Hang Seng Index Futures - Surges to 1-Month High

rhboskres

Publish date: Thu, 20 Jun 2019, 04:59 PM

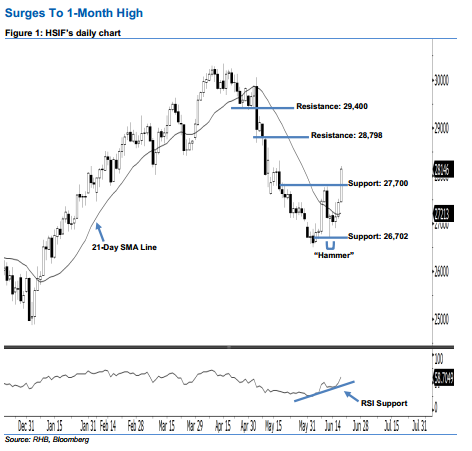

Stay long while setting a new trailing-stop below the 26,702-pt support. The HSIF formed a long white candle yesterday, indicating that momentum of buying could be strong. It surged 702 pts to close at 28,146 pts, off the session’s low of 27,447 pts. Based on the current outlook, the index has posted a third consecutive white candle and hit its 1-month high. This indicates that buying momentum has been extended. Overall, we think the rebound that started off 13 Jun’s “Hammer” pattern may continue.

Based on the daily chart, the immediate support is seen at 27,700 pts, situated near the midpoint of 19 Jun’s long white candle. Meanwhile, the crucial support is anticipated at 26,702 pts, determined from the low of 13 Jun’s “Hammer” pattern. Towards the upside, we are now eyeing the immediate resistance at 28,798 pts, ie the high of 9 May. The next resistance is seen at 29,400 pts, set near the midpoint of 6 May’s long black candle.

Thus, we advise traders to maintain long positions, given that we initially recommended initiating long above the 27,436-pt level on 12 Jun. For now, a new trailing-stop can be set below the 26,702-pt mark in order to minimise the risk per trade.

Source: RHB Securities Research - 20 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024