Dude, don't worry, Can-one can one. Kian Joo Can also

cephasyu

Publish date: Wed, 17 Feb 2016, 05:17 PM

I am quite sure that most know or at least have heard about Canone the can manufacturer which in Jan 2012 acquired the majority stake (32.9%) in Kian Joo Factory Berhad (“KJ”). Most would also have heard that in Nov 2013, Aspire, a company controlled by EPF and Freddie Chee Khay Leong (a director of KJ, previous director of Canone) offered to take KJ private at RM3.30/ share. Shortly after, Toyota Tsusho Corp (“TTC”), an entity from Japan indicated an expression of interest to purchase KJ for RM3.74/share. Now we are all waiting for one of these deals (hopefully at a higher price!) to come through so that we, the shareholders of Canone, can laugh our way to the bank.

The thesis of this article is that Canone as a company is actually worth RM5.72/ share and is independent of whether Canone’s KJ stake is kept or sold due to their growing dairy business, healthy share of profits from KJ and favorable commodity environment.

Again, as before, I must emphasize that I am writing/ publishing this article as an amateur, desktop, armchair... dude. My methodology employs scouring the WWW to find publicly available clues and evidence to piece an analysis and a story on Canone that supports my conclusion and that everyone appreciate and enjoy!

When I was mulling on the structure of this article, I realized that in order to understand Canone, I needed to understand KJ’s business too (shit...I mean sheet, I needed to study two companies). I then realized that Canone, KJ, the See brothers (sons of the KJ founding family) and Yeoh (the now CEO of KJ) had like a million legal suits (sheet, I hate reading litigation history). It was then that I decided to save all of us the trouble (actually mostly me), of researching and you reading all that grandmother litigation story and to stick to the business aspect of Canone and KJ. (Actually I did do some research, so if you like to waste time reading my take on the story, do check out the appendix where I’ve done some grandmothering)

So I hope, while this article is long, I hope you understand that many hours have been poured into the research and writing for your convenience. Without further ado, let’s get started (cracks fingers).

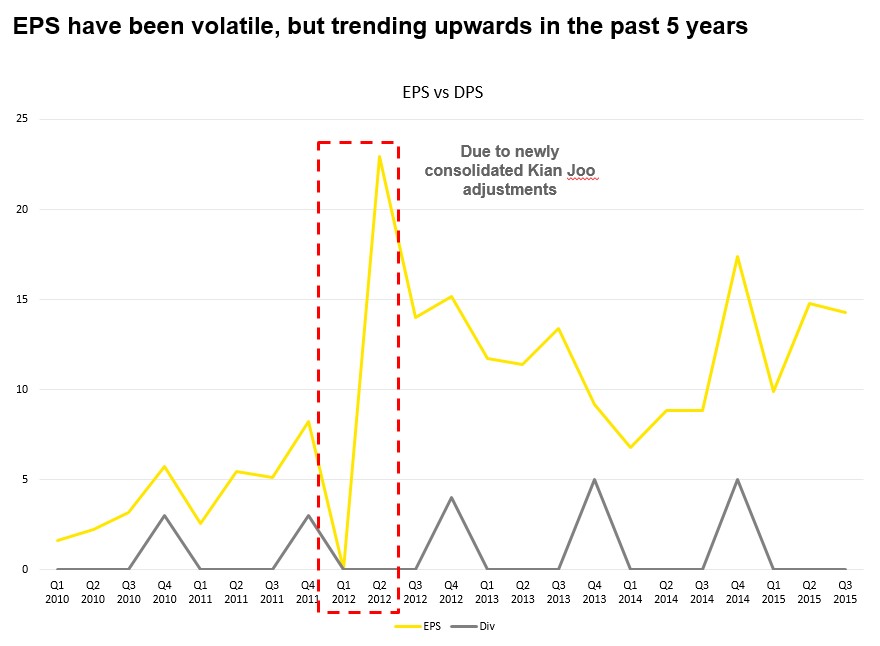

Firstly, let’s look at how Canone has fared over the past 5 years. It was trading at about RM1 prior to 2012, when it finally acquired the 32.9% of KJ at RM1.65/share. KJ was trading at about RM2.20 at the time of acquisition, so they practically managed to get a windfall gain. There’s actually more to this story, as Canone actually submitted their RM1.65 bid for the 32.9% stake as early as 2009 (global financial crisis anyone?) when KJ was traded at RM1.20/share so they bought it at a 37.5% premium but due litigations and delays, they only successfully acquired the shares much later in 2012. Canone’s shares jumped in 2012 after the successful acquisition of KJ and traded between RM2 and RM2.8 until news of Aspire leaked into the market as early as May 2013 (okay maybe its due to post GE13). When the announcement of Aspire in Nov 2013 was released, market had already priced in that news and there was hardly any reaction. Subsequently, the shares have been downward trading due to no solid conclusion of the KJ sale (because of more litigation) until Oct 2015 when Canone started rallying again from RM2.2 to as high as RM5.08 before trending between RM4.2 to 4.5. This could be due to speculation that KJ and Aspire are finally reaching an agreement for the sale.

Before we dive into Canone and KJ’s business, let’s appreciate Canone’s ownership of KJ.

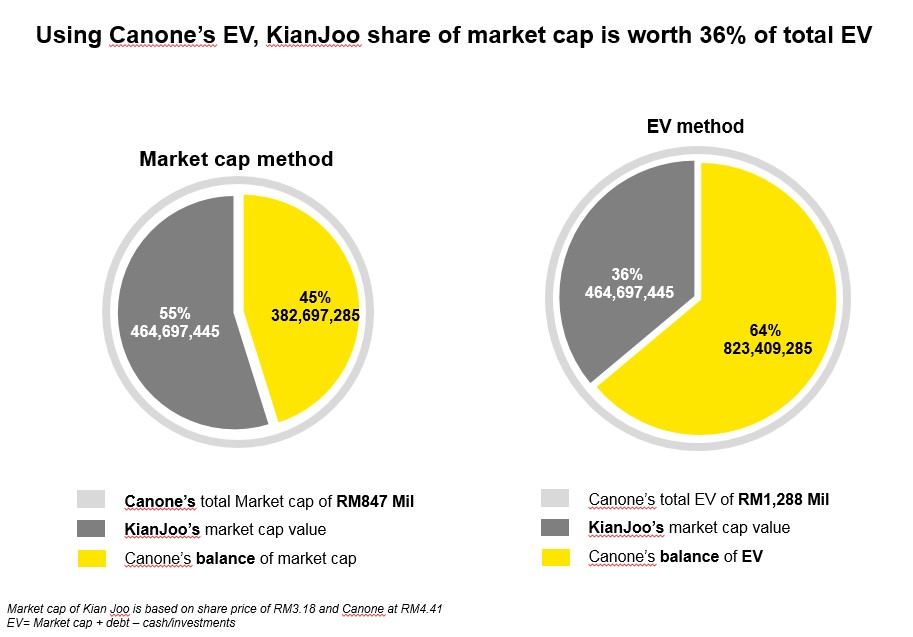

Many have viewed Canone’s ownership of KJ by using market cap. Take Canone’s market cap of RM847mil and less Canone’s ownership of KJ’s market share of RM465mil (32.9% X RM3.18 X 444mil shares) and conclude that Canone’s own business is worth RM383mil by just deducting KJ’s market share and that Canone’s share of KJ is worth 55% of their market value.

I may beg to differ and to use the EV method instead, because Canone has approximately half a billion of debt. Therefore, using the EV method, you will find that KJ’s value to Canone is 36% and Canone’s own business is 64% or worth 823mil. This is important as we view Canone’s earnings contribution next.

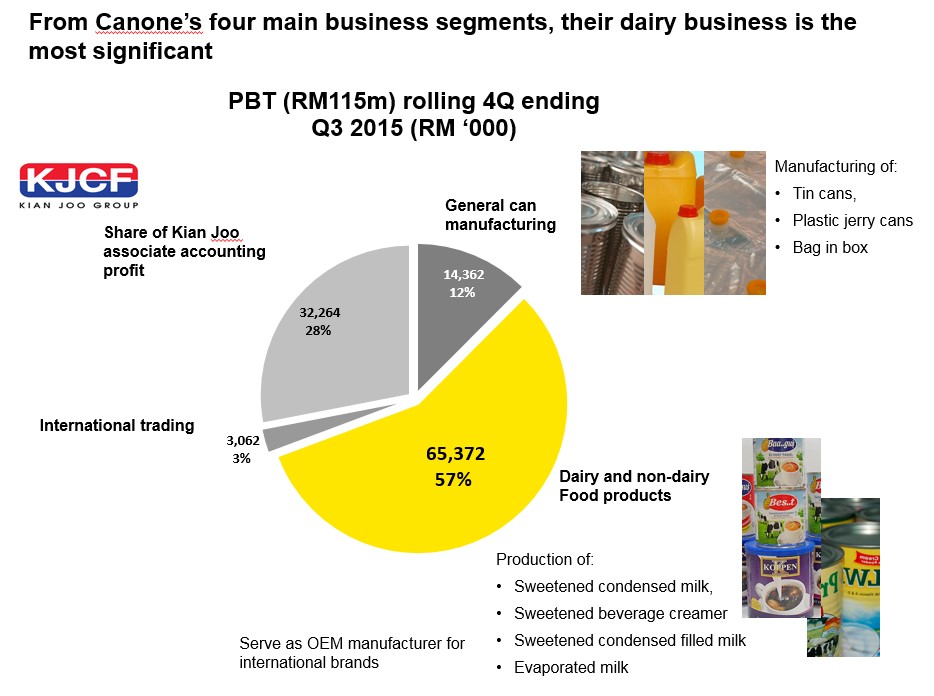

Actually, Canone’s biggest PBT contribution is Dairy products (the heck? I thought their only story are cans and KJ acquisition, Aspire, TTC? They make milk!?). As you can see, only 12% of their PBT is derived from can manufacturing and in fact, they lump plastic jerry cans and bag in box (you’ll see better pictures later) together in this division! So really, Canone is hardly in the manufacturing of cans. International trading is their arm that was set up to sell their dairy products in other countries like Indonesia. Due to its immaterial contribution, we will not cover its activities.

Canone is an OEM for condense and evaporated milk for international brand owners. Canone on its website claims that it exports to Middle East, Africa, ASEAN and South Asia countries. Now I know you’re thinking, “no way, I’m not touching another export counter!” but hold on! In Canone’s latest Q report, it recognized a forex loss of RM3.8mil. Mind you, this was during the Q when USD appreciated from RM3.74 to RM4.40 which means that while all the other exporters were dancing with money, Canone was hurting from the stronger USD. So Canone is NOT a USD forex play.

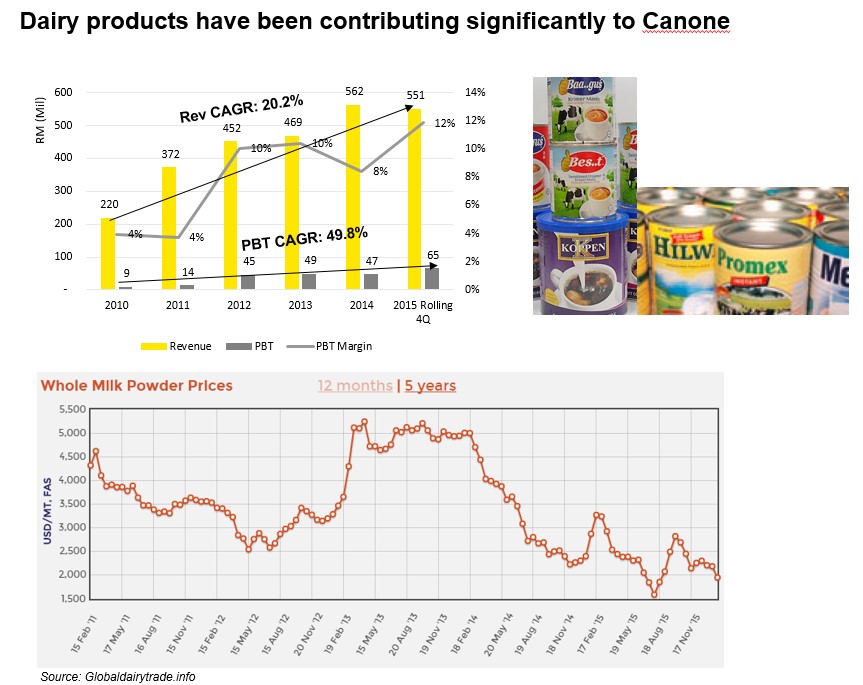

Please look at the revenue CAGR of 20%. That is amazing. PBT CAGR of 49.8%? That is out of this world! Margins are also improving from a low 4% to the latest high of 12%. Quarter and Annual reports from Canone attributes this to higher efficiency as the company reaches economies of scale for milk production.

Furthermore, take a look at milk powder prices, in the last five years, prices have been averaging down due to global oversupply. Also, if you’re betting on the strengthening of the RM, this means that it’ll be cheaper for Canone to purchase raw materials.

I need to talk a little about dairy production. A lot of people are underestimating the value of this business. Most people equate Canone to can production and therefore industrial production/ manufacturing and give it a lower valuation of 8 – 10 PE. Manufacturers, usually trade at a lower valuation because when the economy is bad, people buy fewer cars, iphones, houses etc and this affects manufacturers. However, there are manufacturers like Nestle which are traded at 32 PE and Dutch Lady at 22 PE. Now why is that? It is because whether the economy is booming or at war, people (at the non-war zones) are still going to be eating Magi Mee and drinking Milo (heck even though Milo is so expensive now!). In the same way, even if the economy is bad, people are not going to stop drinking Teh Tarik or mamak coffee (these require condense milk) because it’s such a low value item! Granted, Canone is an OEM for international brands and does not have Nestle’s brand strength or reputation, but it should not be trading at a PE of 8 but at least from 12 to 15 given normal (non-bear) market condition.

One more hint, people are already anticipating strong earnings for Dutch Lady (at the time of this writing) due to low commodity prices and the price has been rallying. F&N have already released their results and their earnings have doubled, heavily attributed to favorable milk based commodities (check it out!).

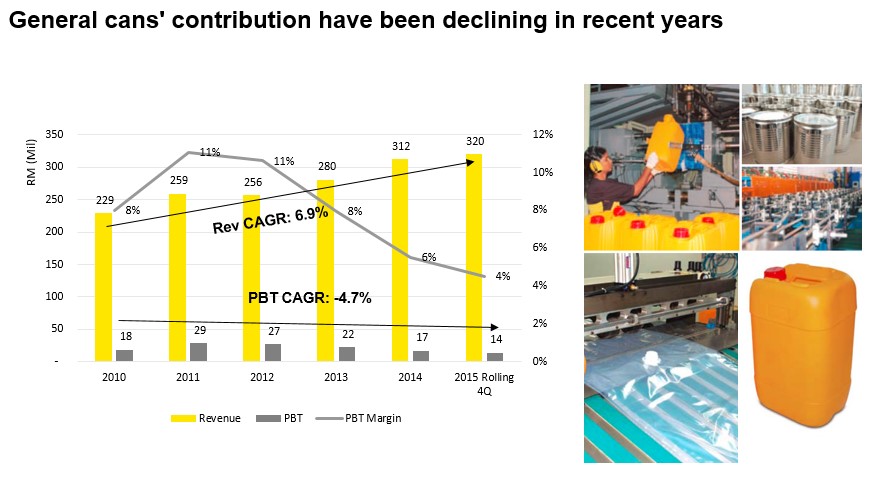

Now let’s look at what Canone is actually know for, making cans (top right in picture above)! As you read earlier, even in their general can division, they also manufacture plastic jerry cans (bottom right picture above, yes this isn’t really a can) and bag in box (bottom left picture above, not a can at all).

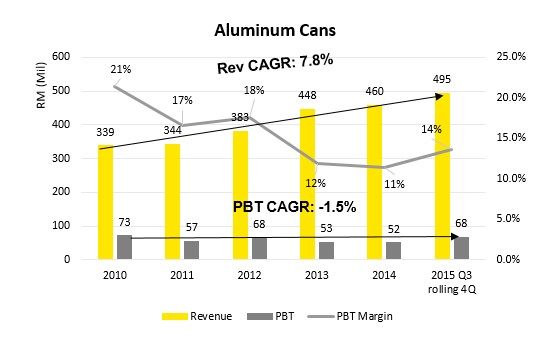

Revenue has been increasing at a decent CAGR of 6.9% but PBT has been declining at 4.7%. Margins have also been declining. Management have indicated that the decline in margins are due to increasing competition, stronger USD (again if you want an anti-USD play, here you go) and higher raw material prices.

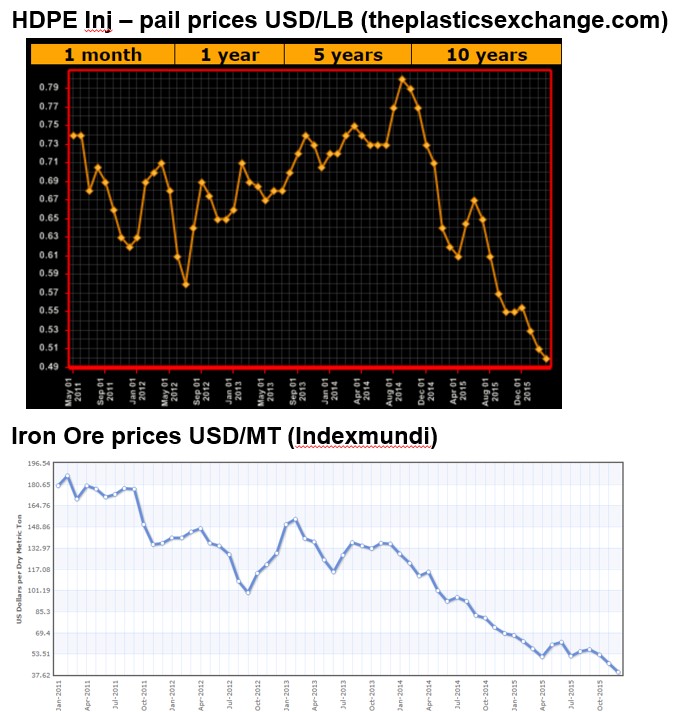

I am actually a little confused by the explanation that raw material prices are higher. If you refer to the appendix, in the past 5 years, aluminum, tin, iron ore and HDPE (high density poly-ethylene) – pail prices have all been decreasing!

This leads me to hypothesize that there is an oversupply of plastic jerry cans, tin cans and bag in box in the market. This leads to over-competitive pricing and eroding margins. Of course I don’t have the breakdown of the numbers so I cannot be sure. However I do know that if the RM strengthens and if commodity prices stay low, this division will find their margin expanding from lower forex loss.

The silver lining for this division is that revenue is increasing. Therefore, it is still able to cover operational overheads and remain profitable albeit a lower margin. Also it only contributes 12% of group PBT.

If you’re reading this far, good job. We’re halfway through because it’s time for our second company analysis, Kian Joo Can Factory Berhad (“KJ”)! Unfortunately, KJ contributes sufficiently significant PBT to Canone that it warrants an analysis on its own. I’m going to take the lazy route (like everyone else) and use Aspire/TTP’s acquisition price as a reference for valuation. Nevertheless, after valuing KJ using the offer price, I will elaborate on KJ’s business because I think that it’s a good business and that Aspire’s offer may be lower than the intrinsic value.

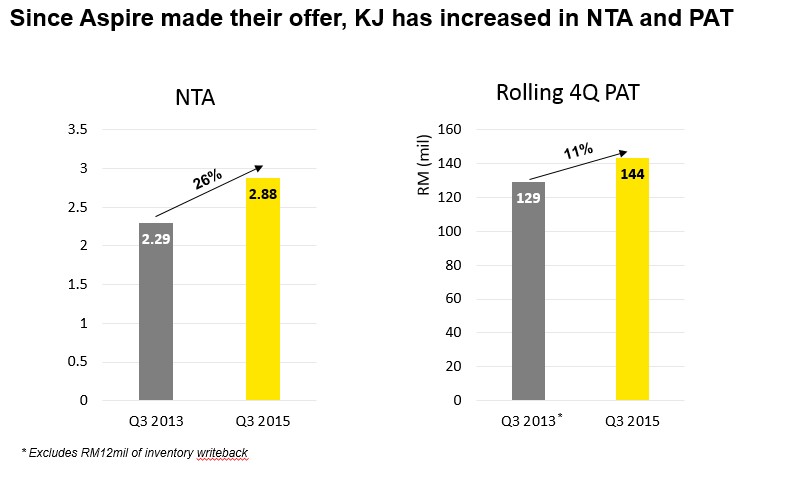

Notice that since Q3 of 2013 (Aspire released the offer of RM3.30/share one the same day that the Q3 2013 results were released), KJ has increased their NTA and PAT by 26% and 11% respectively.

I have noticed that write-ups update KJ’s Acquisition valuation based on NTA. However I do not think using solely NTA is a suitable valuation method as it rewards less efficient companies. For example, imagine if someone wanted to purchase Nestle Malaysia (yes, impossible I know) and tried using NTA as a reference. He would walk up to Nestle S.A. HQ and tell the Board, “I’d like to acquire all of your Nestle Malaysia shares and I’ll offer you a generous 100% premium on your NTA of RM3.45, which makes RM6.90!” Well, I think the Board would give that man a present and in it, he will find a kite. Then the Board will ask him to fly it. Point: NTA valuation does not reward highly efficient, high ROE companies, and should really only be used when a company is in liquidation. However it may still be a good proxy for valuation when a company is sacrificing profits to expand new plants (pre-op cost erode profitability) and therefore will incur lower profitability in the short term for greater long term profitability, which is why I am still using NTA for KJ’s valuation.

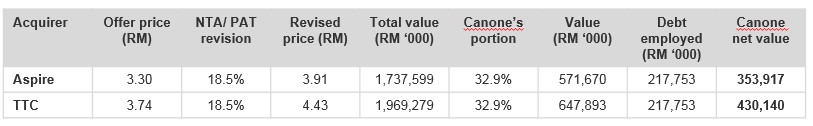

Therefore, I would dare to suggest using both NTA and PAT both at 50% weightage each to update the Aspire and TTC offer. Weighting both increase in NTA and PAT will give an average increase of 18.5%. Therefore, increasing Aspire’s offer by 18.5% will yield RM3.91/share or total value of RM1.74bn (we will use this as the base valuation) and TTC’s earlier offer of RM3.74 will be updated to RM4.43 or a total value of RM1.96bn.

As a side explanation, I deducted Canone’s debt employed to acquire KJ of RM217mil to compute RM353.9m as the net benefit of Canone’s ownership of KJ if the Aspire sale materializes.

Actually we are done with KJ’s valuation for Canone and if you’re disinterested in KJ, you can skip the whole KJ business analysis below until the total valuation section. Okay, so KJ, unlike Canone actually focuses on making cans. Hella lot of cans.

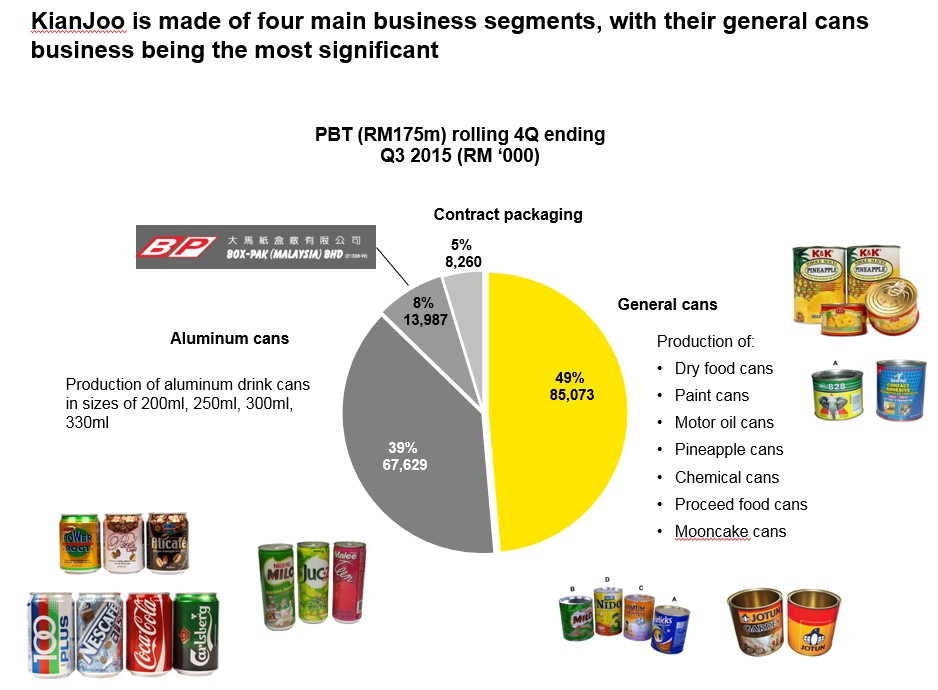

As you can see, KJ’s two biggest PBT contributor are General Cans and Aluminium Cans contributing 49% and 39% of the latest 4 rolling PBT which I will be elaborating below. Notice that KJ’s PBT is RM175m compared to Canone’s PBT of RM115m which is why it commands a higher market cap.

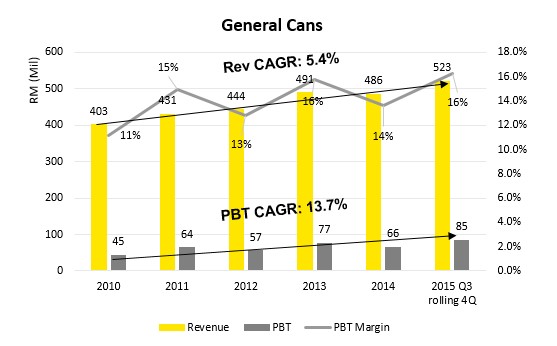

Unlike Canone, KJ actually excels at making a variety of cans. If you notice in the pie chart above, they even make cans such pineapple and mooncake cans. If a company bothers to list products such as mooncake cans (they make up to 30 types of mooncake cans), you know that it makes a lot of cans. If you look at their website, they make like hundreds of types of cans. Unfortunately I am not in the can business, but I would imagine that making cans requires dies, molds and pressing machines to get the exact type of can shape requested. Also, the more unique the can, the more KJ can charge for it, because it’s not generic/ commoditized (higher margins).

I believe this is where a major strength of KJ lies. The ability to make so many types of cans for the needs of reputable companies such as Jotun, Nestle (Milo), Dutch Lady (milk) and Cadbury means that they have the ability to deliver. Unlike Canone which produces very generic tin cans, plastic jerry cans and bag in box, KJ is actually able to specialize such a variety of cans and this is a major competitive strength.

All this variety is translated into a very strong PBT CAGR for the general can division over the last 5 years of 13.7%! Margins have also been expanding from 11% to 16% over the last 5 years.

KJ also produces aluminum cans. This is for soda, beer and other ready to make drinks. This business is also very strong. Although the PBT CAGR has been a weak at -1.5% and revenue CAGR at a 7.8%, the aluminum can business is a very resilient business. Think about it, ready to make can drinks are low value products that are not sensitive to economic swings. People who drink 100 plus aren’t going to stop buying after a game of badminton just because the economy is bad. This is the same story as Canone’s milk business.

Also, if you noticed, they also have big brands under their belt such as Nestle (milo again), 100 Plus (F&N) and Carlsberg Malaysia. The ability to command this sort of customers is a testament to their ability to deliver. Also with falling aluminum prices, a stronger RM will allow KJ to benefit from lower raw material prices.

Looking at KJ’s business, I do not think this business is worth a meager 10PE. As I’ve explained above, these are extremely convincing reasons for KJ to be a long term business that is worth holding for a long time and is worth the updated price TTC offered of RM 4.43/share.

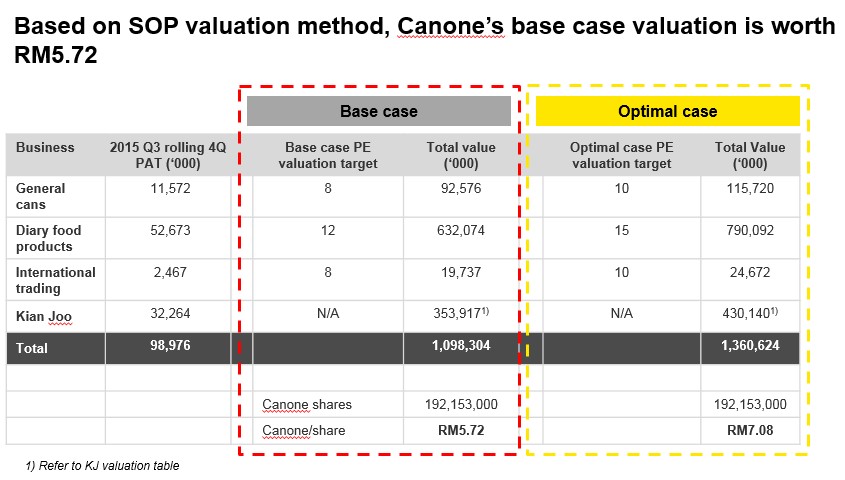

Finally, using SOP valuation method, Canone is worth between RM5.72 to RM7.08. I would err to the side of caution to value Canone based on RM5.72 despite the fact that it’s latest earnings are poised to be stronger based on its dairy food product division showing stronger profits in its upcoming results.

For the base case Canone is worth RM5.72 which is a premium of 33% over today’s approximate price of RM4.30. Canone’s general cans and international trading are estimated to be worth a PE of 8. As mentioned before, due to the resilience and growth strength of the dairy food division, I assign a modest PE of 12. Canone’s portion of KJ is worth RM354m based on an estimated revised offer price from Aspire.

For the optimal case, Canone is worth RM7.08 which is 65% more than today’s price of approximately RM4.30. I upgraded Canone’s general cans and international trading valuation to an estimated PE of 10 and assign a PE of 15 for the dairy division, closer to other industries such as Dutch Lady and F&N, but lower as it does not have the brand strength. Canone’s portion of KJ is worth RM430m based on an estimated revised offer price from TTC.

Technically speaking, the Canone started up-trending as early as late August 2015. Whether it’s a coordinated exercise (yes, I do mean syndicate) the market is anticipating the sale of KJ to Aspire or any other buyer, I cannot tell. What I can tell you is that it’s still an up-trending stock and to buy on weakness or if it breaks resistance. Since the base target price is RM5.72, anything under RM5 is a safe bet. Also, RM5.72 is our conservative base case with lower valuation estimates.

Conclusion

As you can tell from all the data mining above, Canone is more than just cans. It has 3 different businesses with the condense milk business being particularly promising. In addition to that, Canone’s stake in KJ contributes healthy profits year on year, and there is no harm if Canone continues to keep KJ in its books! Both of KJ’s general cans and aluminum business are excellent and it would do Canone well if it keeps this for the long term.

I think the right bet to take at the moment would be to bet on the strength of the dairy division with its Q results due next week. Also, the previous weak market sentiment have given another chance to buy at low RM4. The TP is RM5.74 to RM7.08. Don’t miss this chance.

Also, if you’re a KJ shareholder, don’t let Aspire take your share at RM3.30 now that you know how amazing KJ’s business is. Make sure they pay you handsomely for it.

Happy trading/ investing ya’ll

Cephas

Appendix:

While this is my second article, I have quickly found that there are much joys in writing. I have been wondering for ages why people bothered blogging and secretly (okay, maybe openly) thought they were losers. Therefore, at the end, there is a written appendix for more “storytelling.” I try to keep the main article as short as possible as I know most people are busy and prefer fewer words and more pictures/ conclusion. Therefore, the information/ stores here are supportive but not imperative to the conclusion of the article. Also, please excuse me as I may be a little more jovial (heck is that even possible?) in this section as there are fewer readers at this point.

A1: UMAs are useless/ dumb – Directors never give any important information anyway

When I was going through Canone’s litigation history, I realized that their latest litigation is from Bursa themselves (what the heck? I thought the See brothers were the one with beef against Canone?). As I dug further, I realized that on 5 Jan 2012, when Canone’s share price jumped from RM1.08 to RM1.37 (dayum, 17 %!) in one day, Bursa gave Canone an UMA (unusual market activity, AKA the love letter). Bursa inquired as to whether there was any reason for the jump. As most companies do, they responded to Bursa and release a statement saying that “I’m not aware of anything going on. The market is just having one of those days, you know” (I’m paraphrasing). The very next day, on 6 Jan, Canone released an announcement saying the Federal Court allowed the acquisition of 32.9% of KJ.

Now this was quite a slap in the face for Bursa. They were probably thinking “what the hell? These guys publicly announced that they were unaware of any activities causing a jump in their share price and the very next day they announced the completion of their KJ acquisition? Do they think we’re that stupid? That’s it, we’re going to fine their director’s ass.” And that’s what Bursa did, they fined each director RM50k and up till today, Canone is applying for leave (in lay man terms, “give chance la”) to the KL High Court for this fine.

I actually found this incident very refreshing as it forces companies not to play dumb and to release important information timely. I previously thought those love letters were redundant.

A2: Grandmother Canone and KJ litigation story

I started out writing this article with the intention of reading the entire history of litigation between KJ and Canone and its owners however I soon discovered that the story goes all the way back to at least 1996 (bloody hell, the internet wasn’t even born yet!) when the KJ brothers were trying to take control of the family’s assets: KJ. So I decided against writing it but I thought I’d share whatever I’ve read with anyone who’s interested (who the heck reads the appendix anyway?).

There are actually only 6 main people and two companies in the whole litigation story. There are the 4 KJ See brothers, the current KJ CEO (former Canone CEO) Yeoh and the current KJ COO Freddie Chee (former Canone COO and co-owner of Aspire). The story started way back in 1996 when the See brothers were fighting for KJ which was started by their father See Boon Tay 50 years ago (who the heck is Kian Joo then? Maybe the name rhymes with can). The See brother’s stake was held in Kian Joo Holdings Sdn Bhd which held 34% of KJ. In the process, they hired KPMG to help them liquidate KJ Holdings which took many years due to complications in shareholding (or so I suspect). In 2009, KPMG then organized an open tender to sell off KJ Holdings. The main bidders were Canone (who won at RM1.65/share) and the oldest See brother (Datuk See Teow Chuan) who bid at RM1.51.

Ever since then, the See brothers who were upset that they lost control over KJ have been in litigation to challenge the legitimacy of the bid.

Subsequent to Canone acquiring the 32.9% in 2012, Yeoh booted 3 of the See brothers (they left Anthony See [2nd brother] on the board. I don’t know why). They have been in litigation since demanding compensation for unconstitutional dismissal with some of the brothers being awarded compensation.

Where are we today with all this litigation? Most of today has to do with the KJ brothers trying to be reinstated as directors or for compensation. Canone’s only pending litigation is the Bursa one as explained in A1 above.

If you're still reading at this point, I must thank you! I can't believe you read all this nonsense appendix that is mostly just ramblings from my part. Thanks... dude.

Related Stocks

| Chart | Stock Name | Last | Change | Volume |

|---|

Market Buzz

More articles on The dude series

Discussions

I must say that your write up is not only informative but hilarious as well. Thank u for an entertaining read. All eyes on Toyota Tsusho now whether they will throw in their hat to bid for kianjoo. The deadline to watch is 31st March.

2016-02-17 20:46

DUDE, why u so good at analyzing ONE ??? CAN joke also ... we NO WORRY ONE with DUDE around :) thanks so much for sharing dude .. sincerely, dudess

2016-02-17 20:57

You're good. Splendid write-up with jolly good jokes. I must say your style shadows that of Dali...heads down. Keep it up!!!

2016-02-17 21:00

a good write up however if Toyota doesnt make an counter offer, the price wont move to the price you culculate.

2016-02-17 21:17

Thanks for the great encouragement guys (and dudess)!

Kylo, thanks for the comment! The offer price for KJ hasn't been revised. However first of all this article argues that Canone is worth RM5.72 regardless of the sale of KJ. Secondly, due to the delay, Aspire will resubmit the draft circular for acquisition of KJ by 31 Mar 2016 (if there is no further extension). They will not announce a revised offer price until they release the circular. Finally, I thought the way you killed your father was a little cliche (heck but that's just my opinion)

lching, thanks for your opinion too. The revised Toyota offer is used for the calculation of the RM7.08 TP. I'm not using that TP as it is too optimistic. Also, I'm sorry, perhaps I have not been sufficiently clear that I am using the Aspire/TTC as a proxy for value and the acquisition does not need to materialise for the value to be realised. KJ is making healthy profits as we speak.

2016-02-17 23:23

Dear cephasyu or dude in short,

I give u a BIG Like U.

U certainly have all the qualities n talent of super sales stock broker Jordan in the movie, The Wolf Of Wall Street.

Many stocks in KLSE r in need of the driver with your kind of charming personality in presenting the FA #s.

I encourage everybody to watch the infamous film, fully sponsored by our govman, THE WOLF OF WALL STREET.

Seriously, it's a good show for people who want to know what is behind how stocks go up.

Lots of F--- every where in words n in action. They do that action even in the glass lift. Best of all LOTS of PUSSY r shown every minute.

U get to see how Jordan charmingly promoted n road showed Steve Madden as the greatest shoe maker n designer for ladies.

cephasyu or Dude, Never say NO. U can be constantly on cloud 9 like Jordan in high living.

2016-02-18 07:03

Hi cephasyu, like your sense of humor.

Can-One investors are still in a good position whether the sale is materialized or not since Kian Joo is running a profitable business.

Definitely a plus if the Offer Price is revised upward or Toyota makes a formal bid through IB.

2016-02-18 11:12

nice, I got a like from si fu Icon! :P

Thanks for all the supportive comments, 360capitalist, rosmah (haha!), bull hunter and even pure bull (dude, are you high?)

Dusti, as much as I am confident in Can-one, I do agree that the Aspire deal can be a strong catalyst. The deadline for that is 31 March 2016. However KJ has extended this deadline 4 times and there is no assurance that they won't extend it again.

2016-02-19 16:02

Good write up. I absorbed your information well. Gives me more confidence in canone

2016-02-19 22:13

Cephasyu, excellent writeup and comprehensive analysis! Thanks for sharing ur great analysis. I have been following ur series...waitin for the next episode!

btw, hope you can share where can i obtain the historical PE chart? Did you compute it manually by mapping the historical share price chart with the historal EPS or is there a place i can download such info for free? Thanks

2016-02-20 08:20

Thanks for the encouraging comments, projecti and Vijayy. Thanks for following my series haha. Hopefully I'll Be able to write sufficiently frequent unlike the Sherlock Holmes series.

Unfortunately I manually made all my historical PE charts. I couldn't find any free ones online

2016-02-20 19:44

Dude, love your writing style and the detailed, well researched, well reasoned analysis. For me you are one of the few writers on i3 worth reading. Thanks for sharing. Cheers

2016-02-22 13:11

read and re-read...

I am going to nominate the write Mr.cephasyu for Best M&A Analysts in 2017 Malaysia i3 AWARDS next year

2016-02-22 14:10

natyrag, thanks man. That means a lot.

Duit, I wish there was such an award haha. In any case, thanks for re-reading

2016-02-22 21:12

If anyone's still reading here, Dlady's results just came out. Gross margin is up but net profit is down. Gross margin improved from 34.6% to 42%, due to low milk prices.

Net profit is down because of high advertisement and promotional activities. (management tends to lump more expenses in healthy quarters to cushion the impact)

My point is that milk counters are still benefiting from low raw material prices and Can-one is one of them.

2016-02-23 18:27

Hi cephasyu dude, thanks for your write up. I have just viewed the qr of kianjoo, one thing i am not very understand is the foreign exchange gain and loss. Can you please explain more to me? does this foreign exchange refer to the exchange rate between myr and usd? and how you calculate gain or loss? thanks alot

2016-02-23 20:44

hey investmentisgood. That's a good question. I was looking at KJ's overall Q it and pondering as well.

I'm concerned about overall declining margins, and high op expenses.

The MYR vs USD and MYR vs VND both were relatively stable from Oct 1 to 31 Dec 15, so I'm a little preplexed with the forex losses as well. I can only imagine that they did not mark 2 market their obligations in the last Q and are only doing so this Q. Although I can't be certain.

Sorry, I don't have a good answer myself

2016-02-23 23:29

Cephasyu, I must congratulate you for writing such an interesting article on CanOne. After having seen hundreds of articles on share investment, I consider this article is the best. I believe this article would have encouraged many readers to buy this share and are losing money. CanOne’s 4th quarter result which was announced last evening is affected by the lower profit contribution from Kian Joo.

As you know, the prices of really good shares with excellent profit growth like FLB, ChinWell, VS etc are also falling. I think Dr Mahathir's resignation from UMNO has a big damaging effect on the stock market. I would think many investors including foreign fund managers are selling. Don’t worry, CanOne is one of my larger holdings.

I wish to know you, Cephasyu. My email address is: yewyin33@gmail.com and my name is Koon Yew Yin

2016-03-01 05:27

Ho lee sheet! Here I am expecting people to stone me for assigning such a TP to Can-one and it's result tanked. Instead I get KYY lavishing me with such praise! (although he did mention that I caused people to lose money)

Nevertheless for those who are still reading, I apologize that I was not able to foresee these latest results. I have not reached the level where I am able to accurately predict earnings. As well thought out as my article was, the results were still disappointing. Kian Joo definitely played a role in the disappointing results, and Can-one's milk division only registered a PBT of RM10m vs an average of RM17mil for the previous 3 quarters.

I suspect this could be due to higher raw material cost - commodities quoted in USD and weaker sales from strong competition - F&N / Johortin (Jtin is undergoing an expansion). However I am still puzzled as F&N has registered stronger profits from low milk commodity prices and Dutch lady registered stronger gross margins.

Therein lies the weakness of Canone & Johortin - the lack of brand strength. F&N and Dutch lady can sell directly to the customer, giving them the ability maintain prices. OEMs like Johotin and Can-one has to fight on price if there is an oversupply, eroding margins. At least this is what I hypothesize for now.

2016-03-01 13:47

Hi cephasyu dude, it is me again. I have noticed that in CANONE's previous QRs result, they attributed the profit from the milk division to the stronger USD. Does it mean that they do sell milk products to USA?

Furthermore, I guess the higher raw material cost they have is because they have hedged too early? way too earlier than the drop of the commodities? that's why the pricing drop is still not reflected in the recent qr?

Ya, don't give up dude, it is always good to learn something from the downs. I am still trying to figure out the reasons causing the lower profit.

2016-03-01 18:59

Hey Jim, thanks for the kind comment.

Investmentisgood, usually all exports/imports are quoted in USD. It does not mean that they export to the US specifically. They have mentioned that they export, however, in the past two Q, they recognized forex loss due to stronger USD and a derivative hedging gain. This means that they suffer from stronger USD.

Also based on 2014's annual report, they have RM120m of USD receivables out of a total of RM260m receivables. This means that they are exporting approx 46% of their products in USD. But still suffering from strong USD. Why? @_@

Unfortunately, there are no raw material deriative instruments, only forex instruments. It is possible that they purchased earlier when raw mat was more expensive, but looking at inventory days of 60, they couldn't have bought when it was very expensive.

I am still guessing that it's due to lower selling prices from competition but it's only a hypothesis.

Thanks for the encouragement man, let's not give up!

2016-03-02 18:05

Now that Canone has suddenly 'meletup', I'll bet this post will see a lot of readers. Thanks for the analysis and opinions. You may or may not be correct. But I'm very appreciative of this kind of effort. Thumbs up!

2016-03-14 13:27

The analysis & article was fantastic, though I become pening pening after reading half way. One of the best!

2017-06-05 22:51

goreng_goreng

omg dude, how much effort you put to produce this kind of superb and detail article? even my brain takes 1 week to digest everything. really appreciate your sharing dude guy.

2016-02-17 17:29