E-mini Dow Futures - Outlook Still Positive

rhboskres

Publish date: Mon, 17 Jun 2019, 11:01 AM

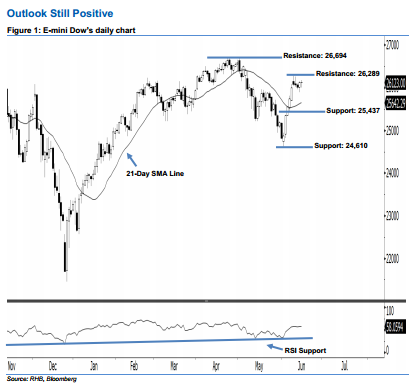

Stay long. The E-mini Dow formed a “Doji” candle last Friday. It settled at 26,123 pts, after hovering between a high of 26,177 pts and low of 26,003 pts throughout the day. Still, the upward momentum is not over yet, as the index continues to remain above the 21-day SMA line. Technically speaking, as long as the E-mini Dow does not erase gains created by 6-7 Jun’s white candles, there is a possibility that the upside swing would keep going. Given that the 21-day SMA line is now likely to turn higher, the bullish sentiment has been enhanced.

Based on the daily chart, the immediate support level is seen at 25,437 pts, ie the low of 6 Jun. The next support is anticipated at 24,610 pts, which was the recent low of 3 Jun. On the other hand, we maintain the immediate resistance level at 26,289 pts, determined from the high of 10 Jun. The next resistance would likely be at 26,694 pts, obtained from the previous high of 24 Apr.

Therefore, we advise traders to stay long, given that we initially recommended initiating long above the 25,437-pt level on 7 Jun. In the meantime, a trailing-stop can be set below the 25,437-pt threshold as well, in order to minimise the risk per trade.

Source: RHB Securities Research - 17 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024