WTI Crude Futures - Possible Price Rejection

rhboskres

Publish date: Wed, 03 Jul 2019, 05:08 PM

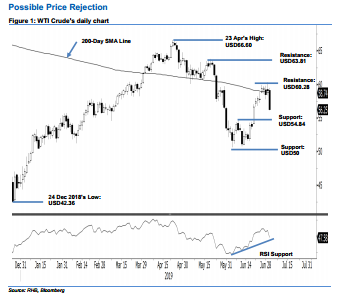

Initiate short positions on possible price rejections from the 200-day SMA line area. The WTI Crude formed a black candle, settling USD2.84 weaker at USD56.25. The session’s trading range was between USD56.09 and USD59.43. The negative session indicates a possible price rejection from the 200-day SMA line and USD60.28 immediate resistance. This implies the risk is high that the counter-trend rebound, which started from the USD50 support area, may have reached an end. Consequently, we switch our trading bias to negative.

Our previous long positions were initiated at USD56.56, or the closing level of 20 Jun – these were closed out at the breakeven mark. As the risk for a retracement to develop has increased due to the possible price rejection from the 200-day SMA line, we initiate short positions at the latest close. For risk-management purposes, a stop-loss can be placed at above the USD60.28 threshold.

The immediate support is still pegged at USD54.84, which was the high of 10 Jun. This is followed by USD50, a round figure. Moving up, the immediate resistance is now set at USD60.28, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 3 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024