat.

- GP is derived from the formula above based on the USD strength and less 1.5% for minimum wage.

- Revenue is then derived from COS by dividing by 1 – GP%.

- Other cost is the average other cost for the last 2 years adjusted for forex and hedging gains and losses.

- Other income is the average for the past 2 years.

- Tax is assumed at 25%.

- EPS is PAT divided by 120.5mil shares.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The dude series

Discussions

hi cep, any significant cs competitor in malaysia? or is cs the best in the business?

2016-06-20 08:41

Thanks Ong, Icon888.

Well done on your AAsia pick, Icon. I wish I bothered to study it. I was too biased against airlines to even look at it which was my folly.

aidwiz, the other notable Malaysian competitor is E-Wood Moulding (S/B). According to their website, they are the largest picture frame manufacturer in Malaysia.

Unfortunately it isn't listed so it's difficult to compare

2016-06-20 12:36

ongkkh

Hello Good Job.

2016-06-20 07:11