FKLI - No Signs of Reversal Yet

rhboskres

Publish date: Fri, 14 Jun 2019, 04:58 PM

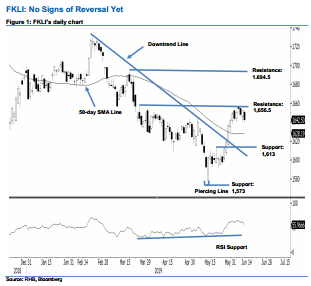

Still consolidating around the immediate resistance; maintain long positions. The FKLI formed a black candle to close at 1,642.5 pts, indicating a decline of 10 pts. The session’s low and high were recorded at 1,639 pts and 1,651.5 pts. The weak session did not flash out a price reversal signal. Instead, looking at the index’s price actions over the recent sessions, chances are high that it is merely consolidating around the immediate resistance of 1,656.5 pts. This consolidation is considered healthy to correct the previous sharp upward move that stared from the low of the 14 May’s “Piercing Line” formation. Maintain our positive trading bias.

In the absence of negative price signals that could indicate the index’s counter-trend rebound has reached an end, we continue to recommend that traders remain in long positions, which were initiated at 1,619.5 pts. A stop-loss can now be placed at the breakeven level.

We are still expecting the immediate support to emerge at 1,613 pts, the high of 13 May. This is to be followed by 1,573 pts, or the low of 14 May. Meanwhile, the immediate resistance is set at 1,656.5 pts, ie the high of 26 Mar, followed by 1,694.5 pts, the high of 19 Mar.

Source: RHB Securities Research - 14 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024