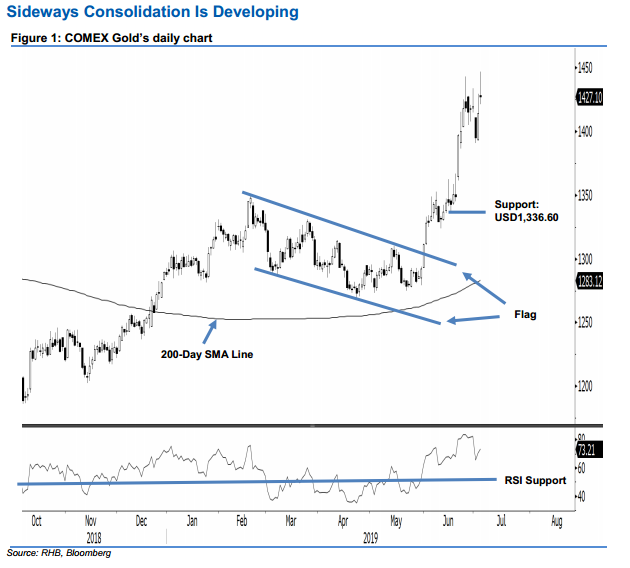

COMEX Gold - Sideways Consolidation Is Developing

rhboskres

Publish date: Thu, 04 Jul 2019, 04:19 PM

The sideways consolidation phase may still be extending; maintain long positions. The COMEX Gold experienced a positive session. At one point, it tested the USD1,432.90 immediate resistance with an intraday high of USD1,446.80. This was before it closed at USD1,427.10, indicating a gain of USD12.90. Still, we believe the precious metal’s sideways consolidation phase has not reached an end yet, and is likely to extend – at least – in the coming sessions. This is deemed healthy with regards to correcting the COMEX Gold’s previous multi-week sharp upward moves, which recently reached an overbought reading. We maintain our positive trading bias.

As we still observing a healthy consolidation phase taking place, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For riskmanagement purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is pegged at USD1,336.60, which was the low of 17 Jun. This is followed by USD1,300, the next round figure. Moving up, the immediate resistance is set at USD1,432.90, or the high of 28 Aug 2013 – this is followed by the USD1,500 threshold.

Source: RHB Securities Research - 4 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024