WTI Crude Futures - Bears Are Charging Ahead

rhboskres

Publish date: Thu, 13 Jun 2019, 05:18 PM

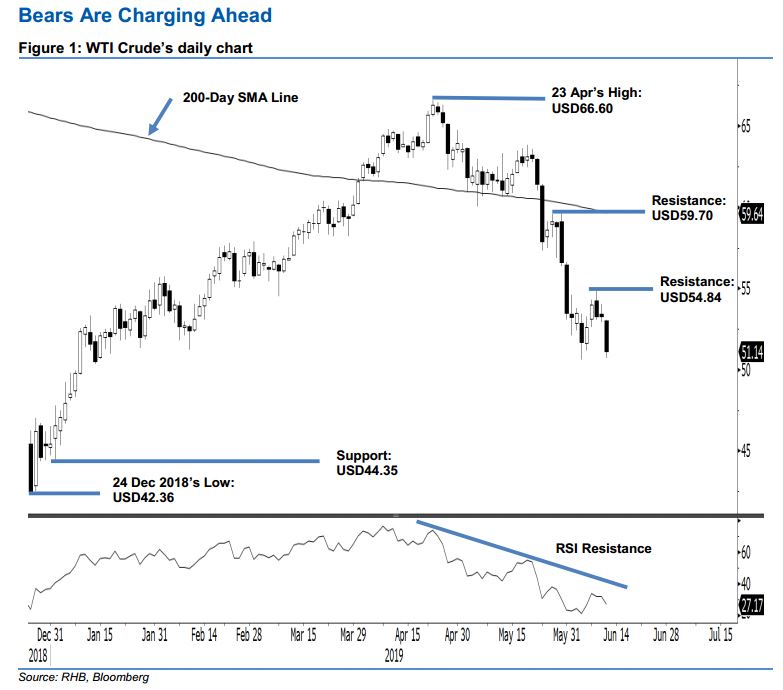

No reversal signals; maintain short positions. The WTI experienced a washout session, dropping USD2.13 to close at USD51.14, slightly breaching the previous immediate support of USD51.23. The intraday tone was discouraging, as it generally trended lower for the whole session – the high and low were posted at USD53.05 and USD50.72. While the commodity’s retracement that started from the high of USD66.60 on 23 Apr continues to flash an oversold Daily RSI reading, there are still no price signals to suggest that an interim low has been established in order for a stronger rebound or total price reversal to set in.

As such, we keep to our negative trading bias. As the bears are still on the strong side, we retain our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, we revised the trailingstop to above USD54.84.

Towards the downside, the immediate support is now envisaged at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. Moving up, the immediate resistance is now pegged at USD54.84, the high of 10 Jun, followed by USD59.70, which was the high of 30 May.

Source: RHB Securities Research - 13 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024