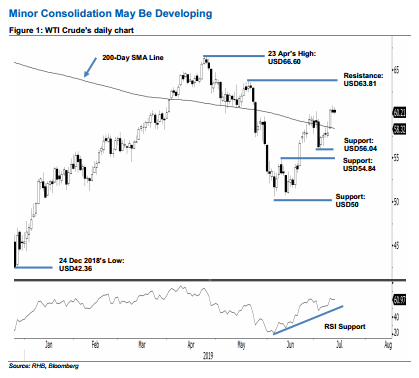

WTI Crude Futures - Minor Consolidation May be Developing

rhboskres

Publish date: Mon, 15 Jul 2019, 10:41 AM

Rebound is taking a pause; maintain long positions. The WTI Crude ended the latest session barely changed, +USD0.01 at USD60.21. Trading happened in the range of USD59.93-USD60.74. The commodity’s price actions over the latest two sessions are suggesting a minor consolidation phase is taking place. This was after the relatively sharp positive move that happened on 3 Jul, which saw the commodity reclaim the 200-day SMA line. Overall, the rebound that started from an area near the USD50 support level is still showing potential to extend. Hence, we keep to our positive trading bias.

Given that the bulls are still showing control over the price trend, we recommend traders stay in long positions. We initiated these at USD60.43, the closing level of 11 Jul. For risk-management purposes, a stop-loss can be placed below the USD56.04 mark, which was the low of 3 Jul.

Towards the downside, immediate support is set at USD56.04, ie the low of 3 Jul. This is followed by USD54.84, which was the high of 10 Jun. Moving up, the immediate resistance is set at USD63.81, or the high of 20 May. This is followed by USD66.60, which was the high of 23 Apr.

Source: RHB Securities Research - 15 Jul 2019

More articles on RHB Retail Research

Created by rhboskres | Aug 26, 2024