FCPO - No Reversal Yet

rhboskres

Publish date: Fri, 12 Jul 2019, 04:53 PM

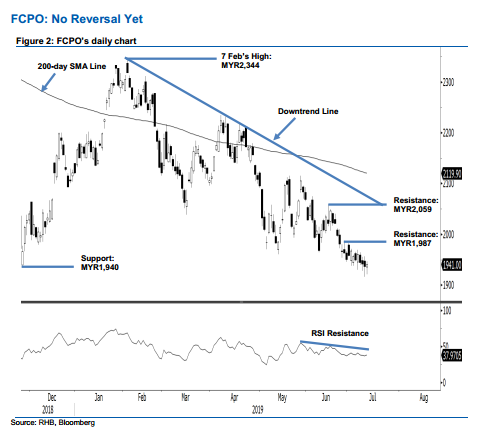

Maintain short positions as the negative bias is still valid. The FCPO managed to reverse its earlier session’s losses to close marginally higher by MYR4 at MYR1,941. The low and high were recorded at MYR1,921 and MYR1,947. Despite the intraday reversal and positive closing, the commodity is still not able to generate price signals that could suggest an end to its retracement leg. Overall, while the recent weaknesses are showing signs of a declining momentum, the commodity’s technical remains negative with the downtrend that started from the high of MYR2,233 on 7 Feb still firmly in place. Maintain our negative trading bias.

On the observation that the bears are still having a firm control over the price trend, we continue to recommend that traders stay in short positions. These were initiated at MYR1,951, the closing level of 28 Jun. A stop-loss can now be placed above MYR1,987, the high of 27 Jun.

The immediate support is pegged at the MYR1,900 threshold. This is followed by MYR1,863, the low of 25 Aug 2015. Towards the upside, the immediate resistance is set at MYR1,987, the high of 27 Jun. This is followed by MYR2,059, the high of 18 Jun.

Source: RHB Securities Research - 12 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024