WTI Crude Futures - Minor Pause by the Bears

rhboskres

Publish date: Thu, 04 Jul 2019, 05:05 PM

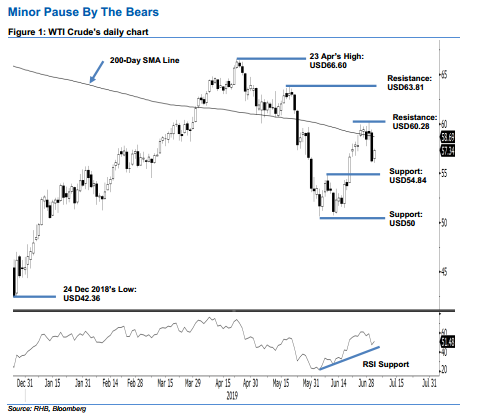

Maintain short positions, as the commodity’s retracement leg is incomplete. The WTI Crude closed its latest session USD1.09 higher at USD57.34. This was after it traded in the range of USD56.04 and USD57.48. This positive session can be interpreted as a minor pause within an ongoing retracement leg, after the black gold experienced a relatively sharp drop in the previous session. Overall, we still believe the price rejection from the 200- day SMA line and USD60.28 immediate resistance suggests the downside risk will still be high in the coming sessions. Consequently, we keep to our negative trading bias.

As the bears are seen to have the upper hand over the price trend, we continue to recommend traders stay in short positions. We initiated these at USD56.25, which was the closing level of 2 Jul. For risk-management purposes, a stop loss can be placed at above the USD60.28 mark.

The immediate support is eyed at USD54.84, which was the high of 10 Jun. This is followed by USD50, a round figure. Meanwhile, the immediate resistance is set at USD60.28, which was the high of 1 Jul. This is followed by USD63.81, or the high of 20 May.

Source: RHB Securities Research - 4 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024