Dude, Lii Hen is the cost and cash king

cephasyu

Publish date: Mon, 18 Jul 2016, 12:49 PM

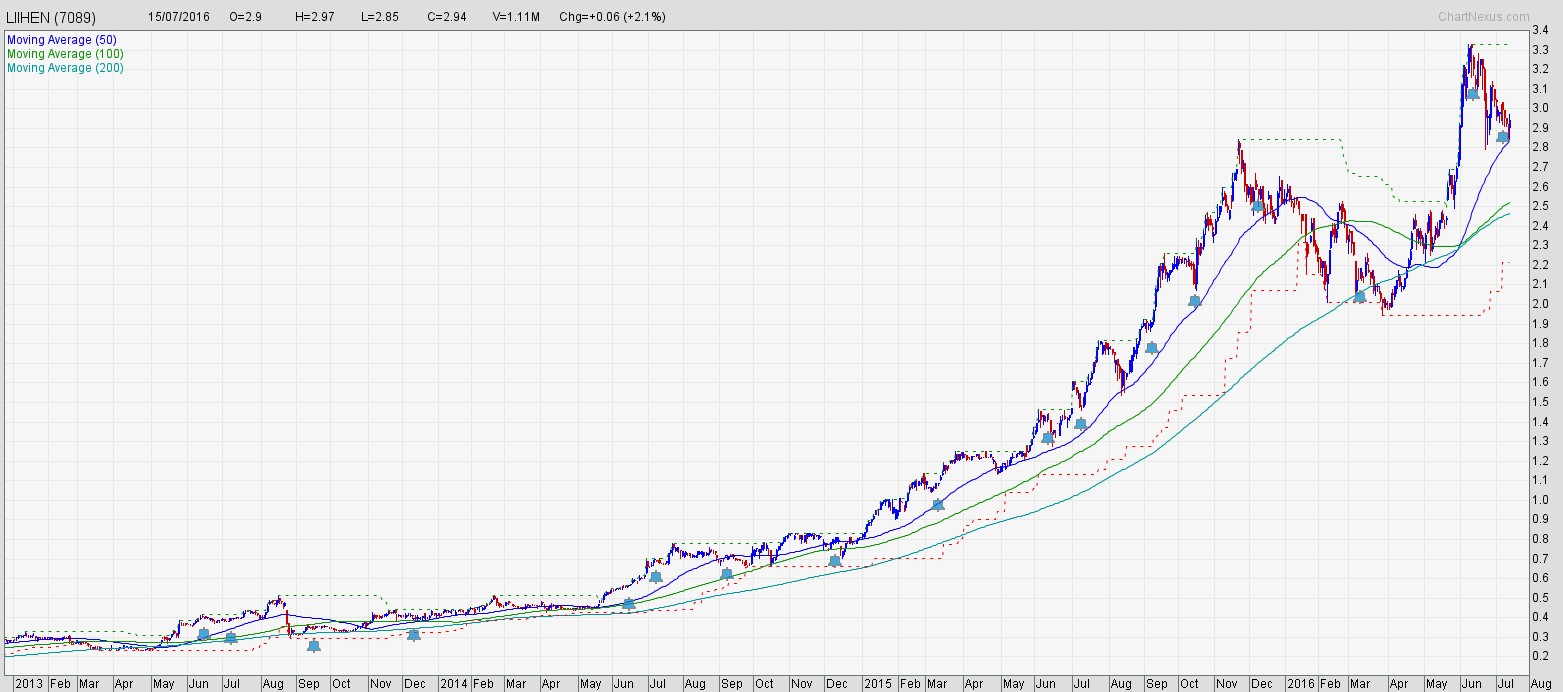

Lii Hen Industries Berhad (“Liihen”), a relatively unknown name a few years back is now no stranger in the Malaysian investing community. This is because they have been making headlines due to profits growing quarter by quarter for 7 quarters continuously leading to a big rally in share price.

Recently a few friends and I were given the privilege to have a tour of a few of Liihen’s factories. There has been no shortage of write-ups of Liihen, but I’d like to give you a view of Liihen based on their financial performance and our observation and opinion.

In my opinion Liihen’s fair value should be approximately RM4.00 at forward FY16 estimated EPS of 40cents at a PE of 10.

The stock currently has a yield of 5.95%, which supports the price. It is expected that the FY16 yield would be 6.8% from a dividend of 20cents. This is based on forward earnings of 40c and the 2015 historical payout ratio of 50% (0.20/3.01 = 6.5%). At the TP of RM4, you would still be able to expect a healthy dividend yield of 5%.

For those unfamiliar, Liihen is a furniture manufacturer based in Muar mainly producing bedroom, living room and dining sets. It exports mainly to the US market with revenue contributions at 78%.

Liihen’s share price chart is nothing short of a Cinderella story. Often many assume that Liihen is nothing but a forex play. While forex does play a significant role in Liihen’s performance, it is careless to think that it is the only factor. Of course the biggest question is whether Liihen is too expensive given that it has risen so sharply over the last 2 years.

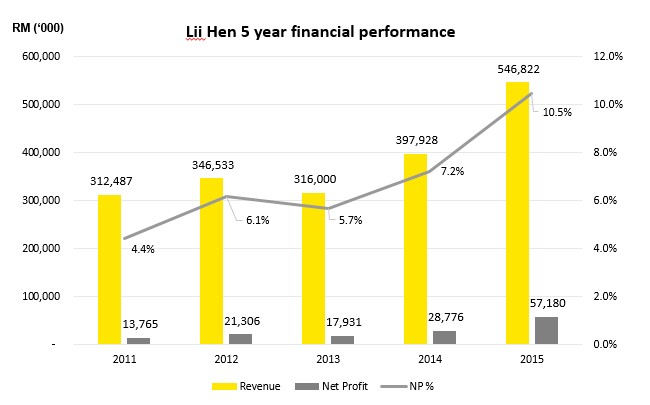

Notice that Liihen’s profit and margins have been increasing YOY. However do notice that revenue in FY2015 (and in Q1 2016) has also increased significantly compared to the prior year. This is because in 2014, Liihen had been quietly expanding, adding production capacities at the perfect time. Combine both forex and additional capacity and earnings explode, with PAT tripling to approximately RM60m compared to the average of RM20m few years before that.

While revenue has been on the uptrend, do not expect that 2016 and 2017 will grow at the same click as we gathered that the land for expansion is pending conversion from agriculture to industrial land. We also understand that management has yet to decide whether it should be used for warehousing or production. We do not expect major expansion in near future. This can be viewed positively as Liihen does not want to blindly expand and risk idle capacity if there is an economic downturn. We understand that utilization rate is approximately 80-90% allowing for moderate revenue growth.

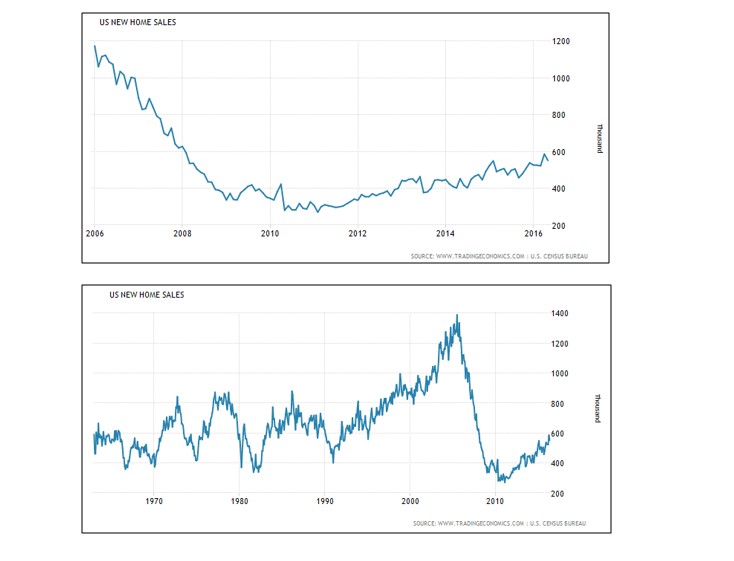

Liihen’s products are targeted towards the middle to lower customer segment in the US seeking affordable furniture. This allows for more resilient sales as low value products are less affected by economic downturns. Quite remarkably, Liihen has been profitable every year since inception – very impressive given that the US had a massive financial and housing (think furniture) crisis in 2007/08.

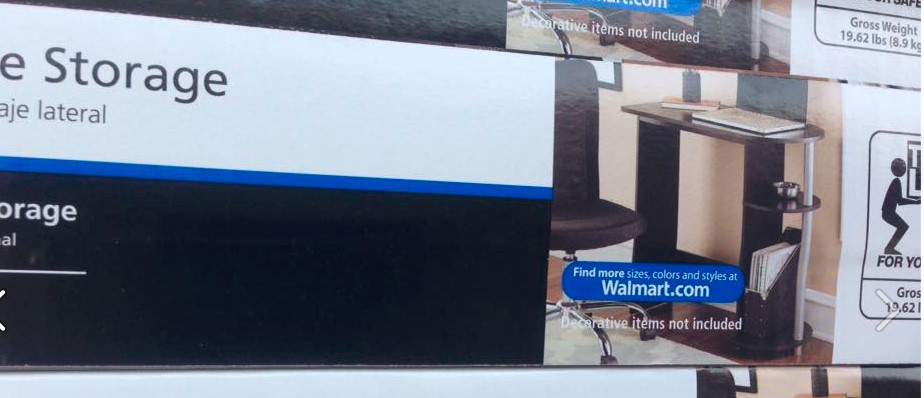

Its customers are mainly distributors who in turn sell to retailers. Liihen also sells directly to retailers such as Walmart (picture above) and Costco which targets cost conscious customers. Liihen manufactures end product furniture ready in boxes that is ready to be sold to end users directly.

The downside of catering towards the lower customer segment is that Liihen needs to be priced competitively in order to retain its customers which results in lower margins. This is where Liihen’s competitive advantage stands out – cost management.

One aspect of Liihen that stands out is how much emphasis Liihen places on cost control. This is why they are able to achieve a net margin of 10.5% in 2015 doubling net profit margins when revenue increases from forex gains.

Furthermore, from our observation and understanding, management (big bosses!) are very hands-on in procurement of supplies to have tight control on costing. They do not leave supply management to their staff, instead they negotiate prices of most of the raw materials themselves.

If you go on google maps and search the coordinates 2.107109, 102.609057 and go on street view, you’ll find most of Liihen’s factories (and subsidiaries) in the vicinity. Liihen intentionally has all its factories close by in order to have a better grip on cost and production. Every factory is a stone’s throw away.

In the area above, Liihen has over 19 factories spanning 55.5 acres – think 21 football fields (the EPL kind and not the little one in your park). This is worth noting because Liihen is not a small company – their production capacity is large – shipping 1,000 standard 40 foot containers every month. Also, if you noticed, the factories are next to palm oil plantation. These are matured plantations which can be purchased at reasonably cheap Muar prices if Liihen decides to expand capacity. Land is not an issue.

Compared to Poh Huat, Latitude and Evergreen which have factories in Vietnam and Thailand, Liihen is better able to manage cost by having all its production in close proximity. Hint, your workers are more productive if they know that the boss can step in at any time to check on you.

This chart may be familiar to some of you. Essentially they both show the same thing – US new home sales over different spans of time. What this chart tells you is that currently home sales are returning to the average over the last 40 years of roughly 600K new homes/ month. New homes need new furniture and if the economy is bad, people are going to buy more affordable furniture from the likes of Liihen.

Management has also given guidance that sales for the next few months is still healthy despite global turbulence. In addition, Liihen is starting to look to export to China with their maiden shipment next month albeit a small shipment of 14 containers.

We cannot finish Liihen’s analysis without looking at Forex which contributed significantly to Liihen’s margin expansion. While this leaves Liihen open to Forex risk, we understand that Liihen mitigates this using two ways.

The first way is by hedging – Liihen hedges 50% of future orders for 3 months and an additional 30% for 6 months if the USD is > RM4.10. This allows them to lock in higher forex rates.

The second way Liihen manages Forex is by managing discounts given to their customers. For example, when the USD was RM4.40, Liihen may offer discounts to selected customers. However if USD weakens below RM4.00, Liihen will withdraw these discounts, protecting their margins.

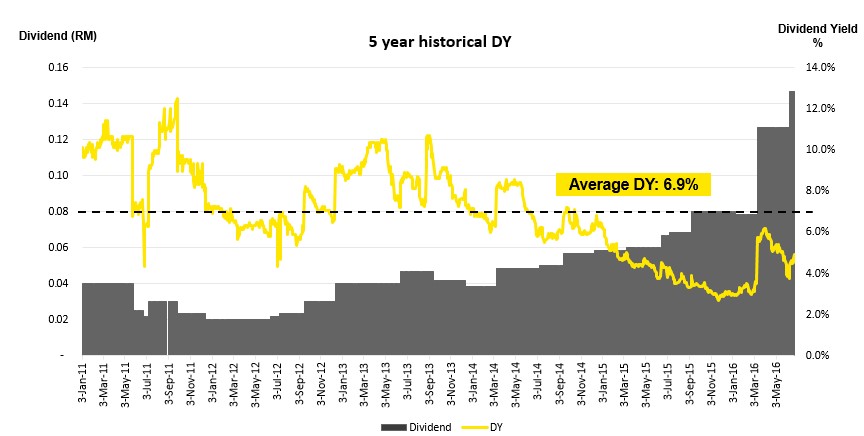

If we look at Liihen’s dividend chart, the historical yield prior to 2014 has been higher due to the depressed share price. However, since Liihen began up trending in late 2014, DY was below the 5 year average. Recently due to stronger earnings and therefore higher dividend, the DY is trending closer to its average.

Dividend yield is a very strong case for Liihen. Liihen pays out dividend 4-5 times yearly. This is very helpful for retired folks who need dividend to support their expenses. In our opinion, this is unlike many other Chinese family businesses which like to hoard cash or buy unnecessary assets. Liihen is not interested in empire building but instead pays dividend very often and this is very positive.

Liihen is expected to earn 40c for FY2016 and if they pay out 50% as in 2015, expect 20c dividend for 2016.

Liihen also has increasing cash reserves currently with net cash of 45c/share. This should be viewed very positively as we move towards an increasingly volatile second half of the decade – prudence with cash is a wise decision.

Conclusion

Liihen really is quite an impressive company that places heavy emphasis on cost management. This allows it to fully maximize profit margins due to the USD strength. Also, with the US housing market returning back to the mean, there is less risk for sales orders moving forward.

While nobody can predict the direction of the USD in the long run, if you believe that the long term direction of the USD is between RM3.80 – 4.40 or upwards and looking for a strong cash flow company with cash reserves and consistent dividends, Liihen is the right investment for you.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The dude series

Discussions

Good report. Thanks. BTW, did you ask management if they are working on 1 or 2 shifts? By increasing no. of shifts, they can increase production without much additional capital investments.

2016-07-18 17:18

And cephasyu, why do you expect only 40 sen EPS (equivalent to RM 72m net profit) this year?. Already, Q1 earnings were RM 21m, after incurring a RM 5m forex loss. Adjusting for forex loss, earnings would have been at least RM 25m. Annualised, would give RM100m or EPS of 55 sen!

2016-07-18 17:30

Hey guys, thanks for the encouraging comments!

eskaylien sorry for the late reply. The reason why I'm only expecting 40c EPS is because I am assuming a USD/MYR forex of 4.00.

For forex players, there are two forex effects. One is the forex impact on the BS and the other is on the P/L. I've explained it in my Classic Scenic article and you can read it there.

In any case, even though Q1 2016 ending forex was at 3.92, the average forex for the quarter was actually 4.20 which is quite high. I am assuming that for the rest of the year, the USD will hover at around RM4.00.

2016-07-19 16:37

cephasyu, thanks for your reply. I still view your forecast as being a bit conservative.

2016-07-19 18:15

wei...benar ke ini...boleh visit factory and they give all this info kah??

....may be uncle KYY brought both Harry, Cephasyu there... they are his adopted kids ma!

2016-07-19 18:34

Expect 20c dividend...... hmm.... it's about 6% dividend yield..... Thank you for sharing your home works and findings. Well done!

2016-08-16 18:40

shortinvestor77

Very good report.

2016-07-18 13:48