Hang Seng Index Futures - Taking a Breather

rhboskres

Publish date: Tue, 25 Jun 2019, 11:27 AM

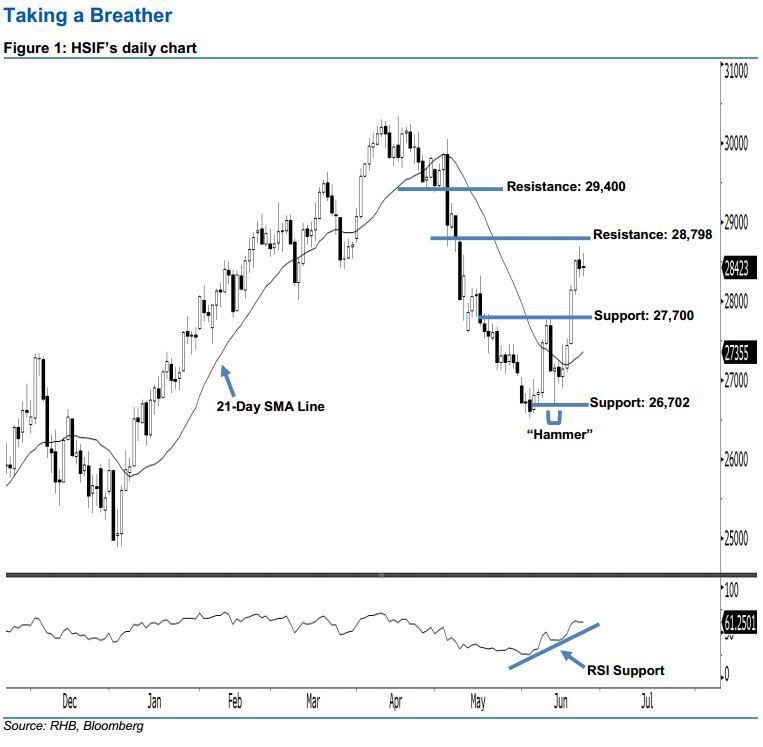

Maintain long positions. The HSIF formed a “Doji” candle yesterday. It closed at 28,423 pts after hovering between a high of 28,605 pts and low of 28,314 pts throughout the session. Still, the bullish sentiment stays unchanged, as this candle can only be viewed as buyers probably taking a breather after the recent surge. Since the 21-day SMA line is now likely to turn higher, the bullish sentiment has improved. Overall, we think the market rebound that began with 13 Jun’s “Hammer” pattern may carry on.

As seen in the chart, we anticipate the immediate support level at 27,700 pts – this is set near the midpoint of 19 Jun’s long white candle. The next support is seen at 26,702 pts, ie the low of 13 Jun’s “Hammer” pattern. To the upside, the immediate resistance is maintained at 28,798 pts, which was the high of 9 May. If a decisive breakout arises, look to 29,400 pts – near the midpoint of 6 May’s long black candle – as the next resistance.

As a result, we advise traders to stay long, since we originally recommended initiating long above the 27,436-pt level on 12 Jun. In the meantime, a trailing-stop set below the 27,700-pt threshold is advisable to secure part of the profits.

Source: RHB Securities Research - 25 Jun 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024