Hang Seng Index Futures - Rebound Is Not Over Yet

rhboskres

Publish date: Mon, 17 Jun 2019, 10:57 AM

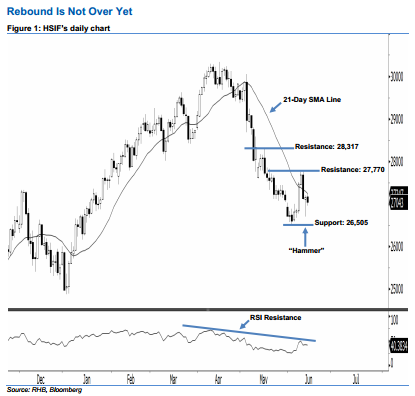

Maintain long positions, with a stop-loss set below the 26,505-pt support. The HSIF formed a black candle last Friday. It dropped to a low of 26,952 pts during the intraday session, before ending at 27,043 pts for the day. Based on the current technical landscape, we maintain our positive view, as the HSIF has continued to hold above the recent low of 26,505-pt support. Given that the index has formed a “Hammer” pattern on 13 Jun, this indicates that the market rebound is not diminished. Overall, we maintain our positive view on the HSIF’s outlook.

As seen in the chart, we are eyeing the immediate support level at 26,505 pts, ie the recent low of 4 Jun. If this level is taken out decisively, the next support would likely be at the 26,000-pt psychological spot. Towards the upside, the immediate resistance level is seen at 27,770 pts, determined from the high of 12 Jun. Meanwhile, the next resistance is anticipated at 28,317 pts, which was the previous high of 17 May.

Hence, we advise traders to stay long, following our recommendation to initiate long above the 27,436-pt level on 12 Jun. A stop-loss can be set below the 26,505-pt threshold in order to limit downside risk.

Source: RHB Securities Research - 17 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024