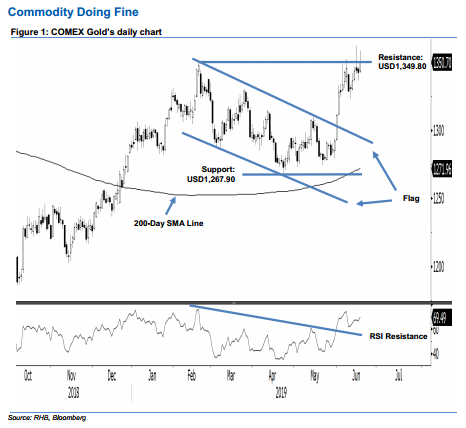

COMEX Gold - Commodity Doing Fine

rhboskres

Publish date: Wed, 19 Jun 2019, 05:20 PM

Maintain long positions, as the bulls are still in control. The COMEX Gold formed a white candle in the latest session, indecisively settling above the USD1,349.80 immediate resistance at the closing. The session’s low and high were recorded at USD1,342.10 and USD1,358.50, before it closed at USD1,350.70 – this indicated a gain of USD7.80. The latest positive session indicates that the commodity’s upward move – which resumed recently after it completed a multi-month consolidation phase – remains in place. While we note that the daily RSI of 69.5 is nearing the overbought threshold, in the absence of a price reversal signal, we stick to our positive trading bias.

On the bias that the bulls are still in firm control over the price trends, we continue to recommend traders stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For riskmanagement purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is pegged at USD1,300, a round figure. This is followed by USD1,267.90, or the low of 23 Apr. On the other hand, the immediate resistance is still maintained at the USD1,349.80 threshold, as it was not decisively breached in the latest session. This is followed by USD1,380.90, which was the high of 6 Jul 2016.

Source: RHB Securities Research - 19 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024