WTI Crude Futures - No Reversal Signals Yet

rhboskres

Publish date: Thu, 20 Jun 2019, 05:06 PM

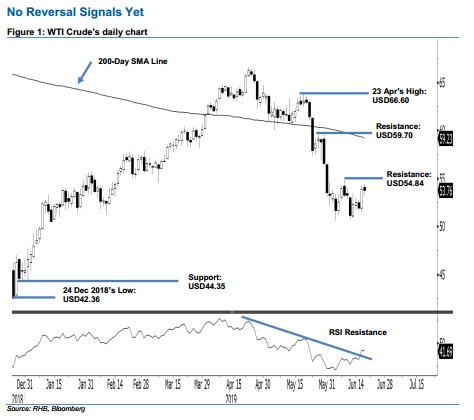

Bulls are lacking strength, keep short positions. The WTI Crude ended marginally lower by USD0.14 to settle at USD53.76. This was after it reached a low and high of USD53.28 and USD54.42. The price pattern developed over the past two weeks indicates a minor sideways consolidation is taking place. This consolidation phase is meant to correct the prior multi-week sharp retracement, which reached an oversold condition two weeks ago. As such, the chances are high that the negative trend has yet to reach an end. Maintain our negative trading bias.

In the absence of price reversal signals, we retain our recommendation for traders to stay in short positions. These were initiated at USD61.81, or the closing level of 2 May. For risk-management purposes, a trailing-stop is placed above the USD54.84 threshold.

Towards the downside, immediate support is at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. Moving up, overhead resistance is set at USD54.84, or the high of 10 Jun. This is followed by USD59.70, ie the high of 30 May.

Source: RHB Securities Research - 20 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024