FKLI - Counter-Trend Rebound Still on

rhboskres

Publish date: Tue, 18 Jun 2019, 10:42 AM

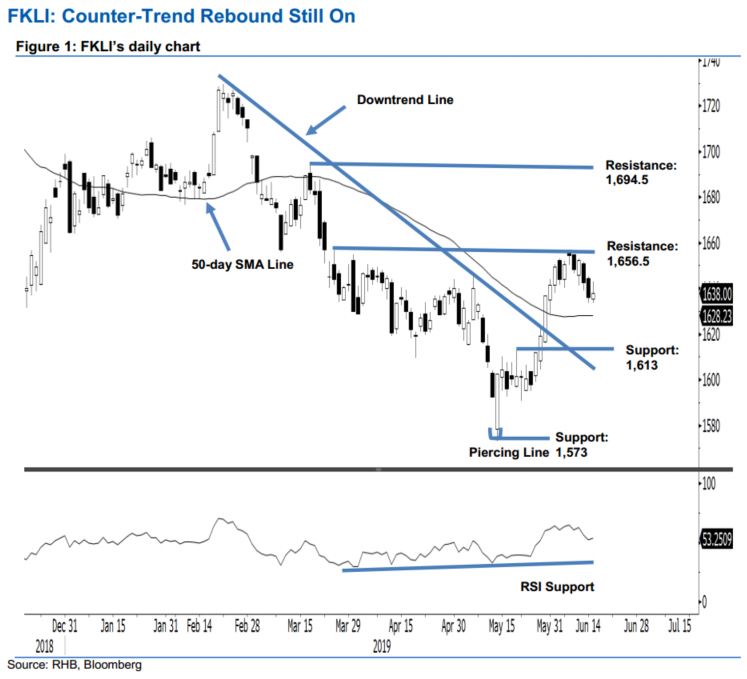

Counter-trend rebound may still be extending; maintain long positions. The FKLI settled 2 pts higher at 1,638 pts – this was after it traded in the range of 1,633.5 pts and 1,643 pts. Broadly, based on the daily chart, we still believe the index’s counter-trend rebound that started from the low of the 14 May’s “Piercing Line” formation is still likely to extend. Its recent sessions’ retracement – after it briefly tested the immediate resistance of 1,656.5 pts on 10 Jun – can be seen as a minor consolidation, instead of a price reversal. Hence, we keep to our positive trading bias.

As the bias is still strong for the index to extend its rebound phase once the said minor consolidation phase is completed, we continue to recommend that traders remain in long positions – initiated at 1,619.5 pts. A stop-loss can now be placed at the breakeven level.

We are still eying the immediate support at 1,613 pts, the high of 13 May. This is to be followed by 1,573 pts, or the low of 14 May. Meanwhile, the immediate resistance is set at 1,656.5 pts, ie the high of 26 Mar, followed by 1,694.5 pts, the high of 19 Mar.

Source: RHB Securities Research - 18 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024