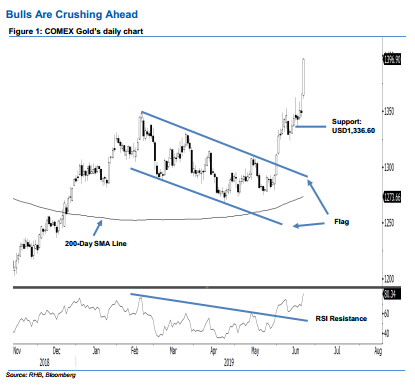

COMEX Gold - Bulls Are Crushing Ahead

rhboskres

Publish date: Fri, 21 Jun 2019, 05:18 PM

Maintain long positions as the bulls are pushing ahead. The COMEX Gold formed a long white candle which at the closing crushed through the previous resistance levels of USD1,349.80 and USD1,380.90. The intraday tone was positive – as it generally scaled higher for the entire session. The low and high were at USD1,361.30 and USD1,397.70, before ending at USD1,396.90, indicating a gain of USD48.10. The breakout from the said previous resistance levels indicates a still-strong upward momentum. While the Daily RSI is now flashing out an overbought reading of 80.34, in the absence of price reversal signals, we keep to our positive trading bias.

Given that the bulls are showing strong control over the price trend, we continue to recommend traders stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is revised to USD1,336.60, which was the low of 17 Jun. This is followed by USD1,300, a round figure. Towards the upside, the immediate resistance is now envisaged at USD1,400, a round figure. This is followed by USD1,432.90, the high of 28 Aug 2013.

Source: RHB Securities Research - 21 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024