E-mini Dow Futures - Taking a Pause

rhboskres

Publish date: Mon, 24 Jun 2019, 11:15 AM

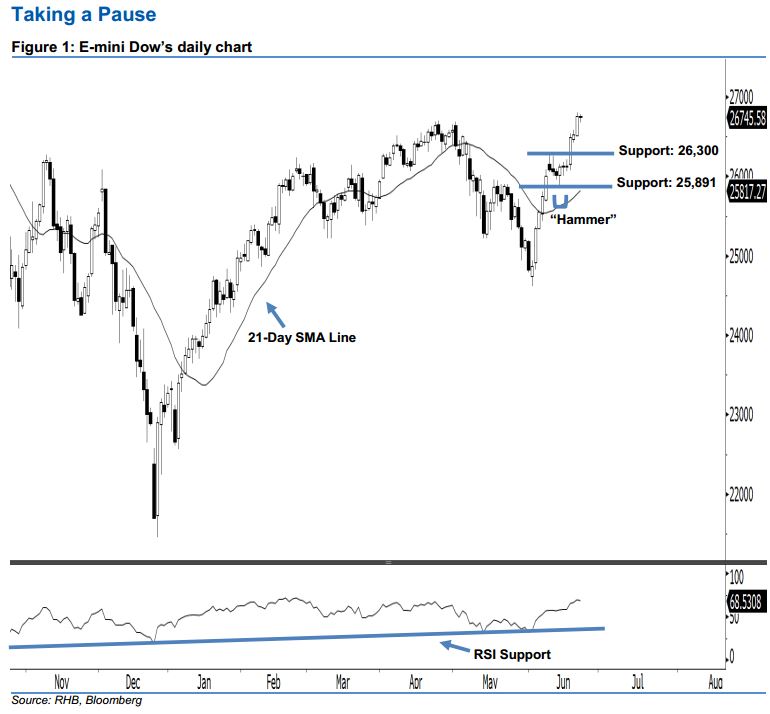

Stay long, with a trailing-stop set below the 25,891-pt support. After the market rose for four sessions in a row, the E-mini Dow formed a “Doji” candle last Friday. It settled at 26,745.58 pts, after hovering between a high of 26,783 pts and low of 26,680 pts. However, it is not surprising that buyers may be taking a pause following the recent gains. Since the 21-day SMA line is pointing upwards, this indicates that the market sentiment remains bullish. Overall, we think the upside swing that begin with 13 Jun’s “Hammer” pattern would likely continue in the coming sessions.

As seen in the chart, we are eyeing the immediate support level at 26,300 pts, set near the midpoint of 18 Jun’s long white candle. Meanwhile, the next support is maintained at 25,891 pts, ie the low of 13 Jun’s “Hammer” pattern. On the other hand, we anticipate the near-term resistance at the 26,966-pt historical high. This is followed by the 27,000-pt psychological spot.

Therefore, we advise traders to stay long, following our recommendation of initiating long above the 25,437-pt level on 7 Jun. A trailing-stop is preferably set below the 25,891-pt mark in order to secure part of the profits.

Source: RHB Securities Research - 24 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024