COMEX Gold - the Positive Posture Remains Firm

rhboskres

Publish date: Thu, 11 Jul 2019, 05:14 PM

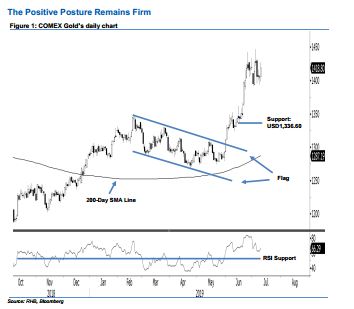

The upward trend is still encouraging, maintain long positions. The COMEX Gold formed a white candle to settle USD12 higher at USD1,418.80. Trading took place in the USD1,398.20-1,427 range. Despite the positive session, the commodity is still trading within the relatively narrow sideways consolidation phase, which has been in development over the past two weeks. This ongoing phase is a healthy development, as it is meant to correct the precious metal’s previous multi-week upward move that happened between May and June. We stick with our positive trading bias.

As the overall technical picture is still healthy – without signs of a deep retracement – we retain our recommendation for traders to stay in long positions. We opened these positions at USD1,333.60, which was the closing level of 5 Jun. For risk-management purposes, a stop-loss can be placed at the breakeven mark.

The immediate support is set at USD1,336.60, which was the low of 17 Jun. This is followed by USD1,300, or the next round figure. Moving up, the immediate resistance is set at USD1,432.90, ie the high of 28 Aug 2013. This is followed by the USD1,500 threshold.

Source: RHB Securities Research - 11 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024