WTI Crude Futures - Bulls Are Back Again

rhboskres

Publish date: Thu, 11 Jul 2019, 05:13 PM

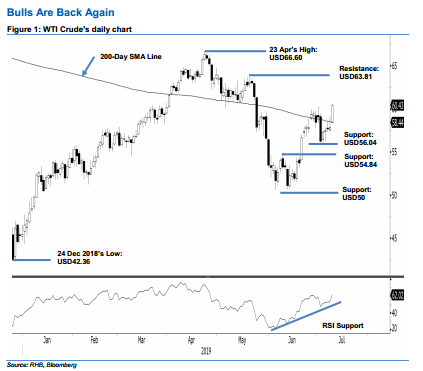

Initiate long positions, as the bulls are back in control. The WTI Crude performed positively in its latest session – settling USD2.60 higher at USD60.43 at the close. The session’s low and high were posted at USD58.35 and USD60.53. The closing level also placed the commodity above the 200-day SMA line and previous USD60.28 immediate resistance. This suggests the correction phase we anticipated was narrower than expected and is now completed. This implies that the WTI Crude is now ready to resume its upward move, which started from a support area near the USD50 mark. We switch our trading bias to positive.

Our previous short positions – initiated at USD56.25, or the closing level of 2 Jul – were closed out at USD60.28 in the latest session. On anticipation that the commodity is resuming its upward move, we initiate long positions at the latest closing price. For risk-management purposes, a stop-loss can be placed below the USD56.04 mark, which was the low of 3 Jul.

The immediate support is revised to USD56.04, ie the low of 3 Jul. This is followed by USD54.84, which was the high of 10 Jun. Moving up, the immediate resistance is set at USD63.81, or the high of 20 May. This is followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 11 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024