WTI Crude Futures - Rebound Is Extending

rhboskres

Publish date: Tue, 25 Jun 2019, 10:31 AM

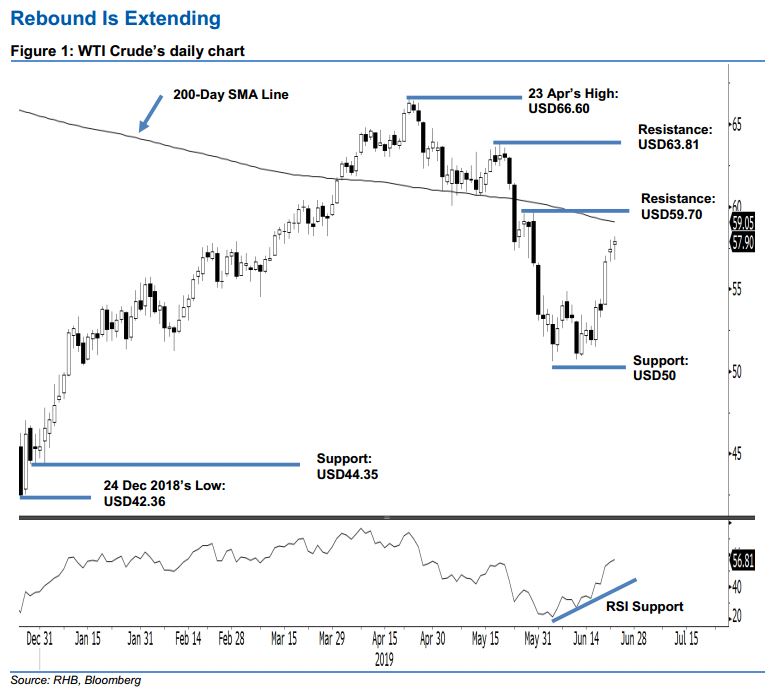

Maintain long positions as further upside is still possible. The WTI Crude ended the latest session positively. It added USD0.47 to settle at USD57.90. Trading took place in the range of USD56.75 and USD58.22. Looking at the commodity’s latest two sessions’ price actions, chances are high that a minor consolidation may be taking place in the area below the 200-day SMA line. At the moment, this consolidation is deemed as healthy to correct its prior relatively sharp upward move. Once this minor consolidation phase is over, the commodity may be able to test the said SMA. We maintain our positive trading tone.

With evidence suggesting the rebound has not reached its end yet, we continue to recommend traders to stay in long positions. These were initiated at USD56.56, the closing level of 20 Jun. For risk management purposes, a stop-loss can be placed below USD50.

Immediate support is envisaged at USD50, a round figure. This is followed by USD44.35, which was the low of 2 Jan. On the other hand, the overhead resistance is now pegged at USD59.70, ie the high of 30 May. This is followed by USD63.81, which was the high of 20 May.

Source: RHB Securities Research - 25 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024