WTI Crude Futures - the Negative Bias Remains

rhboskres

Publish date: Wed, 19 Jun 2019, 05:19 PM

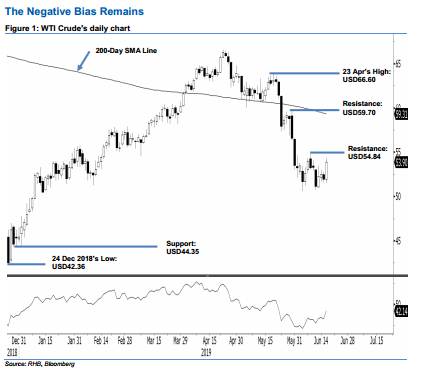

Continue to trap within the minor sideways zone, keep short positions. The WTI Crude formed a white candle in the latest session. It settled USD1.97 higher at USD53.90 at the close – this was after the commodity reached a low and high of USD51.50 and USD54.31. Despite the positive session, the WTI Crude is still confined within the recent 2-week sideways consolidation area. At this juncture, as long as it fails to breach above the USD54.84 immediate resistance, the outlook for it to stage a stronger rebound should still be soft. Consequently, we are keeping our negative trading bias.

Until there are clearer price signals emerging to indicate that the bulls are ready to drive the price trend, we retain our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, a trailing-stop is placed above the USD54.84 threshold.

We are still expecting the immediate support to emerge at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. Meanwhile, overhead resistance is set at USD54.84, or the high of 10 Jun. This is followed by USD59.70, ie the high of 30 May.

Source: RHB Securities Research - 19 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024