WTI Crude Futures - Stronger Rebound May be Developing

rhboskres

Publish date: Fri, 21 Jun 2019, 05:19 PM

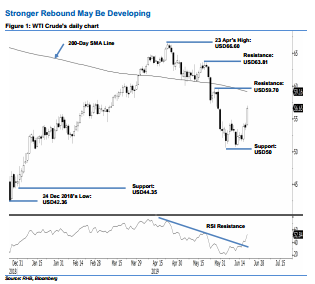

Initiate long positions as deeper rebound may be developing. The WTI Crude performed positively as it ended USD2.89 stronger at USD56.65. Session’s low and high points were at USD54.11 and USD57.02. The strong session effectively pushed the commodity out from its previous immediate resistance level of USD54.84. This suggests the commodity’s previous multi-week’s sharp retracement has likely reached an end, and that at the minimum, a stronger rebound is probably in the process of developing. Towards the upside, we are seeing the 200- day SMA line – which is also located near the immediate resistance of USD59.70 as the minimum target. We switch our trading bias from negative to positive.

Our previous short positions initiated at USD61.81, or the closing level of 2 May, were wound down at USD54.84 in the latest session. As the black gold may develop a stronger rebound phase, we initiate long positions. For riskmanagement purposes, a stop-loss can be placed below USD50.

We are still expecting the immediate support at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. On the other hand, overhead resistance is now pegged at USD59.70, ie the high of 30 May. This is followed by USD63.81, which was the high of 20 May.

Source: RHB Securities Research - 21 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024