Hang Seng Index Futures - Upward Momentum Remains Intact

rhboskres

Publish date: Fri, 12 Jul 2019, 05:09 PM

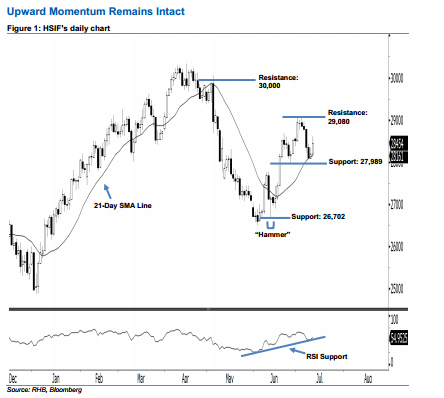

Stay long. The upward movement of the HSIF has continued as expected, as a white candle was formed yesterday. It rose to a high of 28,614 pts during the intraday session, before ending at 28,454 pts for the day. On a technical basis, market sentiment remains bullish, as the aforementioned white candle was the second one in two consecutive days. In addition, the index has marked a higher close above the rising 21-day SMA line, indicating the bullish sentiment has been enhanced. Overall, we keep our bullish view on the HSIF’s outlook.

As seen in the chart, we maintain the immediate support level at 27,989 pts, which was the low of 26 Jun. If a decisive breakdown occurs, the crucial support is anticipated at 26,702 pts, ie the low of 13 Jun’s “Hammer” pattern. On the other hand, the near-term resistance level is seen at 29,080 pts, obtained from 4 Jul’s high. This is followed by the 30,000-pt psychological mark, situated near the high of 6 May’s long black candle as well.

Hence, we advise traders to stay long, in line with our initial recommendation to have long positions above the 27,436-pt level on 12 Jun. A trailing-stop can be set below the 27,989-pt mark in order to secure part of the gains.

Source: RHB Securities Research - 12 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024