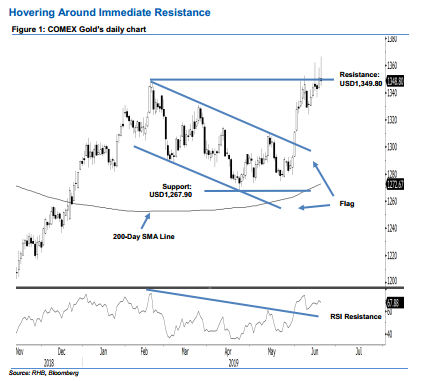

COMEX Gold - Hovering Around Immediate Resistance

rhboskres

Publish date: Thu, 20 Jun 2019, 05:03 PM

Bulls are still attempting a firm breakout; maintain long positions. The COMEX Gold tested the immediate resistance of USD1,349.80 in the latest session – repeating its efforts in the recent two weeks. Session’s low and high were posted at USD1,344.80 and USD1,366.60, before closing at USD1,348.80, indicating a gain of USD1.90. The past two weeks’ price actions continue to signal the commodity is consolidating around the said immediate resistance, this is to correct its prior sharp upward move upon the completion of its multi-month consolidation in the form of a flag pattern. Maintain our positive trading bias.

As we believe once the ongoing consolidation is over, the commodity is likely to extend its upward move, we continue to recommend traders stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is set at USD1,300, a round figure. This is followed by USD1,267.90, or the low of 23 Apr. Moving up, the immediate resistance is still maintained at the USD1,349.80 threshold. This is followed by USD1,380.90, which was the high of 6 Jul 2016.

Source: RHB Securities Research - 20 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024