E-mini Dow Futures - Persistent Upward Momentum

rhboskres

Publish date: Thu, 20 Jun 2019, 05:01 PM

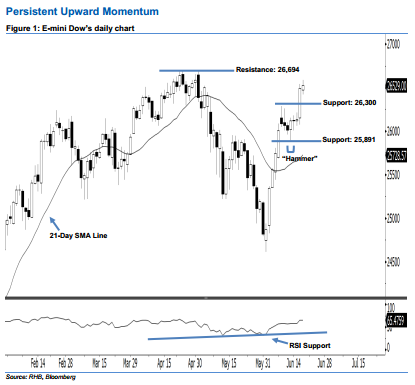

Stay long, with a new trailing-stop set below the 25,891-pt level. The E-mini Dow’s upside strength continued as expected after it ended higher to form another white candle. It rose 34 pts to close at 26,529 pts, after oscillating between a high of 26,585 pts and low of 26,422 pts. As the index has successfully taken out the 26,289-pt resistance mentioned previously and formed a second consecutive white candle, this can be viewed as buyers extending their buying momentum. Furthermore, as the 14-day RSI indicator is now rising higher without being overbought, the bullish sentiment stays intact.

As shown in the chart, we now anticipate the immediate support at 26,300 pts, set near the midpoint of 18 Jun’s long white candle. If this level is taken out, look to 25,891 pts – which was the low of the 13 Jun’s “Hammer” pattern – as the next support. Towards the upside, the immediate resistance is seen at 26,694 pts, defined from the high of 24 Apr. The next resistance would likely be at the 26,966-pt historical high.

To recap, on 7 Jun, we initially recommended traders to initiate long positions above the 25,437-pt level. We continue to advise staying long for now, while setting a new trailing-stop below the 25,891-pt threshold. This is in order to lock in part of the profits.

Source: RHB Securities Research - 20 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024