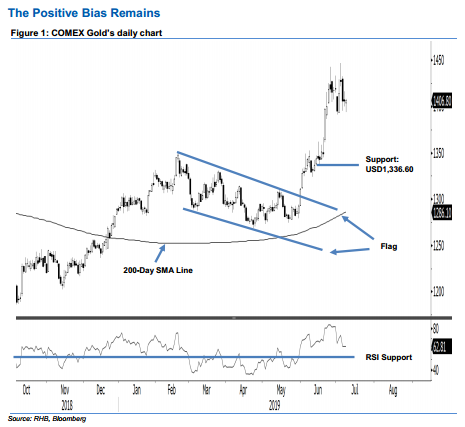

COMEX Gold - the Positive Bias Remains

rhboskres

Publish date: Wed, 10 Jul 2019, 05:37 PM

Maintain long positions, as the upward bias remains intact. The COMEX Gold closed the latest session marginally better by USD0.60 at USD1,406.80. The session’s low and high were posted at USD1,394 and USD1,408.10. Still, the precious metal remains trading in the sideways consolidation zone that has been in development over the past two week. This implies that we are not seeing an end to the commodity’s upward move. This consolidation phase is necessary to correct the COMEX Gold’s previous multi-week upward move, which took place between May and June. We stick with our positive trading bias.

As the bulls are still having a healthy control over the price trends, we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For riskmanagement purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is expected at USD1,336.60, which was the low of 17 Jun. This is followed by USD1,300, or the next round figure. Towards the upside, the immediate resistance is set at USD1,432.90, ie the high of 28 Aug 2013. This is followed by the USD1,500 threshold.

Source: RHB Securities Research - 10 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024