Dude, IQ is for the smart (preliminary report)

cephasyu

Publish date: Thu, 04 Aug 2016, 10:48 PM

IQ Group Berhad (“IQ”) is a company that specializes in manufacturing of sensor products for various applications. They are a relatively small company with a market capitalization of only RM186m.

Key highlights:

- Technically ripe breaking 200 days SMA and 6 month resistance

- Meets 4/5 of Fong SL’s investment criteria

- Clean balance sheet – net cash of 54c/ share

Recently, IQ broke the 6 month technical resistance of RM2.05 and the 200 day SMA. This is the trigger to very quickly perform an analysis on IQ. I suspect that the jump in price was due to either insiders buying ahead of the Q results. Although volume for IQ is thin, nevertheless the volume is significantly higher than 50 day volume EMA.

Like most, I am a disciple of both Fong SL and KYY’s investment methods.

Fong’s methods are relatively straight forward with the following criteria:

-

Return on equity (ROE) - good

- 15.5% - reasonably high

-

Cash flows - good

- Op cash flows for the past 5 years have been positive and higher than PBT besides 2016 mainly due to higher tax payment and receivable at balance sheet (due to higher revenue on Q4 2016)

-

PE Ratio – good

- 8.9, lower than 10

- Dividend Yield – 4.77%, good

-

NTA backing – pass

- 1.52 (72% of share price)

Borrowing from KCChong’s article for Fong’s criteria: http://klse.i3investor.com/blogs/kcchongnz/88651.jsp

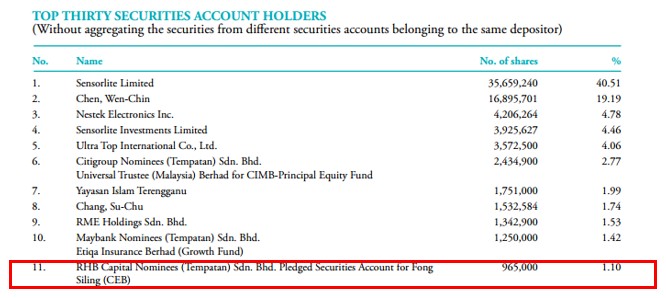

Seeing that most of Fong’s criteria has been met, it is no surprise that he is part of the top 30 shareholders list as at the last annual report date. Note that the top 30 shareholders form 91.3% of total shareholding. This leads to IQ being extremely illiquid as there are few retailers and punters (something I particularly like).

I think the most important thing next is to know whether it will make more money next year (KYY’s golden rule) however this question is extremely difficult and requires extensive research which I have not done yet.

In short, IQ is engaged in:

- OEM - you design, I build, your brand

- ODM - I design, I build, your brand) and

- Distribution - I design, I build, my brand, you sell

IQ manufactures mostly sensors which have lighting and feedback applications. I understand that they will be able to benefit from two big things:

- Trend of moving to Green Building Index (“GBI”) requirements which requires buildings to have lighting sensors to save electricity (& save the world)

- Internet of Things (“IOT”) – as we move to a more connected world, everyday objects will have sensory and connectivity features. IQ group (mentioned in the latest annual report) is well positioned to bring their innovation and expertise to the IOT era

While I cannot yet tell whether IQ group will be more profitable in the next year compared to the current, however at least with this investment, the downside is limited.

With that, I apologize that I am unable to give a target price, however I hope this has been useful information for you (for now).

Happy Investing,

Cephas

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The dude series

Discussions

very low freeflow..up extremely quick and hardly much seller. :D it is a gem

2016-08-04 23:27

Haha I think still okay - few punters that will TP at this junction

But the important point is the Q result coming out this month

2016-08-04 23:53

Dear cephasyu do u have other report on IQ since this is a preliminary report ?

I have checked the company QR and seems the balance sheet is good and PE < 10

2016-08-07 11:06

Sorry Shareinvestor88, it's not easy to find information on IQ. They are very under the radar.

What I can tell you so far is that it is very interesting that their latest Q their revenue is quite high, which is unusual since Q1 of the year is usually their weakest quarter.

2016-08-11 10:09

shareinvestor88

Dear Cephas good article. Can buy now despite went up past 2 days ?

2016-08-04 23:04